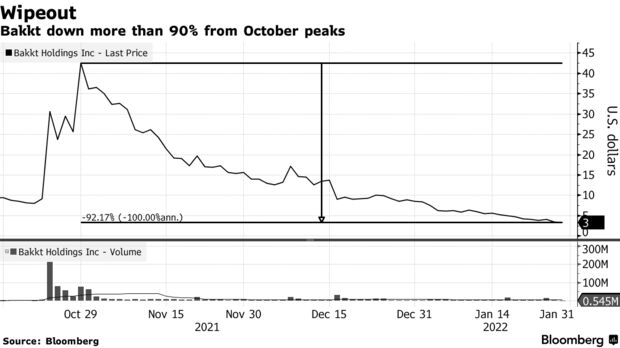

Shares of digital-asset marketplace Bakkt Holdings Inc. have dropped to all-time lows, wiping out about $10 billion in market value since reaching a record high following the firm’s much-touted public market debut in October.

The platform, majority owned by New York Stock Exchange parent Intercontinental Exchange Inc., began trading in October after the close of a $2.1 billion SPAC deal.

The shares rose to as high as $50.80 weeks after as cryptocurrency prices surged, pushing the exchange’s market value to around $11 billion. Bakkt was little changed at about $3.40 Friday.

Bakkt’s stock has steadily dropped as losses and roiling markets pushed investors to take cover. The market value sank below $1 billion this week for the first time.

The Alpharetta, Georgia-based company started focusing on developing Bitcoin futures contracts and custody services for institutional investors when it was founded in 2018 with Kelly Loeffler at the helm. Loeffler left the firm in 2019 to serve as a U.S. senator from Georgia.

Bakkt had momentum at the start. The firm announced partnerships with fintech giant Fiserv Inc. and payments provider Mastercard Inc. in a bid to offer more crypto related services and products. It also partnered with Starbucks and Apple Pay.

Still, Bakkt posted a wider net loss in the third quarter, in part, due to higher expenses to attract users as well as new partners.

Read full story on Bloomberg