Investing in cryptocurrency might seem like diving into the great unknown. And in a seemingly Bitcoin-everything world — one in which high-powered computers ensure cryptocurrency is created, exchanged and logged through a series of codes on the blockchain — it can be daunting for any newbie.

But rest assured, this solely digital mode of currency is safe — and way more credible — than what many believe. Matt Muller, director of security operations at the cryptocurrency exchange platform Coinbase, explains how every single transaction is validated, reliable and secure.

“There can certainly be questions about the process and safety of cryptocurrency, especially given that it’s an entirely new way to perform financial transactions,” Muller said. “We like to think of crypto as the new and improved version of personal finance. It moves away from relying on traditional opaque financial institutions and instead places the authority in a public, fully transparent ledger. Your finances shouldn’t be corporate. And it’s our goal to explain the benefits of evolving to fit today’s global and technology-driven economy.”

That is transforming the traditional paper-driven process of sending and receiving funds into publicly available software, using what’s known as the blockchain ledger, which records transactions in a way that is totally verifiable and transparent.

Still, anxieties can give consumers a difficult time when considering an investment in crypto, but that means losing out on a promising sector.

Here are the top five security misconceptions about crypto — debunked.

1. My cryptocurrency will be stolen by hackers.

In today’s day and age, data breaches happen, but cybercrime is certainly not limited to the cryptocurrency industry. Major credit reporting bureaus have experienced data breaches in this pandemic age when many everyday transactions recently went virtual.

And while hackers can try to use this information, it’s important to find a platform that takes extra steps to protect its users. This could include monitoring the dark web or any data breaches from another website.

“It’s one of the reasons why we encourage everyone, whether or not they’re involved in cryptocurrency, to do things like use a password manager, which allows people to set unique passwords on every single website,” said Muller, who advises against having the same password for all accounts — from banking to social media. “If any one of those accounts happens to get exposed, now, suddenly, somebody can use that same password to log into everything.”

Also, it is important to remember that data breach issues happen globally and constantly.

“This is definitely not just a cryptocurrency-related thing,” he said. “And the good news is, the same steps that you can take to keep yourself secure in the crypto economy will also help protect your digital life generally. So, it is a win-win.”

2. Because crypto is decentralized and anonymous, it attracts criminals.

Another common misconception is that cryptocurrency is somehow easier for criminals to target .

“Based on just how transparent the blockchain is, we’d pretty strongly disagree with that,” Muller said. “As a U.S.-regulated exchange, where there are cases in which fraud occurs and/or criminals may use cryptocurrency, we make sure that law enforcement is part of the conversation.”

Thanks to the blockchain technology, if law enforcement is investigating a crime that involves crypto, it can be traced across the entire blockchain.

“They can work with exchanges, like Coinbase, to send a warrant or subpoena and understand who is actually conducting the transactions,” Muller said. “This is dramatically different from the world of cash. Once cash is handed between two people, there’s no record of that.”

3. Blockchain is a public ledger of transactions, so my information is out there for anyone to find.

To the average person, the blockchain might look a bit like gibberish. Why? Because it is essentially a long string of letters and numbers. Still, it uniquely identifies the person who is sending or receiving funds.

“It’s privacy preserving in that you don’t actually have your name published on the blockchain,” explained Muller. “So, people can transact, and they can do it in a public way, where everyone can verify that Person 123 sent funds to Person ABC. And the people on both ends may know each other, but everyone in the middle can only see that a transaction occurred, and now we have a record of it.”

There’s no need to worry about personal information being available for identity theft on the blockchain, which is a safer way to record transactions than some mobile payment services.

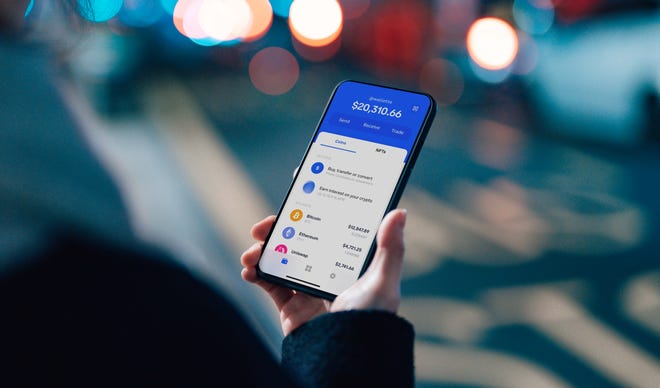

Some online platforms for buying, selling, transferring and storing cryptocurrency provide a user-friendly layer that does all the work for you.

4. Cryptocurrency is so volatile, the blockchain must not be reliable.

When people associate the volatility of cryptocurrencies with the credibility of blockchain technology, it leads to this common security misconception. Muller points out that blockchain technology, because it is in fact so reliable, extends to uses beyond cryptocurrencies — from securely sharing medical data to tracking music royalties.

It can also help to break down this common security misconception into two parts: security and value.

“Unfortunately, we can’t help predict what your asset is going to be worth. But the math underlying the blockchain can help guarantee that it will be there,” he said. “People are still learning and finding new use cases for cryptocurrency and assigning different values to it. That’s where the market can certainly have a little bit more volatility, but that has no relation to security.”

5. Crypto isn’t real money, so it can be double spent, and transactions can be reversed.

When blockchain technology is understood, this common security misconception is also easily debunked, Muller explained. When a transaction lands on the blockchain, that transaction gets confirmed as does the transaction history. The more established the blockchain, such as the Bitcoin network, the more transactions would have to be erased to reverse or double spend. And that’s a near impossible feat.

“Rather than an attacker trying to fake a single transaction, they might have to try to fake hundreds of transactions,” Muller explained. “Computationally, the cost of doing this for them would be so mathematically astronomical, it’s just not worth it.”

In fact, there has been no successful attack against the Bitcoin network. While smaller, newer blockchains may be more susceptible to such risks, platforms like Coinbase evaluate the risk for its clients.

“It’s something we take very, very seriously,” Muller said. “Because we want to make sure that when we custody funds on your behalf, that those funds will be there in the future.”

And the future of money starts today.