Sustained declines in the prices of technology stocks and cryptocurrencies are stirring panic among many venture capitalists, after a year of record fundraising and investment.

Prominent investors have sounded alarms in recent weeks about a wide disconnect between private and public market valuations. Among the doomsayers are partners at the world’s most powerful tech investment firms, including Founders Fund, Sequoia Capital and SoftBank Group Corp.

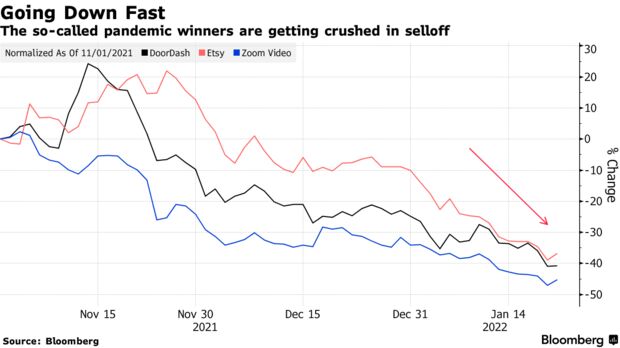

Technology companies that flourished during the pandemic, including DoorDash Inc., Etsy Inc. and Zoom Video Communications Inc., have dropped more than 30% since November. For venture capitalists, that’s forcing a reassessment of how eagerly they should pursue deals and at what valuations they’re comfortable paying.

“The markets have been overheated for some time, so I think the adjustment is healthy” said Amy Wu, head of the cryptocurrency investment arm at FTX. “Private market valuations have not yet adjusted.”

Rising interest rates, inflation and the reopening of economies from Covid-19 restrictions have put a damper on technology stocks after stimulus measures helped send them surging. Venture capital deals had boomed over the past two years, reaching a record $621 billion globally last year, according to research firm CB Insights.

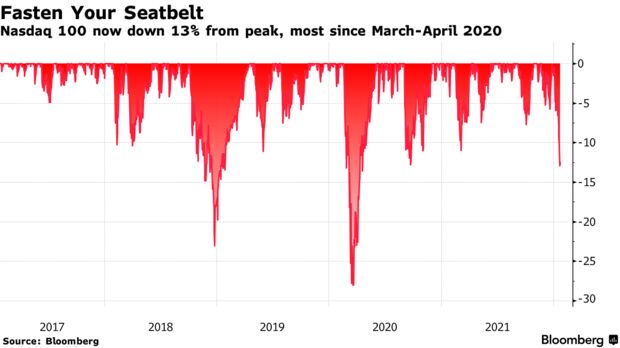

On Monday, major stock indexes, including the tech-heavy Nasdaq, whipsawed. They remain well below last year’s high and face the prospect of further corrections.

Some VCs were issuing warnings even before the record-setting year had concluded. More began to take notice last week, when Rajeev Misra, the chief executive officer of SoftBank’s Vision Fund, declared private markets “overvalued.” SoftBank was the biggest lead investor in startup deals last year, according to research from CrunchBase.

Shailendra Singh, a managing director at Sequoia Capital in India, said he’s “looking forward to a much needed correction in startup funding environment.” Keith Rabois, a general partner at Peter Thiel’s Founders Fund, wrote Monday on Twitter: “There are times when panic is the appropriate response.”

One alarming byproduct, according to Sarah Guo, a partner at Greylock: investors reneging on startup deals. At the other end of the market, investors in some venture funds recently decreased their financing commitments over concerns about the rapid pace of deals and high valuations, said Ryan Nece, a managing partner at Next Play Capital, which invests in venture funds and directly in startups. Guo and Nece didn’t identify the investors.

It will take time for a correction to reveal itself on a market-wide scale. VC and private equity firms are sitting on immense piles of cash earmarked for startups, and competition for deals remains high.

Glenn Solomon, a partner at GGV Capital, said entrepreneurs should stockpile cash and minimize wasted resources — advice that was endorsed by Bill Gurley of Benchmark. Solomon invoked a chilling phrase in his pronouncement: RIP Good Times.

That was the name of a memo penned by Sequoia Capital in 2008 that correctly foretold a startup winter that followed a global economic crisis. Sequoia issued a similar warning in 2020 at the onset of the coronavirus pandemic that was right but only briefly.

The chill on the market unexpectedly gave way to one of the biggest years on record for tech stocks, startups and Sequoia itself.

It’s unclear which way the current downturn will go. “Venture capitalists have yet to adjust down valuations offered,” said Jean Tardy-Joubert, a partner at Highland Europe. “Investors are taking more time to build conviction: It’s becoming a buyer’s market.”

A look back at a single day of deals this month, just in Europe, offers an example of how crazy startup deals have become. On Jan. 11, Bolt, an Estonia-based Uber rival, said it raised 628 million euros ($709 million) from investors including Sequoia Capital, and fintech Qonto became France’s best-valued startup, hitting a $5 billion valuation on a $552 million round, only to beaten later that day by electronics reseller Back Market, which reached a $5.7 billion valuation.

They were all topped the next day by London-based payments company Checkout.com, which raised $1 billion at a $40 billion valuation.

A possible signal of investor appetite can be found in the trading of private stock on secondary markets. Greg Martin, whose firm Rainmaker Securities works on late-stage secondary transactions, said shares in a couple of once-hot startups he declined to name are down. However, the bidding isn’t real-time and can lag by several weeks, he said.

A likely scenario is that the pace of deals will slow before valuations fall, said Dan Scheinman, an angel investor who backed Zoom in its earliest days. Andreas Weiskam, a partner at Sapphire Ventures, agrees. “There’s probably going to be some sort of slowdown in pace, I would imagine, overall, but people will still want to invest.”

Weiskam said he believes it will take about a half-year for the public market turmoil to more fully impact venture funding. ”There’s still going to be pressure to put a lot of money in the best deals,” he said.

— With assistance by Sarah McBride, Katie Roof, and Thyagaraju Adinarayan. Read full story on Bloomberg