Bitcoin and cryptocurrency prices have dropped sharply over the last week, with the combined crypto market now down around $1 trillion from its November peak (even as Wall Street giant Goldman Sachs issued a huge bitcoin price prediction).

The bitcoin price has fallen around 10% since the beginning of 2022, crashing towards $40,000 from highs of almost $70,000 late last year.

Meanwhile, other major cryptocurrencies Ethereum, Binance’s BNB, Solana, Cardano and XRP have also crashed back, all losing double-digit percentages this past week.

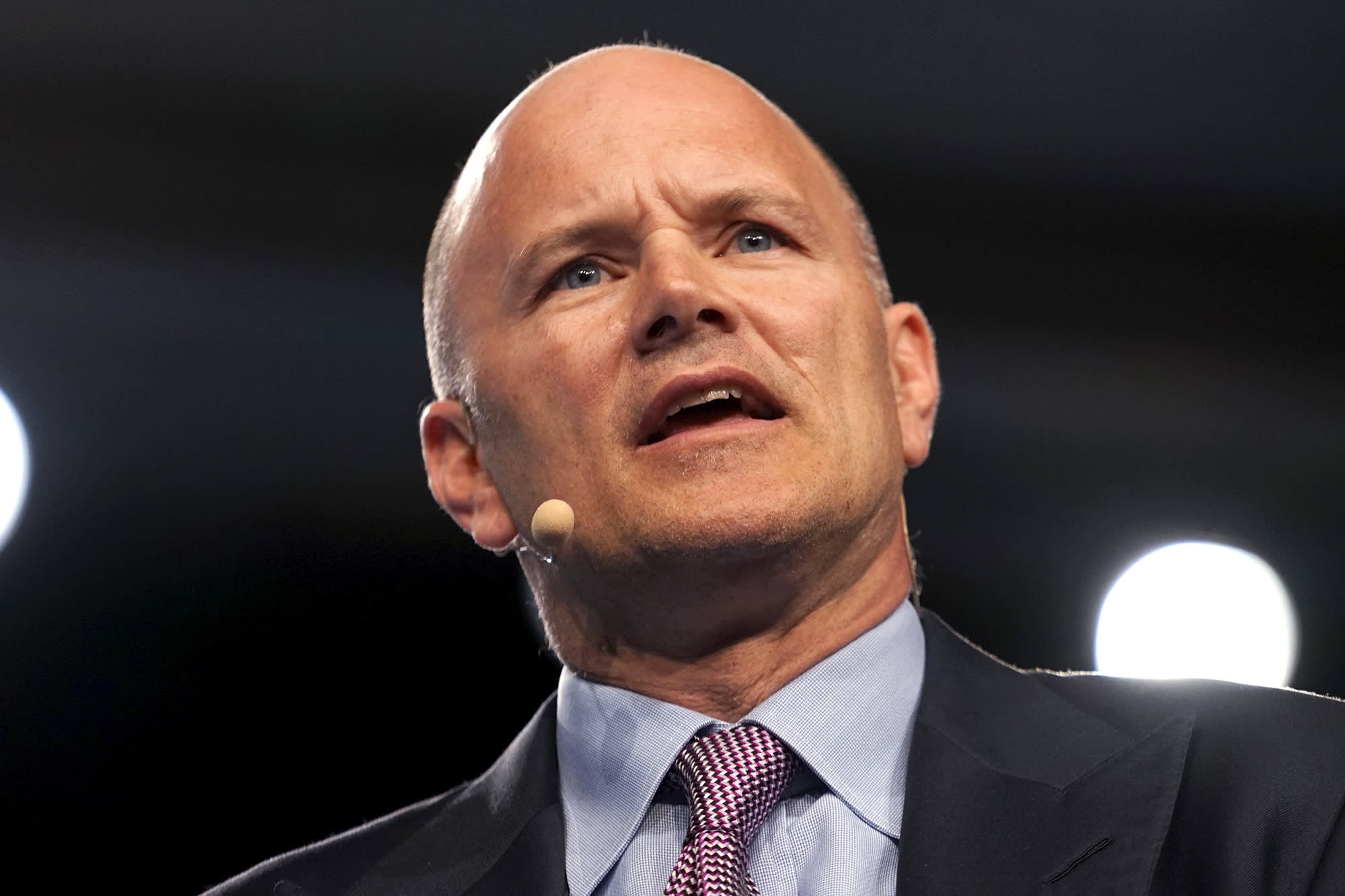

Now, as traders desperately hunt for signs the sell-off has ended, bitcoin and crypto billionaire Mike Novogratz said he doesn’t expect bitcoin to fall any further—calling the price bottom just under bitcoin’s lows this week of $40,680.

“On the charts, $38,000, $40,000 feels like where we should bottom,” Novogratz, the chief executive of crypto investment management company Galaxy Digital, told CNBC, pointing to “tremendous amount of institutional demand on the sidelines.”

“I know big institutions who are going through their process to put positions on and so I think they’re gonna see those as attractive levels to buy,” said Novogratz, a Wall Street veteran that jumped headfirst into bitcoin and crypto in 2017 after stints at Fortress and Goldman Sachs.

Wall Street giants and institutional investors have flooded into cryptocurrency markets since 2020 as digital assets grab trader attention. The bitcoin price has risen around 400% over the last two years, with smaller cryptocurrencies such as ethereum and solana making even greater gains.

However, bitcoin and cryptocurrencies remain highly volatile, putting off many big investors despite some predicting bitcoin will win market share from gold as a store of value over the next few years.

The bitcoin price dropped sharply this week after the Federal Reserve released the minutes of its December meeting in which officials discussed the possibility of earlier and faster interest rate hikes and shrinking the Fed’s huge balance sheet in order to rein in soaring inflation.

The bitcoin price fell to lows of just over $40,000 per bitcoin this week before rebounding and has now climbed to over $42,000. The ethereum price has also bounced off its lows this week, helping the price of its smaller rivals Binance’s BNB, solana, and cardano to rally. Ripple’s XRP also moved higher.

“We’ve had this philosophy that the Fed’s gonna keep rates low forever and even now, they’re going to raise rates to 2% over two years gradually and continue to buy Treasuries for a while,” Novogratz said. “So we’re in this liquidity bubble.”

Novogratz also warned that if the Fed fails to get a handle on inflation, the situation could spiral out of control.

“If inflation doesn’t come down like the Fed thinks, all bets are off,” he said.

Read full story on Bloomberg