Some Bitcoin miners are trading in their diamond hands to pay for their picks and shovels.

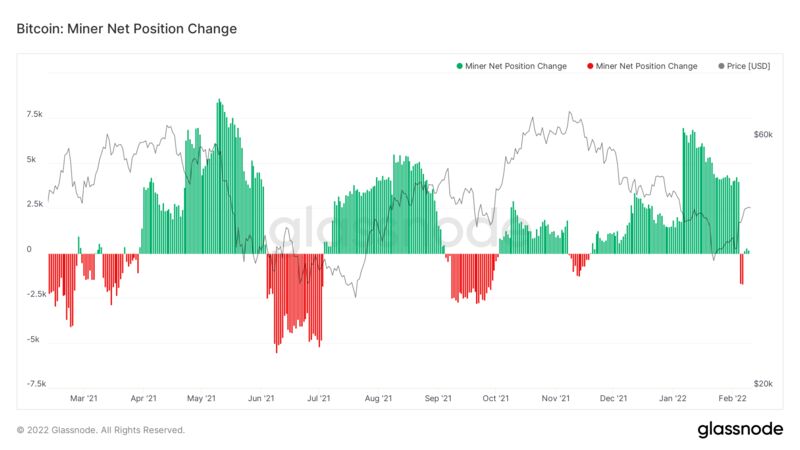

A metric tracking Bitcoin miners’ holdings turned negative on Feb. 5 for the first time since mid-November, according to crypto analytics platform Glassnode.

The turn in the metric, or the net change of miner balances over a trailing 30-day window, shows that miners have sold their coins in a possible sign a shakeout of less-efficient operators is coming.

Miners were adding to their stockpiles for months, even as prices fell to $35,000, according to research firm Delphi Digital. But with Bitcoin still lingering 35% below an all-high in November, miners with costly operations are under pressure to mind their cash balances while also investing in more powerful equipment.

Shares of the bigger miners are rebounding off the lows from the recent selloff. Marathon Digital Holdings Inc., Riot Blockchain Inc., Stronghold Digital Mining Inc. and Hut 8 Mining Corp. are up more than 40% from lows in January. But those with smaller operations could be selling strategically.

Marathon and Hut 8 told Bloomberg they remained “hodlers” during the recent crunch. “We started hodling in October 2020, and since then, we have not sold a single satoshi,” Charlie Schumacher, a spokesperson for Marathon Digital, said. A satoshi, derived from supposed Bitcoin creator Satoshi Nakamoto’s name, refers to a percentage of a coin.

Likewise, Sue Ennis, head of investor relations for Hut 8 Mining, said: “We are believers in Bitcoin. Some miners sell Bitcoin or use it to pay expenses. We hold or ‘hodl’ ours.” Riot and Stronghold did not respond to emailed inquiries.

Bitcoin miners have pledged to grow, committing to buy more mining rigs and raise the rate at which they can mint Bitcoins. But given how both equity and crypto markets are behaving, there’s “little margin for error” in terms of execution this year relative to 2021, Lucas Pipes, a B. Riley analyst, said.

“The machines got a lot more expensive. If you promised to raise your exahash to a certain level, it’ll cost you 20% to 30% more to get there,” he said, referring to a Bitcoin processing rate.

Read full story on Bloomberg