Non-Fungible Tokens (NFTs) as an asset class have exploded on to the scene in 2021 and gripped investors the world over with prospects, transcending beyond the realms of mere tokenism by unlocking far more value for all stakeholders involved.

For artists, NFTs offer the promise of price discovery that does not exist beyond the few renowned auction houses functioning today, while investors can cash in on their purchased NFTs anytime they deem fit.

This flexibility along with the immutable nature of these digital assets have catapulted NFTs to the top of the list of crypto-based assets in existence today.

In India, there is an exponentially growing interest in NFTs riding on the back of this global trend and buoyed by the slew of NFT releases by prominent celebrities.

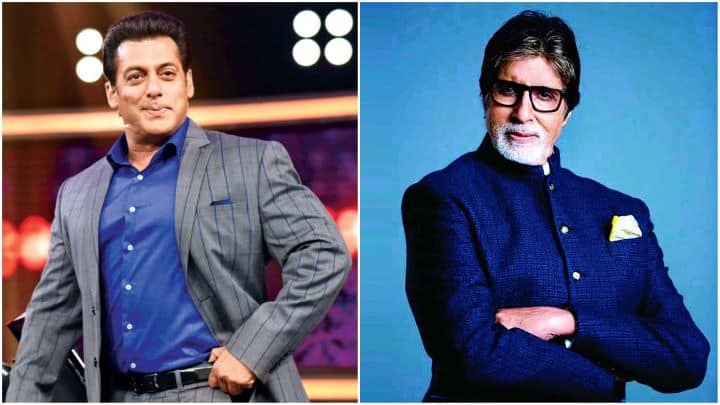

Amongst the most notable ones are Bollywood superstars Amitabh Bachchan and Salman Khan, who are on the anvil of launching their collection, and cricketers like Dinesh Karthik who have already put up NFTs based on their match-winning moments.

With a country that counts Gen-Z and Millennials as comprising the bulk of the crypto investor base of more than 100 million investors, these NFTs are bound to be lapped up with a strong fervour.

Dileep Seinberg, Founder and CEO, Thinkchain, a Crypto, NFT, and Blockchain Consulting company says NFTs are primarily released by celebrities to either cash in on their legacy or by newcomers to earn a quick buck without having the fear of being accepted by the audience.

“There are some celebrities who have built around themselves a great life. They are looking to monetize on their legacy by launching their own NFTs. The others are fairly new to the industry and earlier they were dependent on some godfather or commercially driven studios and distribution network, where these artists barely received the worth of their efforts. With the advent of blockchain, it is possible to skip all the middle layers to reach an audience who can appreciate the work and reward buying their NFTs,” he says.

Despite this bullish outlook though, the near-term uncertainty surrounding crypto assets may dampen investor sentiments considering the often contradictory commentary emanating from the Central authorities that govern all asset classes in the country.

If there were to be a ban on private cryptocurrencies, as is being mulled by the RBI, it will impact the trading of NFTs and dim the otherwise bright prospects of this revolutionary asset class.

Mia Ekta, Founder, and lead developer, Sugarland says every time a government bans or threatens to regulate any sector, celebrities and influencers tend to sync with the public and bring people together to communicate to the government about the regulation not being acceptable.

“NFTs have proven to be lucrative – and now are becoming a revenue-generating resource for millions of artists who have already joined ‘the NFT stream’, not to mention the future potential the space holds,” she says.

Aliasgar Merchant, Developer Relations Engineer at Tendermint says India has a rich cinema and artistic legacy that goes back more than a century and this creates an opportunity for NFTs to find a unique niche for themselves on a global level. Also, India being one of the fastest-growing economies in the world presents additional opportunities for NFTs.

Seinberg adds that India is one of the most favourite destinations for foreign investments and has a talent pool that is renowned globally. “What’s most lucrative for foreign investors is the price difference at which Indian artists can produce original works.

For instance, high end-VFX films like ‘Koi Mil Gaya’ are produced at a cost that is 3-4 times lesser than Hollywood. Such a huge price difference can lure foreign investors to invest money in NFTs made locally,” he says.

Read full story on Indo-Asian News Service (IANS)