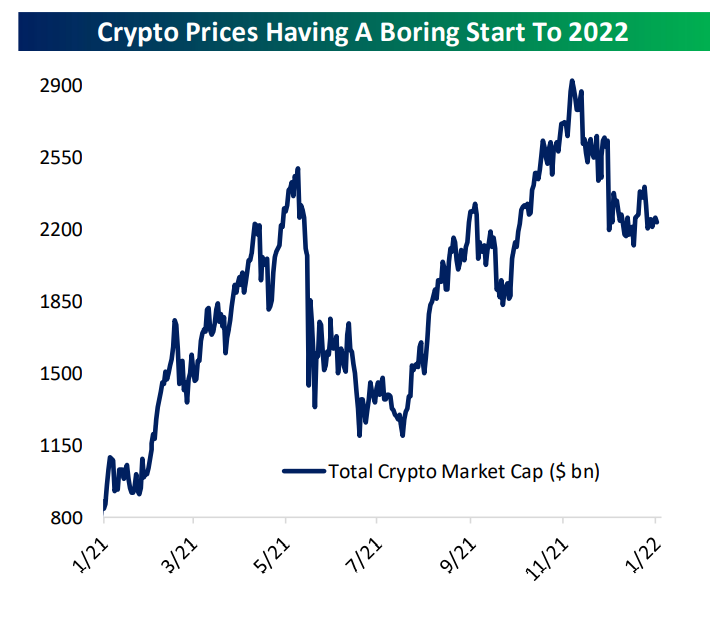

Cryptocurrencies have been on a wild ride the past few months but, it turns out, they haven’t actually traveled very far.

Digital assets have been making a series of lower lows and lower highs since reaching a peak in market value of about $3 trillion in November.

In aggregate, prices are flat over the last seven months and while changes at the start of 2022 aren’t dramatic by historical standards, “the most interesting outcome for price action this year would be lower volatility, regardless of the size of gains or losses in either direction,” wrote analysts at Bespoke Investment Group.

Cryptocurrencies are notorious for their volatility — prices can swing willy-nilly in one direction or another without much of a solid catalyst. For years, many institutional and retail investors steered clear of them precisely because of this factor, so lower volatility could mean that the crypto investor base expands as price swings become more muted despite any disappointment among professional traders.

“For most people, it’s hard for an instrument to be a trusted long-term financial play if it has incredible volatility,” said JJ Kinahan, chief market strategist at TD Ameritrade. “It just makes people too nervous or too nervous to even be involved, so the more stability a product like that starts to see, the wider the audience it attracts.”

Bitcoin, the largest cryptocurrency by market value and a poster-child for volatility, has stumbled into the new year, and is this week trading below its average price over the last 200 sessions. That’s a key technical indicator investors pay attention to for signs as to where it could move next. Bitcoin declined on Monday but recovered as much as 3.3% Tuesday to trade around $47,519.

And the coin’s recent underperformance has led its dominance overall crypto market share to drop to 39.5%, the lowest level in nearly three years, according to Arcane Research.

Katie Stockton, founder and managing partner of Fairlead Strategies, a research firm focused on technical analysis, said Bitcoin can see support at $44,156, though a close above $46,334 on Tuesday would confirm a counter-trend signal she watches closely. If that plays out, the coin could potentially see an oversold bounce and could test $55,644 again, she wrote by email.

Read full story on Bloomberg