What do you do after you crowdfunded more than $40 million to bid on a copy of the U.S. Constitution — and then you don’t win the auction? Asking for a decentralized group of internet frens.

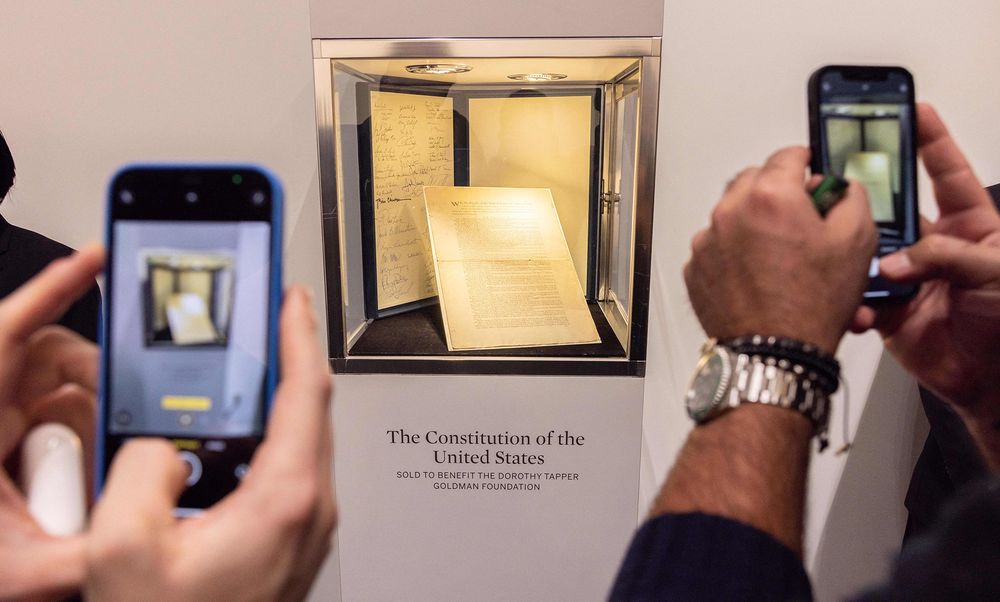

Over the course of a few days, a group of crypto investors operating as ConstitutionDAO raised tens of millions of dollars (or 11,600 ETH worth $49.6 million based on Friday’s prices) to participate in a Sotheby’s auction of a copy of the U.S. Constitution.

The artifact ultimately sold for a record breaking price of $43.2 million, to noted crypto skeptic and billionaire Ken Griffin.

While the nominal leaders of ConstitutionDAO declared their intentions to refund supporters through Juicebox.money, a platform built on the Ethereum blockchain that operated as a sort of crypto Kickstarter, that process might prove to be both a technical and an organizational challenge.

“ConstitutionDAO has reached some sort of a coordination moment. There are decisions to be made both technically and socially, and the PEOPLE will have their first opportunity to really use their voice,” a Juicebox.money developer going by the name Jango wrote in a blog post released Friday.

ConstitutionDAO said in a statement posted to Twitter that it had 17,437 donors, with a median donation size of $206.26. Beyond that, and several tweets celebrating their “historic” effort, the group hasn’t given much indication to what will happen with the funds and declined to comment for this story.

Had the group won the auction, investors were supposed to receive a governance token depending on the size of their contribution, which would give them a say on where the copy of the Constitution would be displayed or how it should be exhibited.

For his part, Griffin said he will loan the document to billionaire and Walmart heir Alice Walton’s Crystal Bridges Museum of American Art in Bentonville, Arkansas.

The hedge fund titan and founder of Citadel is worth $21.9 billion, according to the Bloomberg Billionaires Index, and has an expensive taste for art. About six years ago, he was said to have paid about $500 million for two paintings by Abstract Expressionist masters in one of the largest private art deals ever.

Griffin said earlier this month that the crypto space could be disrupted by Ethereum’s blockchain. But he still has questions about how the digital assets should be valued. And last month, In previous remarks about cryptocurrencies, he has said his firm doesn’t trade the assets because of regulatory uncertainties.

“I wish all this passion and energy that went to crypto was directed toward making the United States stronger,” Griffin told Bloomberg’s Erik Schatzker at the Economic Club of Chicago on Oct. 4. “Let’s face it — it’s a Jihadist call that we don’t believe in the dollar. I mean, what a crazy concept that is.”

-Read the original story on Bloomberg