Bitcoin traded below $40,000 and Ether tumbled as much as 9.4% as the Ukraine crisis deepened, with Western nations imposing new sanctions on Russia after President Vladimir Putin refused to stop attacks on its neighbor.

Bitcoin, the largest cryptocurrency by market value, dropped by around 5% to about $37,450 as of 4:40 p.m. in New York, while Ether’s slump briefly took it below $2,600.

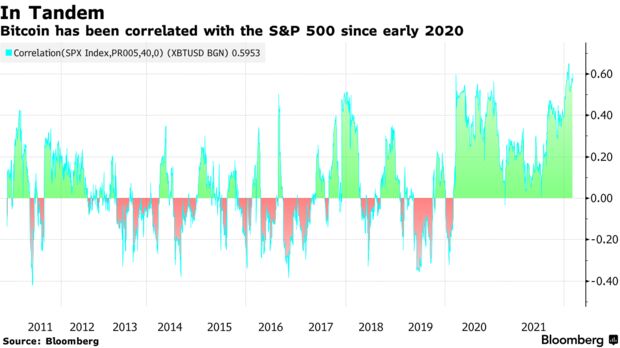

The sell-off in crypto markets follows a global equities rally on Friday that saw the S&P 500 jump 2.2%. With Bitcoin’s correlation to stocks near a record high, declines in the token point to a lower or at best muted open for equities on Monday.

Western nations unleashed a broad array of sanctions against Russia, agreeing to exclude some Russian banks from the SWIFT messaging system and to target the Russian Central Bank’s international reserve.

Meanwhile, Russian President Vladimir Putin put the nation’s nuclear forces on higher alert as fighting continued inside Ukraine, while U.S. citizens were advised to consider leaving Russia immediately.

Promising Technicals

Bitcoin remains well above the Jan. 24 low of $32,970 that strategists like JPMorgan Chase & Co.’s Nikolaos Panigirtzoglou have said pushed it into oversold territory. On Friday, Grayscale Investments said any rally in crypto prices in the face of a “bad news event” would indicate “seller exhaustion from the current crisis.”

Technical indicators look promising as well, according to Rick Bensignor, president of Bensignor Investment Strategies and a former strategist at Morgan Stanley. A “constructive rally” could push Bitcoin to the $50,000 to $55,000 level, he wrote in a note Sunday. “The stop-out is under the January low.”

The Bitcoin hash rate — the amount of computing power being used to mine and process transactions on the network — appears to be taking a hit from the conflict. It was around 173.8 million terahashes per second on Saturday, down from a record 248.1 million terahashes on Feb. 12, according to data from Blockchain.com.

“The Bitcoin hash rate has been decreasing as many miners across both Ukraine and Russia have been impacted by the Ukraine war,” said Hayden Hughes, chief executive officer of Alpha Impact, a trading social-media platform, in a message Sunday.

“Some mining infrastructure is in conflict zones and has been shut off, and other miners have shut down and relocated from areas that are perceived to be possible future conflict zones.”

Read full story on Bloomberg