Exchange-traded fund providers enjoyed a record year in Canada, with BlackRock Inc., Vanguard Group Inc. and two of the country’s largest banks dominating the chase for investors’ money in 2021.

Total inflows came in at C$52.5 billion ($41.3 billion) for the year, a 27% increase from a year earlier, as retail and institutional investors continue to turn to ETFs for “tactical and strategic” reasons, National Bank Financial analyst Daniel Straus said in a report.

More than half of the new money went to three groups. Bank of Montreal’s ETF division topped the list with C$9.6 billion, slightly ahead of RBC iShares, an alliance between Royal of Bank of Canada and BlackRock. Vanguard was next with C$8.6 billion.

No other firm had net inflows of more than C$4 billion.

Big Three

RBC iShares, BMO and Vanguard have nearly 70% of Canada’s ETF market

The big three ended the year with about 70% of the C$323 billion in ETF assets under management, according to Straus’s calculations.

Rising markets and Covid-19 lockdowns help explain the strong year of inflows, the analyst said. “Over the past 12 months, Canadian investors had little discretionary outlets for their spending, given travel restrictions, retail closures and other lockdowns to businesses like gyms, restaurants and mass entertainment,” he wrote.

“It makes sense that enhanced buying power would therefore make its way to investment accounts of all types, especially funds.”

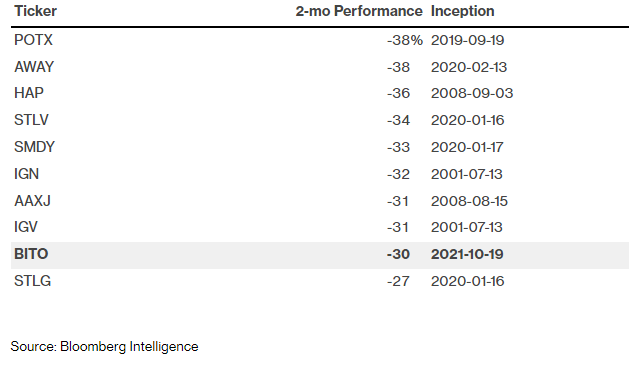

The Canadian market was also given a boost when regulators allowed the creation of physical cryptocurrency funds. In total, crypto ETFs received close to C$6 billion of inflows in Canada during the year. U.S. regulators have been more hesitant to sign off on crypto products, though the first Bitcoin-linked ETF listed in the U.S. made its debut in October.

Exchange-traded fund providers enjoyed a record year in Canada, with BlackRock Inc., Vanguard Group Inc. and two of the country’s largest banks dominating the chase for investors’ money in 2021.

Total inflows came in at C$52.5 billion ($41.3 billion) for the year, a 27% increase from a year earlier, as retail and institutional investors continue to turn to ETFs for “tactical and strategic” reasons, National Bank Financial analyst Daniel Straus said in a report.

Read full story on Bloomberg