Bitcoin declined for the first time in five trading sessions, with losses accelerating after it failed to sustain the positive momentum seen following this past weekend’s flash crash.

The largest digital token slipped below the $50,000 level, with losses extending in afternoon trading in New York. Bitcoin was down 6% to $47,602 as of 4:06 p.m., while other digital assets also dropped. Smaller ones, including Monero and EOS, were among the hardest-hit.

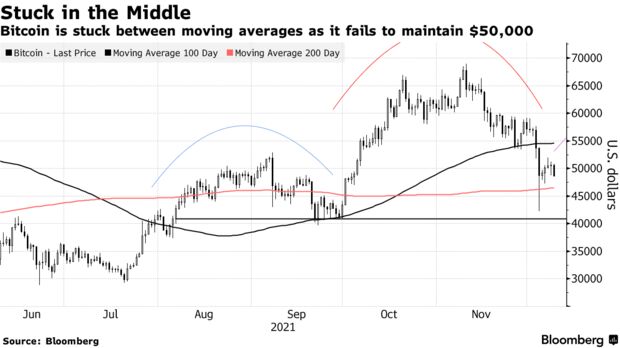

And on a technical basis, Bitcoin is seen by some analysts as being caught in a no man’s land between different moving averages. The coin might be forming what’s known as a head-and-shoulders pattern, which would be a bearish development.

“The problem with crypto is, who’s going to catch that falling knife?,” Cate Faddis, president and CIO at Grace Capital, said in an interview on Bloomberg TV. “I am very concerned about crypto — honestly, it reminds me of ‘08 with the real estate and it could spread to the entire market.”

“People have to understand truly, in my opinion, what it is. It’s a speculative investment,” Chuck Cumello, president and chief executive officer of Essex Financial Services, said by phone. “A more mainstream investment doesn’t drop 20% on a weekend. That just doesn’t happen.”

Cryptocurrencies have posted wild moves over the last few sessions, most notably over the past weekend, when many were swept up in a broader risk-off wave that also hit U.S. equities. It happened as spiking inflation is forcing central banks to tighten monetary policy, threatening to reduce the liquidity tailwind that lifted a wide range of assets. The largest crypto ended up losing as much as 21% during that decline.

Brett Munster at Blockforce Capital says leverage in markets had been building for a little while ahead of the weekend crash. That’s not inherently a negative development on its own — except when sudden price moves cause traders to fall below their margin requirements, a development that then results in forced liquidations. Such liquidations tend to be self-reinforcing, which “can lead to liquidation cascades,” he wrote in a note.

Still, many crypto fans are brushing off short-term moves and are looking at longer-term trends. Mike McGlone at Bloomberg Intelligence says the coin is a risk asset that’s slowly evolving into a digital-reserve asset “in a world going that way.” That should have positive implications for its price, which he estimates could reach $100,000 next year. Plus, demand and adoption are rising and still appear in early days versus supply, which is declining.

“The key question nearing the end of 2021 is whether Bitcoin is too hot,” McGlone wrote in a note. “Our chart shows the crypto fairly priced at about its upward-sloping 50-week moving average.”

Read original story on Bloomberg