A renewal of interest by traditional hedge funds in shorting Tether has highlighted the difficulty of betting against the stablecoin that serves as a foundation for much of the trading in the cryptocurrency market.

At stake is not just Tether’s $80 billion market value, but also the vast array of trades facilitated by Tether in the crypto market. Fir Tree Capital Management is making a substantial short wager on Tether, predicting it could pay off within a year, Bloomberg News reported last week, citing sources familiar with the matter.

For institutional investors, there are two main ways to put on the trade. First, a fund can borrow Tether from a market-maker, using other assets such as Bitcoin and dollars as collateral. It can than turn around and sell Tether, hoping to buy it back at a discount when Tether drops below its targeted one-to-one peg to the dollar and return it to the lender while pocketing the difference.

Depending on the level of collateral, funds could pay up to 12% to borrow Tether, according to crypto firms.

Alternatively, hedge funds can turn to derivative products. For example, they can buy a put option, which gives them the right — but not the obligation — to sell Tether at a later date. If Tether breaks the peg and falls, the put option will be “in the money,” meaning the trade will be profitable.

For years Tether has been at the center of speculation that the coin wasn’t backed one-to-one with dollars and dollar equivalents as claimed. Because of that, shorting Tether, to many traditional finance firms like Fir Tree, sounds like an obvious trade. Fir Tree didn’t immediately respond to a request for comment.

Yet as the most traded cryptocurrency in the world, Bitcoin included, Tether also has survived several negative incidents, including a nearly $43 million fine by the Commodity Futures Trading Commission and a settlement with New York.

Opposing Views

On the two sides of the trade are market participants with opposing views, often shaped by their background and geographical locations. While some U.S. traditional finance investors view it as an asset backed by reserves and are concerned about its risk profile, crypto-natives, especially in Asia, view it as a settlement payment and are comfortable holding it on balance sheet, said Joshua Lim, head of derivatives trading at Genesis Global Trading Inc.

BKCoin Capital, a crypto hedge fund, previously tried to short Tether but was unable to find a counterparty willing to take the trade, said its founding principal Kevin Kang. The recent bet by Fir Tree shows that the crypto market is different from a few years ago with rising institutional participation.

“What’s changed is the type of players that are coming into the market,” Kang said. “There weren’t a lot of multibillion-dollar managers in the market bringing on $100 million trades, but now it’s common.”

For traditional firms, shorting Tether “gives them an asymmetry trade [where] their downside is limited because Tether won’t go much higher than $1 at any given point,” Kang said. “But if they do break the peg, then the upside is unlimited.”

According to Tether’s website, a breakdown of Tether’s reserves shows that 84.25% is backed by “cash and cash equivalents & other short-term deposits and commercial paper.” But about 53% is commercial paper. Tether previously said the commercial paper it held doesn’t included any issued by the troubled Chinese property giant Evergrande Group.

Shorting Tether also isn’t a new concept — according to Jeff Dorman, chief investment officer of crypto investment firm Arca — he said traders started looking into this bet as early as four years ago.

“Every digital asset and non-digital asset firm tried and failed at some point,” Dorman said.

Crypto native funds argued that in practice, the trade is much harder to make money because of the nature of the market.

Tether plays a significant role as an on-ramp to the volatile crypto market for many crypto traders because of a lack of access to traditional banking. It gained popularity in China especially after buying cryptocurrencies with cash was banned initially back in 2017.

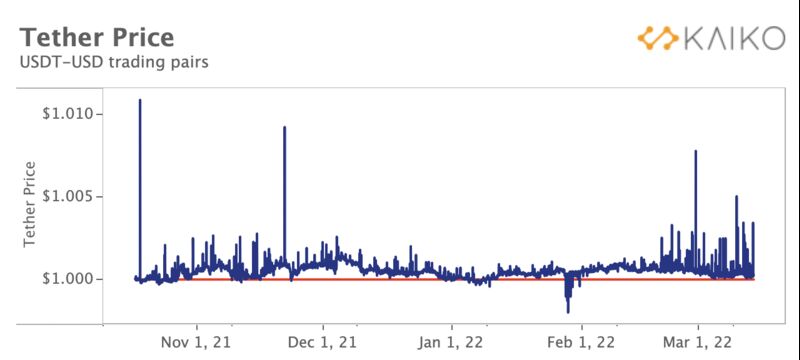

Data from crypto trading data firm Kaiko shows that while Tether’s price has turned more volatile in 2022, it mostly had traded at a premium instead of a discount on one dollar.

“It’s very common for Tether to trade at a premium in times of volatility,” Clara Medalie, research head at Kaiko, said. “We think it is because Tether is a crypto haven, so people rotate funds out of Bitcoin and into Tether, which creates a premium.”

Not only borrowing Tether can be expensive for any funds shorting Tether, but buying Tether puts options can be hard too.

“Tether puts are difficult to offer,” John Kramer, director of trading at crypto market maker GSR, said, adding that the offer ultimately is just binary options. “We often see interest to buy them. While we are able to price them, they do not trade much because it’s expensive insurance to buy.”

Read full story on Bloomberg