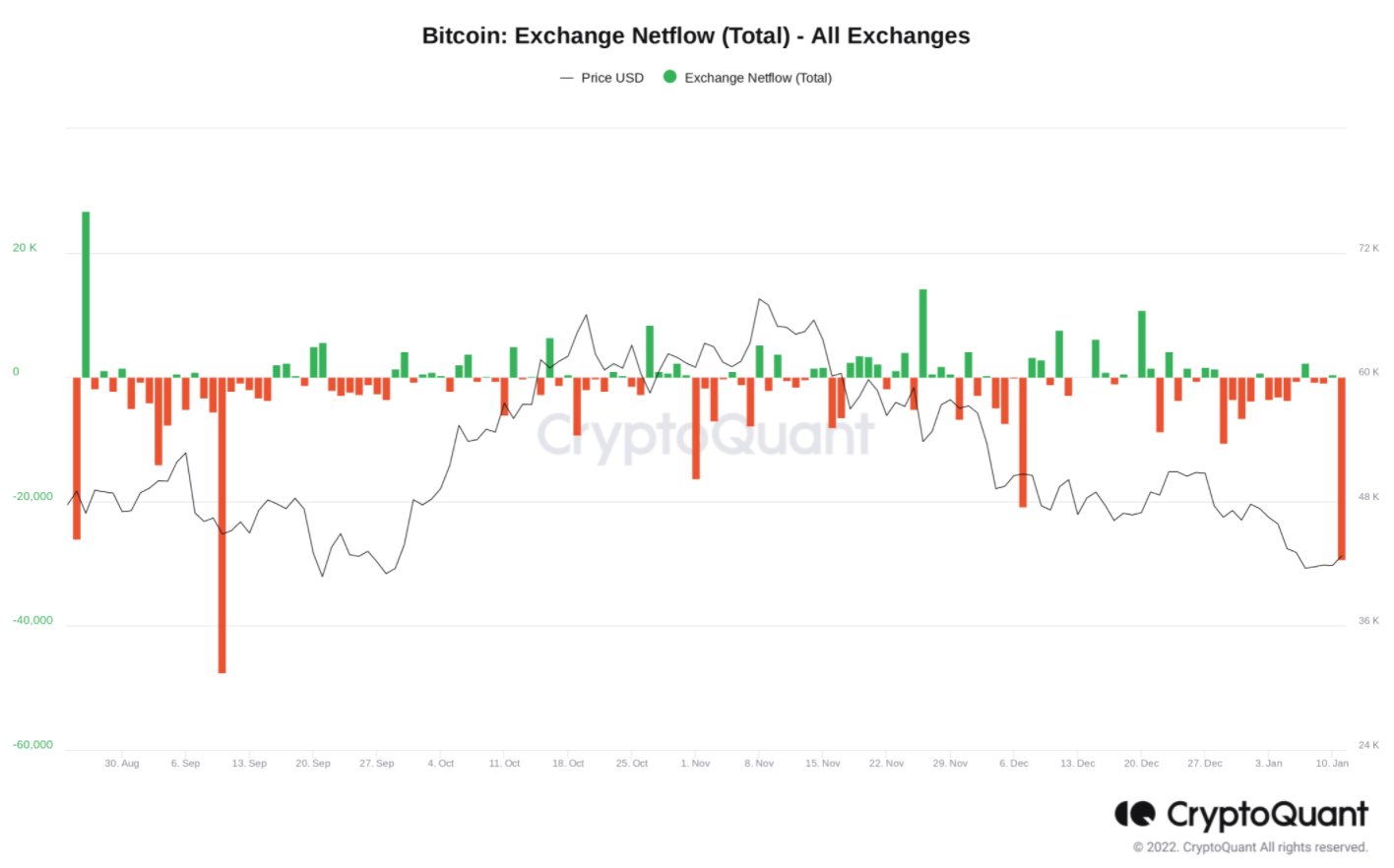

According to data from on-chain analytics platform CryptoQuant, more than 30,000 BTC worth $1.3 billion was withdrawn from crypto exchanges on Jan 11.

“With the short-term optimism returning to the crypto market, Bitcoin experienced yesterday the largest exchanges outflows in over a month,” wrote The Block in a tweet on Wednesday.

The BTC/USD pair has gained momentum since the event, trading at $43,700 as of Thursday morning.

Outflows from exchanges are perceived as an indicator of bullish sentiment in the market — the reason being, whales and larger holders are believed to be moving coins off exchanges and into storage to hold for the long term.

The last time exchanges recorded outflows of this scale was in September 2021 when Bitcoin’s price was on a downward trajectory, before regaining momentum and surging toward a new all-time high.

The leading digital asset fell from a high of $52,633 to $41,000 in the month of September but rallied over the next two months to hit its peak price ahead of $69,000 in November 2021.

Data from glassnode shows that whales aren’t the only large Bitcoin holders that have been accumulating the cryptocurrency. Bitcoin miners have also been holding their BTC positions, and in some cases acquiring more.

Last week, Nasdaq-listed Bitcoin miner Bitfarms Ltd. acquired 1000 BTC worth $43.2 million, increasing its Bitcoin position to 4,300 BTC.

Read full story on Benzinga