People like free money, but free money with a fee might not garner the same enthusiasm.

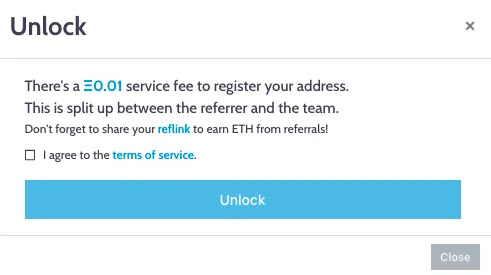

Fees.wtf, which started as a community tool to horrify Ethereum users by showing them how much money they had spent in gas, announced an airdrop on Jan. 13. Unlike other airdrops, this one came with a .01 ETH fee, a break from the norm in crypto. The move had some people up in arms.

“Lol why would you charge a fee for claiming?” tweeted Eden Au, research director at blockchain information platform, The Block. “Such a blatant cash grab,” tweeted Anthony Sassano, founder of Ethereum newsletter, The Daily Gwei.

Despite the backlash against the fee, people were paying it — Etherscan showed tens of .01 ETH fees streaming into wtf.fees’ team wallet every second on Jan. 13, shortly after the tokens became claimable.

Others questioned the utility of the fees.wtf token, whose ticker is WTF.

“The ‘service’ being offered, in my opinion, is a web UI that can be replicated on many tools for free, without any ‘tokenomics,’” Harry, who works at MyCrypto, an Ethereum services firm, told The Defiant.

Fees.wtf uses Etherscan’s API to fetch the total amount a user has spent on gas and multiples that by ETH’s current price to show the dollar-denominated amount a wallet has spent to transact on Ethereum.

To Harry, it’s not a complicated process and one that can be replicated for free.

“It is unclear what the actual $WTF token value is based on since the FAQ section seems to be intentionally vague and short,” Harry added.

Indeed, fees.wtf’s FAQ section doesn’t address WTF’s utility outside of saying it can be used in governance and to upgrade a users’ referral link.

The referral link is a feature which allows users to take a percentage of the .01 ETH fee for themselves. The percentage starts at 10% and gets as high as 50%, .005 ETH if a user pays a total of 11,110.

The fees.wtf team did not respond to messages sent on Discord, but they did post an announcement about the fee. “When we were building, we were thinking of ways to make WTF go viral,” a wtf.fees team member who goes by feenix wrote. “So we developed the ref link system.”

Feenix also justified the .01 ETH fee by saying the claim of WTF tokens came with an NFT which will give the holder access to the pro version of the project.

Fees.wtf describes their pro version on their FAQ page as “an updated, multichain version of fees.wtf that will have metrics, charts and useful insights into how and where you got rekt by fees.

Wild Transactions

There was also a separate fee of up to 10% applied when users transfer the token, which could also be waived if a wallet address was whitelisted, Harry informed The Defiant.

The actual airdrop didn’t appear to go any more smoothly than the announcement of the .01 ETH fee. A lack of liquidity looks to have been the main problem.

Low liquidity causes massive price swings with automated market makers (AMMs) like Uniswap, which facilitate trades. This is called slippage. This enabled wild transactions where fractions of one WTF were traded for 58 ETH. WTF is trading for $0.10 as of Jan. 13 while 58 ETH is worth almost $200,000 as of Jan. 13, making the transaction an unbelievably good deal.

High Slippage

Another transaction raised eyebrows as it involved a trade of just 2,243 WTF for over 851 ETH, worth $2.8M.

Fees.wtf’s team addressed the low liquidity, which led to high slippage, saying bots had battled over the small amount of assets in the trading pool which was composed of WTF and ETH.

Others on Twitter confirmed that bots were mostly responsible for the trading activity.

In all, fees.wtf’s airdrop wasn’t received well when the specifics behind claiming became public and they continued to go south when the token launched.

From a PR standpoint, the WTF token can only go up from here.

Read the original post on The Defiant.