MicroStrategy Inc. posted a fourth-quarter loss after taking a $146.6 million impairment charge to write down the value of its Bitcoin holdings.

The enterprise software-maker run by Michael Saylor, which has made holding Bitcoin on its balance sheet as part of its business strategy, took the writedown after the U.S. Securities and Exchange Commission said in January that it couldn’t strip out Bitcoin’s wild price swings from the unofficial accounting measures it had touted to investors.

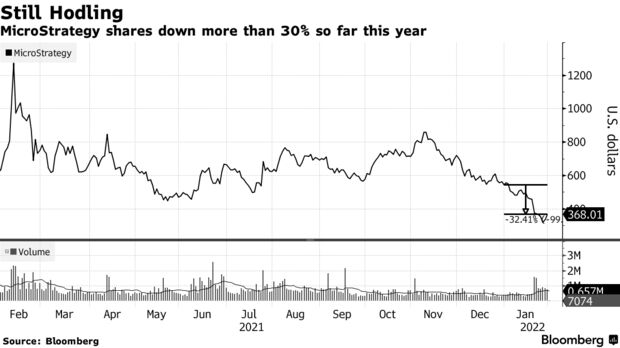

While Bitcoin gained 6.7% in the quarter, it closed about 32% off the record high reached in early November.

The net loss was $90 million, or $8.43 per share on a diluted basis. The average analyst estimate was for a profit of $1.49 on an earnings per share basis, though the estimate may not have been on a comparable basis. The impairment charge was $26.5 million in the year-ago period. Revenue increased 2.4% to $134.5 million.

Shares of Tysons Corner, Virginia-based MicroStategy were little changed in postmarket trading. The stock has slumped 31% this year amid a rout in cryptocurrency prices and concern about the impairments. MicroStrategy had jumped 40% last year and 172% in 2020 after Saylor embraced Bitcoin.

Saylor’s strategy has wreaked havoc on results. In the six quarters since MicroStrategy began investing in Bitcoin, the company has taken impairment charges in each quarter, data compiled by Bloomberg show. In five of the six quarters, MicroStrategy has been unprofitable. That’s after being profitable in eight of the nine quarters before adding Bitcoin to the balance sheet.

The fourth-quarter impairment was the third largest, or the equivalent of 25% of the Bitcoin purchased during the three-month period. In the second quarter, MicroStrategy wrote off an amount equivalent to 80% of what they added that quarter.

Cumulatively, MicroStrategy has written off 24% of the $3.75 billion of Bitcoin it has purchased even as the company sits on a paper gain around 30%.

Earlier Tuesday, the firm announced that it spent about $25 million on Bitcoin between Dec. 30, 2021 and Jan. 31, 2022, paying an average price of $37,865 per coin, according to a filing. Bitcoin traded at about $38,807 late Tuesday.

The company held more than 125,000 Bitcoin as of Jan. 31, which were acquired at an average price of $30,200 per token, or an aggregate purchase price of $3.78 billion, according to the filing.

Read full story on Bloomberg