Bitcoin will continue to take market share from gold as part of broader adoption of digital assets, making the often touted price prediction of a $100,000 by advocates a possibility, according to Goldman Sachs Group.

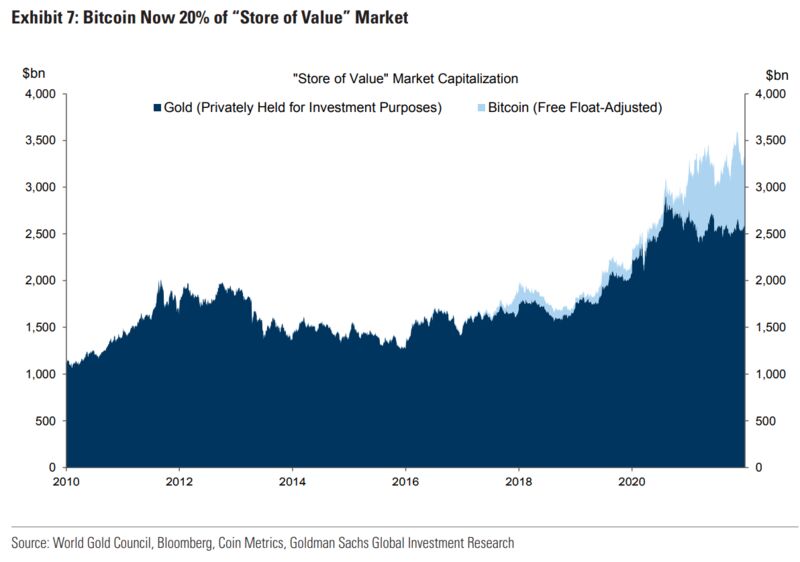

Goldman estimates that Bitcoin’s float-adjusted market capitalization is just under $700 billion. That accounts for 20% share of the “store of value” market which it said is comprised of Bitcoin and gold. The value of gold that’s available for investment is estimated at $2.6 trillion.

If Bitcoin’s share of the store of value market were “hypothetically” to rise to 50% over the next five years, its price would increase to just over $100,000, for a compound annualized return of 17% or 18%, Zach Pandl, co-head of global FX and EM strategy, wrote in a note Tuesday.

Bitcoin traded around $46,000 on Tuesday in New York, after climbing about 60% last year. The largest digital asset by market value hit a record of almost $69,000 in November. It has surged more than 4,700% since 2016.

Read More: Bitcoin at $100,000 or Popped by Fed? Analysts Eye 2022

Although the Bitcoin network’s consumption of real resources may be an obstacle to institutional adoption, that won’t stop the demand for the asset, the note said.

Bitcoin has long been referred to as digital gold. And the criticisms levied at gold tend to apply to Bitcoin as well: It pays no interest or dividends, and it doesn’t imitate the performance of more traditional assets. Advocates say Bitcoin, like gold, serves as protection against the systemic abuse of fiat currencies.

— With assistance by Vildana Hajric. Read full story on Bloomberg