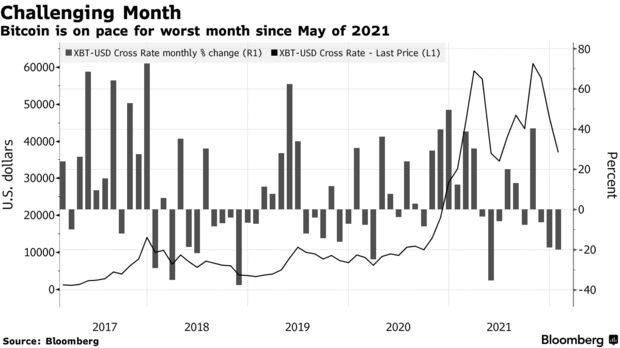

Bitcoin is closing out a rough month, with January declines topping 20%, the worst since last May’s drubbing.

The largest cryptocurrency by market value has notched only 11 up days this month, according to data compiled by Bloomberg, meaning that it’s spent 65% of the month mired in a decline. Other digital assets have also suffered, with No. 2 token Ether down roughly 30% since the end of December.

Bitcoin dipped as low as $33,000 in January from a record of almost $69,000 less than three months ago amid a broader selloff in risk assets on growing conviction that the Federal Reserve will soon raise rates as it ratchets back its ultra-accommodative policy settings.

The plunge has hit all corners of the crypto ecosystem, from Bitcoin and memecoins to publicly-listed crypto exchanges and miners.

“Crypto is a very volatile asset class — and I hope that everyone participating in that market is aware of the volatility potential,” Troy Gayeski, chief market strategist at FS Investments, said by phone. “It’s a much trickier environment than it was six months ago, 12 months ago, 18 months ago where it was ‘green-light go.’ Now it’s ‘yellow-light caution.’”

On Monday, Bitcoin fell as much as 2.9% to trade at around $36,680 before recouping some of the losses.

The declines in prices have also translated to lower volume, according to a report from CryptoCompare.

“Macro sentiment around risk assets has been the leading narrative in the markets, with expectations of significant tapering of quantitative easing” following a string of hot inflation prints, wrote analysts in the report.

Digital-asset investment products have seen outflows for the first time since August, with weekly outflows averaging $88 million so far in January, they said. And total assets under management for Bitcoin products have fallen by 23% since December.

Bitcoin lost roughly 50% from its November peak to its January lows. That decline puts it at “the low end of the range” of big drawdowns, historically speaking, according to Goldman Sachs’s Zach Pandl and Isabella Rosenberg.

The pair estimate that since 2011, there have been five previous major pullbacks for the coin off of then all-time highs, with an average peak-to-trough decline of 77%. On average, the declines lasted seven to eight months, they wrote in a note. Bitcoin’s largest cumulative decline — a loss of 93% — happened in 2011, they said.

While the market’s recent turbulence may not be as rattling to crypto veterans who are accustomed to its volatility, many investors have only gotten in relatively recently, making the swift slump particularly painful.

“I’ve always said if you’re uncomfortable waking up to a 30%, 40%, even 50% decline for whatever reason, you probably shouldn’t own it,” said Gayeski.

And memories of the last ”crypto winter” — a phrase endemic to the digital-asset space that refers to a sharp slump followed by months of doldrums — are renewing fears that a repeat could be playing out currently. The last such decline happened in 2018, when Bitcoin fell roughly 80% and subsequently took more than a year to reach another high.

“While the selloff in Bitcoin has been relatively muted going into this week, the outlook for the cryptocurrency market as a whole remains negative with heavy losses seen across a range of once-popular altcoins,” said Nicholas Cawley, Strategist at DailyFX. “If the market as a whole is looking to Bitcoin to lead the way higher, it is most likely to be disappointed.”

Read full story on Bloomberg