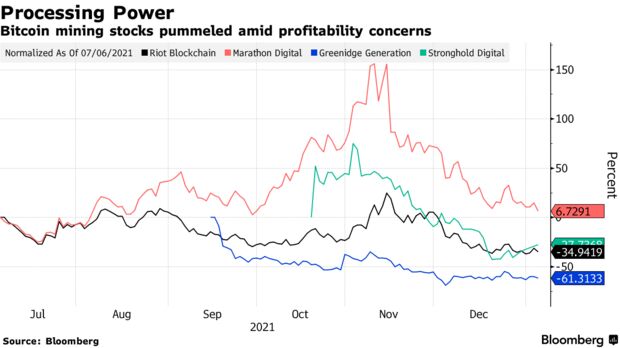

Bitcoin mining stocks are taking a beating as the recent slide in the price of the world’s largest digital asset has analysts reconsidering their outlooks following a record-breaking year.

B. Riley Securities Inc. cut price targets on Marathon Digital Holdings Inc., Riot Blockchain Inc., Greenidge Generation Holdings Inc. and Stronghold Digital Mining Inc.

The firm also reduced estimated earnings multiples. Marathon fell as much as 9.8%, Riot dropped as much as 7.6% and Greenidge was down as much as 5.6%. Stronghold edged higher.

“The main reason for the lower target multiples is the higher-than-expected capital cost of the industry,” B. Riley analyst Lucas Pipes wrote in a report Wednesday, while maintaining a buy rating across stocks under sector coverage. Price cuts ranged from 20% to 45%, with Marathon seeing the smallest price cut and Greenidge, the biggest.

Miners’ processing power or hash rates have been come under scrutiny as falling Bitcoin prices and hash rates near highs stoke fears of greater competition. Global hash rates have been climbing since late June and are back near pre-China crackdown highs, according to Blockchain.com.

Pipes has an estimated average network hash rate of 230 and 315 exahash per second, for this year and 2023, respectively.

Meanwhile, Cantor Fitzgerald initiated coverage on Riot with an overweight rating and $45 price target earlier this week, arguing that the company stands to win more market share after its recent announcement to add mining capacity that could triple its hash rate by the end of the year.

“While we recognize the price of Bitcoin is volatile and difficult to predict over the short-term, over the longer-term we are bullish on the price of the digital asset, which is an important revenue driver,” Cantor analyst Mike Colonnese wrote in an initiation coverage report for Riot on Tuesday.

Read full story on Bloomberg