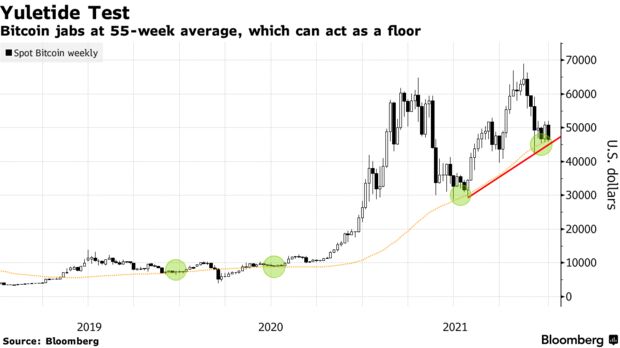

Bitcoin is continuing its December retreat and testing a key technical level that over the past two years has tended to act as a floor for the world’s largest cryptocurrency.

The digital asset fell as much as 2.7% in Asia on Thursday and was trading at about $46,700 as of 2:15 p.m. in Singapore. It’s down some 18% this month amid a broader retreat in the crypto sector.

Bitcoin’s drop has taken the token to its 55-week moving average, a level it effectively held after a December flash crash and during the mid-year embers of a crypto rout. The technical study suggests a decisive break below the average would put a slide to $40,000 in play.

Bitcoin is an emblem of volatility and a major question heading into 2022 is whether all those gyrations to come will eventually leave it lower rather than higher as the tide of pandemic-era stimulus recedes.

Crypto’s proponents remain undeterred, pointing to trends such as increased interest in the sector from a clutch of financial institutions.

This year “has seen crypto and blockchain mass adoption increase significantly with a large influx of institutional investments that has renewed confidence in this sector,” Walid Koudmani, an analyst at XTB Market, wrote in an email.

That “could ultimately lead to significant price gains and increased volatility as retail investors attempt to catch up,” he said.

Read full story on Bloomberg