A film crew has gone deep inside the “Fort Knox of bitcoin” to reveal the secrets of a mysterious, top-secret bunker that holds “billions” in crypto.

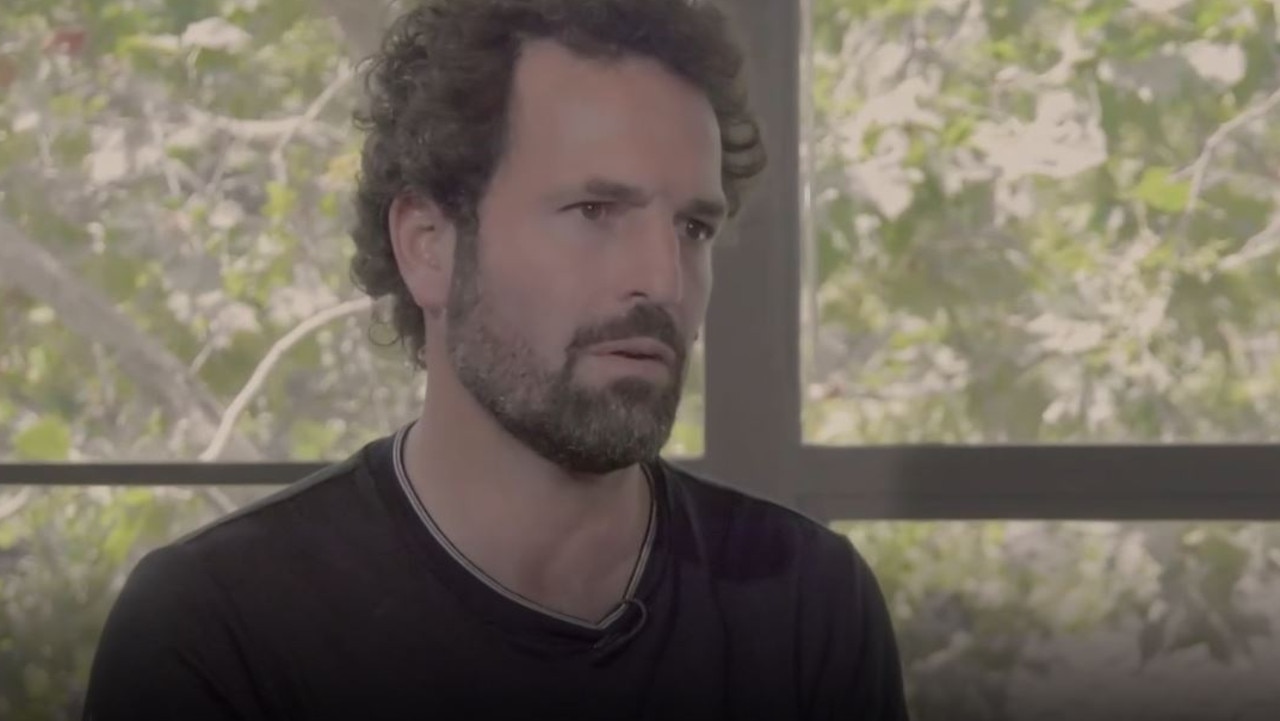

In Cryptopia: Bitcoin, Blockchains and the Future of the Internet, host Torsten Hoffmann and his crew travel to the bunker in an undisclosed location in Switzerland.

They were the only crew to be granted access, after campaigning for security clearance for months.

The bunker, dubbed the “Fort Knox of bitcoin”, is used by Xapo, a Gibraltar-based company that provides a bitcoin wallet combined with a cold storage vault and a bitcoin-based debit card.

CEO Wences Casares told Hoffmann Xapo was “the largest custodian of bitcoin in the world because a lot of the largest holders in the world use us for security”.

And while exact figures remain under wraps, it is rumoured that 10 per cent of all bitcoins are stored in Xapo’s vaults in secret locations.

“Most of our seven million customers are in emerging markets … in countries where there is problems with the currency, we have explosions in activity like Venezuela right now or Turkey,” Mr Casares said.

“And we developed this system of vaults where we have five private keys for each one of our bitcoin addresses.

“We keep those private keys in an offline server that has never been online, will never be online.

“It’s inside a vault, the vault is inside a bunker, usually deep underground. Our main one is in Switzerland in a decommissioned military bunker.”

The bunker’s underground location means it is earthquake and flooding proof, with the site boasting nuclear grade doors and biometric security checks that require a person’s “pulse” for an added layer of security.

“There is absolutely no way, zero way, to attack the data which is on the cold storage side,” Christoph Oschwald, a former military commander who now runs the bunker, told the crew.

“While the server is in your basement, it still can be stolen, right? So, this is like money. It’s data, yes, it’s bits and bytes, but it is money at the end, and a lot of money. And this is why this datacentre here is more a bank than a datacentre.”

According to Hoffmann, the existence of the bunker, and the fact it stores billions in crypto, means that “if you don’t think bitcoin is already changing the world’s concept of money, you haven’t been paying attention”.

Mervyn Maistry, the former COO of Deutsche Bank Analytics and Information Services, went one step further, claiming that his research showed that “the crypto markets are going to probably be worth about $8.7 trillion in 2027” – a figure 50 times today’s sum.

That’s backed up by Wences Casares, who believes bitcoin may reach a million dollars per coin.

According to Hoffmann, supporters tout crypto as “an insurance against inflation, protection from corrupt politicians and a weapon against the state … maybe even the end of money as we know it?” while critics slam it as “fraud” and say “public blockchains are just slow and useless databases” – and countless others remain stumped over the entire concept of digital currency.

But Hoffmann concludes by claiming that it will be “users, maybe millions of them, who will adopt this technology without even knowing what a blockchain is or how it works”.

“Because here’s the thing, the average users don’t care about the wires that move their money … What will move them are services that’ll make their days brighter, their chores lighter and their lives richer.”

Read full story on News.com.au