Bitcoin is unlikely to break above $46,000 anytime soon, barring a macroeconoic “vibe shift” like a change in risk-on sentiment, according to Wilfred Daye, head of Securitize Capital.

The cryptocurrency’s trading range narrowed this week as the war in Ukraine continued and the U.S. Federal Reserve raised rates in line with expectations. The notoriously volatile coin is on track to end the week 5% higher at $40,700, paring back its decline from a November high to 40%.

“Tactical longs in Bitcoin don’t have enough steam to get prices over that level,” Daye said, adding that price momentum was weak over the past five trading sessions. “For Bitcoin to breakout, a tech rally and macro risk-on sentiment are the key ingredients.”

Bitcoin prices have recently been mired in the tightest trading range since October 2020, which some attribute to long-term holders stepping in to buy when token prices decline as short-term investors curb the more substantial gains.

“Bitcoin is consolidating under $41,000 as the percentage of long-term holders in the market continues to increase,” said Marcus Sotirou, analyst at U.K.-based digital asset broker GlobalBlock. “But for 2022, I can’t expect an aggressive uptick in prices, because of the macro conditions.”

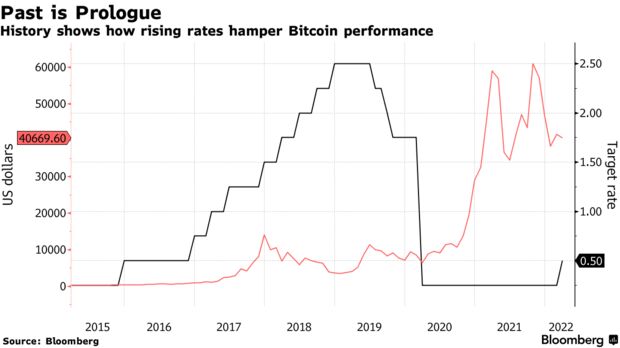

Billionaire cryptocurrency investor Michael Novogratz said Tuesday on Bloomberg TV, Bitcoin was likely to stay in a range of $30,000 to $50,000 as interest rates in the U.S. rise. Past performance data suggests the token is unlikely to sustain a rally as the Fed tightens monetary policy through the year, he said.

Read full story on Bloomberg