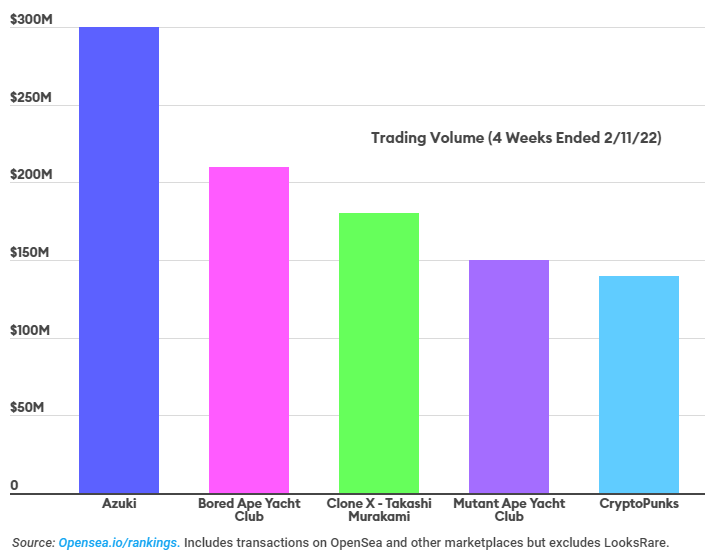

In the past four weeks, these anime-like “skateboarder” characters notched $300 million in transactions, beating out even the Bored Ape Yacht Club.

On January 12th, at 10:00 am Pacific, a group of four 30-something men living in Los Angeles released 8,700 nonfungible tokens. The anime-style characters known as Azukis were priced at $3,400 apiece.

They sold out in three minutes, raking in over $29 million. Another $2 million worth were sold in a private offering a few days later. Then things really heated up. In the four weeks ended February 11, Azukis did nearly $300 million in transaction volume across several major NFT marketplaces like OpenSea.

The most expensive Azukis now trade for a half-million; cheaper ones can be had for $36,000. Over the last month, total Azuki sales have easily surpassed more well-known tokens like the Bored Ape Yacht Club and CryptoPunks.

They are already the eighth-most traded NFTs of all time. Chiru Labs, the startup behind Azuki, makes a 5% royalty on every Azuki NFT resale–meaning it has pocketed an additional $15 million in royalties, on top of the $31 million it amassed in the initial Azuki offering.

The four founders of Chiru are anonymous, which is not unusual in the privacy-obsessed crypto world (the identity of two South Florida men who have made millions from the Bored Ape Yacht Club were recently revealed, outraging a vocal minority on Twitter).

But the fifth key player in Chiru is relatively well known, at least in the gaming industry: Arnold Tsang. Until two weeks ago, Tsang, a 39-year-old conceptual artist, had a day job leading character design for Overwatch, the blockbuster shooter from Activision Blizzard that has 60 million total registered players.

Today, Tsang is officially joining Chiru full time as part of a push to extend the Azuki brand, which he designed in his spare time, into apparel and a lot more.

“The dream is for Azuki to have such big IP (intellectual property) that there’s an animated series, maybe even games and all kinds of merch,’’ he says. Tsang adds that he chose to make his identity public “as a pledge of trust. This is who I am, this is what I’ve done. Put your trust in me that I’m not going to run away after making money and just go off to a deserted island.”

Tsang and the four Chiru Labs founders are just the latest to cash in on the NFT gold rush. Over the last year, the five-year-old industry has exploded—with OpenSea trading $5 billion worth of NFTs in January alone.

The 10,000 NFTs that make up the CryptoPunk collection are worth about $4 billion, according to analytics firm Nansen, more than the market cap of Nordstrom or H&R Block. It’s also a smoky market filled with potentially lots of fake trades.

A recent Reuters investigation of one newer marketplace found that the 27 most expensive NFT transactions last month, totaling over $1 billion, were transacted among just two wallets; the top 100 sales occurred between just 16 wallets.

Top Collections Feeding the NFT Frenzy

With over 1,000 NFT collections being launched every month, according to Chainalysis, it’s also a mystery why a few take off while most flop. Andrew Steinwold, who runs a $100 million Chicago-based NFT investment fund that owns some Azukis, thinks the quality of Azuki’s art is “comparatively high.”

Other collectors point out the unusually high production value of Azuki’s website, which has a gallery with a sophisticated set of filtering features akin to those of OpenSea, where you can narrow down an NFT search by criteria like the type of hat, clothing, or facial expression appearing in an image.

Chiru Labs has also released open-source software that allows others to “mint” multiple NFTs for much lower transaction fees, which can otherwise run up to $300 each.

Tsang’s theory: Azukis capture “the rebellious culture of skateboarders,” which connects well with those into crypto and NFTs.

Another factor that has driven the rise in interest for Azukis: pent-up demand for anime art. Over the past few years, Netflix has ramped up its anime content, and in late 2020, it announced that 100 million households had watched an anime show on Netflix over the prior year.

In August 2021, the 0N1 Force NFT collection was launched with an anime style. Less than two weeks after it came out, its average price went from about $1,500 to $30,000. (Since then, interest in the project has dropped off sharply, with some accusing its leadership team of mismanagement.)

Even the creators seem a bit baffled. Zzzagabond, the typically ridiculous online handle of one of Chiru’s founders, suspects Asian investors are driving some of the most expensive purchases of Azuki NFTs.

“My hunch is that they’re Asians who, for the first time, see art that really resonates with them,” Zzzagabond, who was born in China, says. “I’ve had a couple of conversations with Asian investors who told me that this was the first NFT that they purchased.”

Zzzagabond leads Azuki, and he says he previously worked in business development at Google, followed by a four-year stint at a decentralized finance platform (he won’t say which one). Another founding member, who goes by the nom-de-web of Location Tba, says he was formerly a software engineer at Facebook. Yet another, Hoshiboy, claims to be a two-time alumnus of startup incubator Y Combinator.

Why are they staying so secretive about their identities? “There’s a mystique and magic and allure to something where the project isn’t really about our identities and our past experiences,” Zzzagabond says. “I think eventually our identities will be doxed,” he adds, using the term for exposing someone’s name on the internet.

To build a sustainable business, Chiru will try to lean heavily on the Azuki brand, opening up new revenue sources beyond the royalties. In late February, it will launch an Azuki clothing line, starting off with red jackets. It eventually wants to go Hollywood.

Maybe TV shows would pay Azuki for the right to use their intellectual property, Zzzagabond muses. Perhaps, in the popular TV show The Masked Singer, one of the costumes could be an Azuki design, he speculates. There are equally vague plans for Azukis in the metaverse.

After all, when you have minted over $40 million from thin air in a matter of weeks, everything must seem possible.

Read full story on Forbes