Despite the recent proliferation of cryptocurrency in Americans’ lives—hello, Elon Musk on Saturday Night Live—cryptocurrencies have some ground to gain before they become ubiquitous with consumers and their finances.

But they have quickly become omnipresent across the global sports industry. The significant rise in crypto sponsorship deals provides massive visibility to the budding industry–yet these crypto brands will eventually need to extend their efforts beyond naming rights, logo patches and arena signage to succeed with consumers.

In just two years, crypto involvement in the sports industry has grown from niche investments to a huge growth driver. According to Nielsen Sports Sponsorglobe, 84 new crypto/blockchain/NFT sports deals had been signed globally through the first three quarters of 2021. That’s up 664% from the 11 signed back in 2019 in the same time period.

Comparatively, auto deals grew 52% and insurance deals grew 6%. Among the deals signed this year, none was more noteworthy than the recently announced 20-year $700 million naming rights deal that will transform the Staples Center in Los Angeles to Crypto.com Arena on Christmas Day.

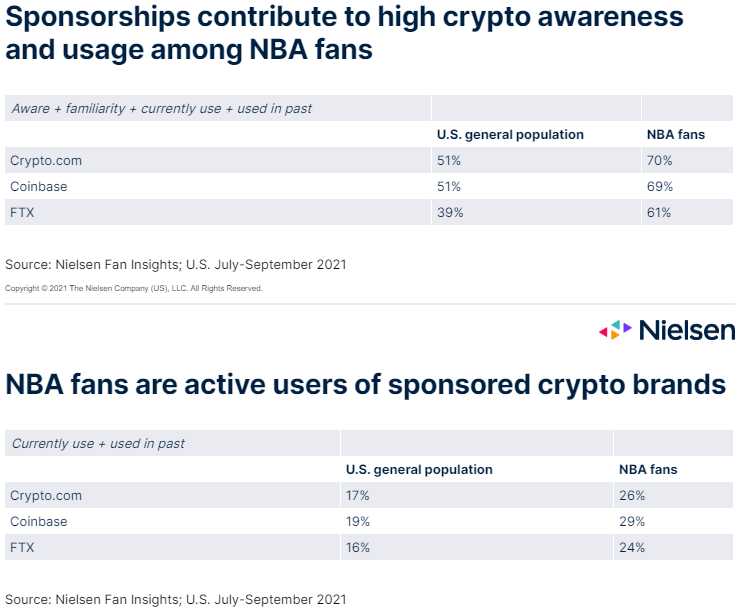

The renaming is just the latest crypto deal in the NBA. In addition to being the new arena name for the Lakers and Clippers, Crypto.com recently inked a six-year deal as the official jersey patch partner for the Philadelphia 76ers.

Separately, Coinbase is the official crypto partner of the NBA, FTX recently purchased the naming rights to the Miami Heat’s arena and made Golden State Warriors star Steph Curry its brand ambassador, and StormX is the official jersey patch partner for the Portland Trail Blazers.

Crypto advertising and sponsorships in sports makes sense for an array of reasons, with visibility typically being the top driver, especially among new brands and categories.

In the U.S. alone, sports programming accounted for 98% of the most-viewed programs across broadcast and 72% of the most viewed programs on cable television between January and September, with Super Bowl LV accounting for 20.3 billion minutes viewed. The on-site signage, displays and activations at sporting events only add additional layers of awareness and promotion.

The upside of these massive efforts is that consumers are very receptive to brand sponsorships in sporting events. In fact, Nielsen’s 2021 Trust in Advertising survey found that 81% of global consumers either completely trust or somewhat trust brand sponsorships at sports events, just behind recommendations from friends and family and branded websites.

The high visibility and consumer sentiment about sports sponsorships validates the dramatic increase in crypto investments; ultimately, brands will need to transition their efforts from awareness to consideration.

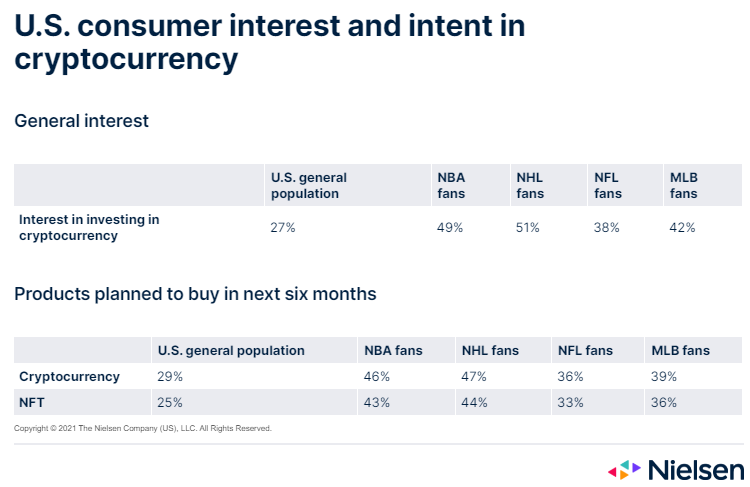

Through that lens, Nielsen Fan Insights data highlights why the NBA is such a strong partner for crypto. Notably, just under half of NBA fans (49%) express a general interest in crypto products, which is 80% more likely than the overall U.S. population. What’s more, 46% of NBA fans intend to use a crypto product in the next six months which is 61% more likely than the general population.

From a fan engagement perspective, non-fungible tokens (NFTs) have quickly gained momentum as leagues and teams use them for new and engaging ways to provide extended value to fans. NBA Top Shot, for example, is an NFT marketplace featuring officially licensed digital collectibles. After opening to the public in October 2020, NBA Top Shot has become one of the most high-profile NFT successes to date.

Much like their receptiveness to crypto, NBA fans are more than just aware of NFTs. According to Nielsen Fan Insights data, 43% of NBA fans intend to buy NFTs in the next six months, which is 75% more likely than the general population. For NBA fans, NFTs:

- Are a good way to engage with teams (26%)

- Offer growth potential (23%)

- Were recommended by a financial authority (21%)

Despite the growing presence of crypto and blockchain tech in the sports industry, familiarity and usage intent among consumers will take time to build. Sports sponsorships rank high in terms of trust, but just under half of NBA fans (48%) are still unfamiliar with NFTs and 43% are unfamiliar with cryptocurrency, let alone see a need for them.

The prominence of certain brand sponsorships, however, such as Crypto.com, Coinbase and FTX, appears to be paying off in both awareness and usage.

Unlike traditional sponsors, like those from the auto, insurance and travel industries, cryptocurrencies, blockchain technologies and NFTs have more to win over from a fan perspective than just awareness.

Awareness through exposure is a critical first step, and the sports industry is ripe with visibility options. After creating awareness of cryptocurrency through these—and other—sponsorships, there will come a time to bridge the gap between awareness and intent, transitioning from brand building to conversion, as detailed in Nielsen’s Brand Resonance white paper.

They will, just as any brand would need to, solidify their unique value propositions and evolve their relationships with fans from one-way to two-way conversations backed by education and trust-building.

Read full story on Nielson.com