Bitcoin’s drop since its November high has been so steep that the average buyer over the last couple of months is likely underwater until it once again tops $47,000.

That’s according to Blockforce Capital, which found that the average price investors paid for the coin over the last five months is $47,000, meaning that, on average, anyone who bought during that period has probably lost money and might not be inclined to buy more until they break even.

This indicator, known as short-term cost basis, is an “impediment to creating some consistent momentum,” wrote Blockforce Capital’s Brett Munster, who analyzed Glassnode data.

Bitcoin is down about 35% since it peaked at almost $69,000 as risk aversion grows with the Federal Reserve and other global central banks starting to tighten financial conditions and remove pandemic-era liquidity from the system.

Riskier assets, including cryptocurrencies, tend to suffer in such an environment as traders pull back from high-flying investments. The coin, trading at roughly $44,750 on Thursday, would need to rise another 5% or so to reach the break-even level for recent buyers.

Coincidentally, Munster points out, $47,000 is also right around Bitcoin’s 200-day moving average, which currently stands at roughly $49,000.

That’s “a widely recognized indicator for determining which direction markets are trending in,” he wrote, adding that “this threshold could provide resistance as those recent buyers may look to recoup their investment and sell off.”

Though January was rough, the last few days have been better for Bitcoin. Thursday marks its eighth positive day, a feat not seen since July. It’s added more than $100 billion to its market value since February started, according to data from Coinmarketcap.com

“While it’s still too early to declare with any certainty that $33k was the bottom, there is reason to believe that there is now much more asymmetry to the upside than downside,” wrote Blockforce’s Munster.

“That doesn’t mean Bitcoin couldn’t fall back down again, but the data seems to suggest that the upside potential now outweighs the downside.”

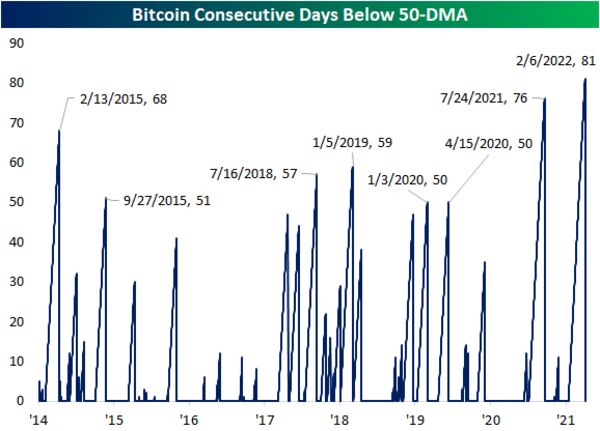

There are other hopeful signs. The coin has broken out of the downtrend that had been in place since the fall, according to Bespoke Investment Group. It also managed to close above its 50-day moving average on Monday for the first time in 81 days, which had been a record stretch below that level.

When that’s happened in the past, the coin has tended to outperform relative to the norm in the following week, month and three-month periods, on a median basis.

“The end of past extended streaks below its 50-DMA have been followed by stronger-than-normal returns over the next few months,” Jake Gordon, an analyst at Bespoke, wrote in a note.

— With assistance by Lu Wang, and Kenneth Sexton. Read full story on Bloomberg