The Bank of France and the Swiss National Bank successfully tried foreign exchange transactions using digital currencies, saying the experiment provided them with “tremendous” insight into the novel technology.

Project Jura, which involved the Bank for International Settlements, UBS Group AG, Credit Suisse, Natixis SA and others, also looked at issuing, transferring and redeeming tokenized French commercial paper valued at 200,000 euros ($226,090) between between French and Swiss financial institutions.

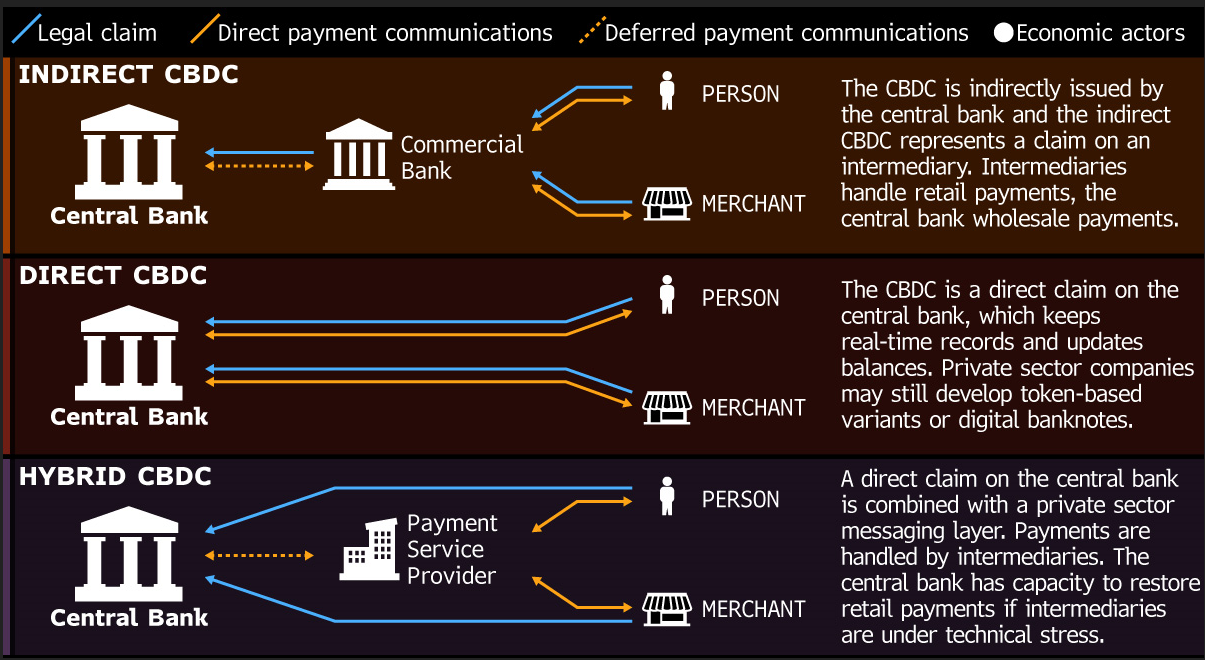

Monetary authorities around the world are studying how the advent of digital money might change the way the financial system operates. The People’s Bank of China could be the first major central bank to issue a digital version of its currency to keep up with — and control of — a rapidly digitizing economy.

In addition to issuing e-coins to the general public, central bank digital currencies used by financial institutions, also known as wholesale, could facilitate international payments.

“We are glad that it worked, but we still have a lot to do,” said Sylvie Goulard, deputy governor of the Bank of France. “We wanted to transfer money from one country to another and the other way around, and we achieve this.”

Matters needing further investigation include how scalable the technological platform can be, according to SNB Governing Board Member Andrea Maechler.

“We are still at the beginning,” she said.

While the insights gained from the experiment were “tremendous,” its success shouldn’t be interpreted as a signal the Swiss central bank is set to go for a wholesale CBDC.

“The SNB has no plans to issue a CBDC of any sort,” she said.

-Read original story on Bloomberg