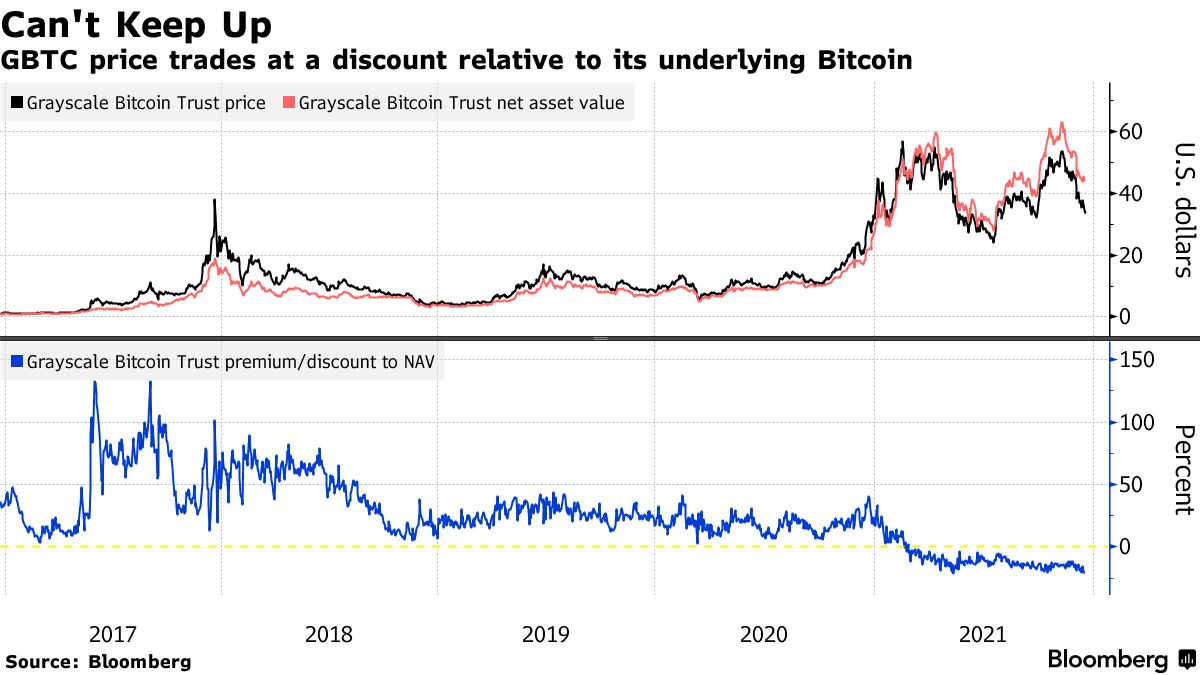

A month-long selloff in cryptocurrencies has been especially painful for holders of the Grayscale Bitcoin Trust. While Bitcoin has sank nearly 32% since November’s record high, the $30 billion fund (ticker GBTC) has lost nearly 37% over that span.

That’s widened the difference between GBTC’s share prices and the underlying value of its Bitcoin holdings to negative 21% as of Friday’s closing prices, according to data compiled by Bloomberg.

The discounts boils down to the structure of the trust. Unlike most traditional exchange-traded funds, GBTC doesn’t allow for redemptions — meaning that shares can’t be created and destroyed to calibrate the supply of shares with demand. Instead, trust shareholders must find buyers in the secondary market, which can intensify the discount when the price of Bitcoin falls.

Grayscale Investment LLC’s parent company, Digital Currency Group, has sought to repair the discount by buying back GBTC shares. Grayscale also filed to convert GBTC — the world’s biggest Bitcoin fund — into an exchange-traded fund in October, though the U.S. Securities and Exchange Commission has only allowed derivatives-based products to launch.

Grayscale has stepped up its campaign in the months amid little indication that the SEC’s stance has changed. The asset manager sent a letter to regulators urging them to approve GBTC’s conversion last month. Coinbase Global Inc., which serves as custodian of the fund, followed last week with a similar letter on Grayscale’s behalf.

“There was a letter submitted on our behalf in filings for the ETF that called out the fact that the SEC should really maintain an even playing field,” Grayscale Chief Executive Officer Michael Sonnenshein said on Bloomberg Radio. “These two products are going to be tied to that same underlying Bitcoin market, which is where the SEC has really historically had their issues.”

Read full story on Bloomberg