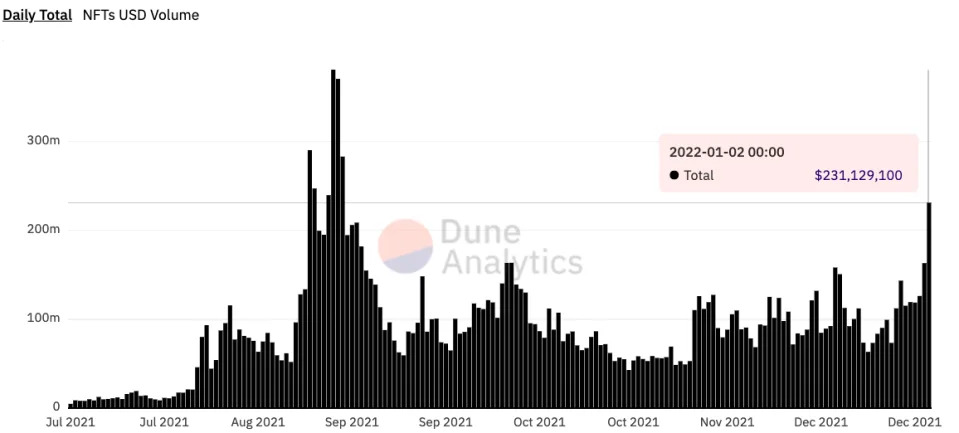

Daily volume across the top Ethereum NFT marketplaces OpenSea, Rarible, Foundation, SuperRare, surpassed $231M on Jan 2, its highest level since Aug. 30, according to a Dune Analytics query.

The query also includes Larva Labs, which has project-specific marketplaces for its flagship projects CryptoPunks and Meebits.

August 2021 was easily the most torrid month in history for NFTs. OpenSea, the market leader in terms of volume, facilitated more than $3.42B worth of NFT transactions in August, a sum considered insane at the time.

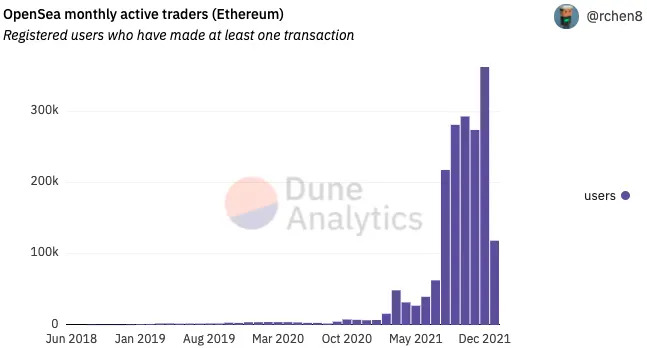

Volume returning to that range provides more evidence that NFTs have staying power. With more than 362,000 active traders, OpenSea also set a record in December, according to a Dune Analytics dashboard by Richard Chen, general partner at 1confirmation, a crypto-focused investment firm.

Mutant Ape Yacht Club (MAYC), a derivative of Bored Ape Yacht Club (BAYC), is setting the pace for the NFT rebound — the project leads all NFTs in weekly volume at $89.2M, according to CryptoSlam.

Mutant Ape Yacht Club has seen its floor more than double in the last month to 16.5 ETH, a $600,000 value as of Jan. 3, according to a Dune Analytics dashboard.

BAYC, MAYC’s originator, sits at number two in weekly sales at $86M, with the floor hitting 77 ETH ($284,000) as of Jan. 3, up from 51.71 ETH a month ago, according to another Dune dashboard.

Searches for the phrase “NFT” also hit a worldwide high in mid-December, according to Google Trends.

For now, Ethereum appears to be the dominant market in terms of NFTs. Of the top 50 projects in weekly volume terms, CryptoSlam lists only four as existing on non-Ethereum blockchains as of Jan. 3 — Axie Infinity’s NFTs lead the group of outliers, sliding in at the fourth slot overall.

NBA Top Shot, which is on the Flow blockchain, sits at 17th in weekly volume with two Solana projects, Shadowy Super Coder and Solana Monkey Business, rounding out the only other non-Ethereum NFTs in the top 50.

Despite the overall NFT market looking up, there is persistent resistance from the gaming community as well as the furry community. NFT detractors often cite ecological concerns regarding the electricity, and thus carbon emissions, which the assets consume over the course of their lives on the blockchain.

Ethereum’s anticipated shift to a proof-of-stake consensus mechanism this year as a part of the ETH2 upgrade will reduce the blockchain’s energy usage by 99.95%, according to a post by Carl Beekhuizer, an Ethereum Foundation researcher.

Zeneca, a fixture in the NFT community, thinks it’s a matter of time before the gaming community comes around, tweeting that less than a hundredth of a percent of worldwide gamers have used OpenSea.

Despite this and the recent momentum “most projects are still going to zero,” the NFT investor and content creator said in his tweet. Long term investors excited by NFTs’ recent momentum are betting they’re holding the right bags.

Read the original post on The Defiant.