In the past 12 months, ETF issuers have seized on everything from Bitcoin futures, to blockchain, to NFTs and more to tap into the DeFi boom. It was only a matter of time before they got to Web3.

In the latest iteration of money managers capitalizing on all things crypto, Simplify Asset Management filed an application to launch Simplify Volt Web3 ETF, which would trade under the ticker WIII.

WIII will invest up to 10% of its total assets in the Grayscale Bitcoin Trust (GBTC) and will also be utilizing an options strategy to hedge against risks, according to a filing. It carries a management fee of 0.95%.

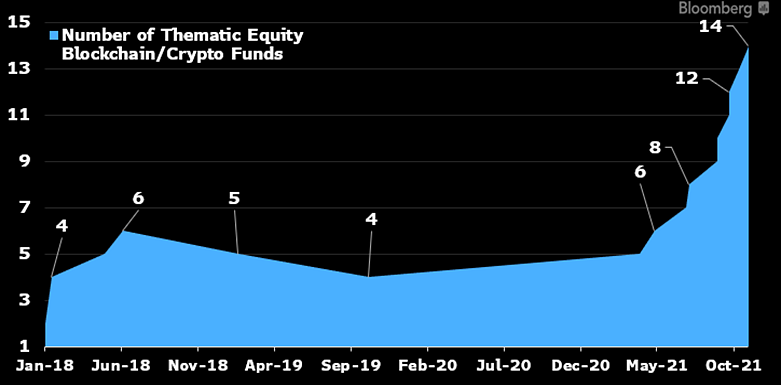

“This filing shows we’re still in a bull market for blockchain/crypto thematic equity fund launches,” said James Seyffart, analyst at Bloomberg Intelligence.

ETF issuers have been enthusiastic about trends that have emanated from the crypto world and many are looking to capitalize on the boom. The Roundhill Ball Metaverse (META) has swelled to roughly $950 million assets under management since its June launch, and ProShares recently filed its own application for a similar product. Meanwhile, Defiance ETFs debuted one centered around non-fungible tokens, or NFTs.

Web3 was born of the idea that crypto’s sole purpose isn’t to just send money around from person to person — there are other utilizations, including building out a whole new internet.

A simplified explanation puts it like this: The term Web 1.0 generally describes everything from the earliest interconnection of computer networks; in the next phase, Web 2.0 companies built applications on top of that, from social media to search engines to wikis; Web3 aims to create software and platforms that aren’t dependent on traditional companies and Web 2.0 business-models such as advertising.

In terms of WIII, “it seems based on the filing, that this will invest with some overlap to metaverse-focused ETFs as well,” said Seyffart. “We can’t know for sure until its launched and we can see the actively managed fund’s holdings.”

— With assistance by Emily Graffeo. Read full story on Bloomberg