Bitcoin’s richest trader has lost a hefty $800 million in just a single day as the volatile cryptocurrency market continues to plummet.

The cryptocurrency has plunged to $42,963, a drop of just under one per cent on January 6.

At just after midnight, Bitcoin was trading at $43,515.

The toe-curling loss comes as the cryptocurrency plummeted a whopping 16.5 per cent on Saturday, shedding a fifth of its trillion dollar value.

The mystery trader, who owns the largest share of Bitcoin in the world – some 288,000 of them – began seeing their fortune fade in the early hours.

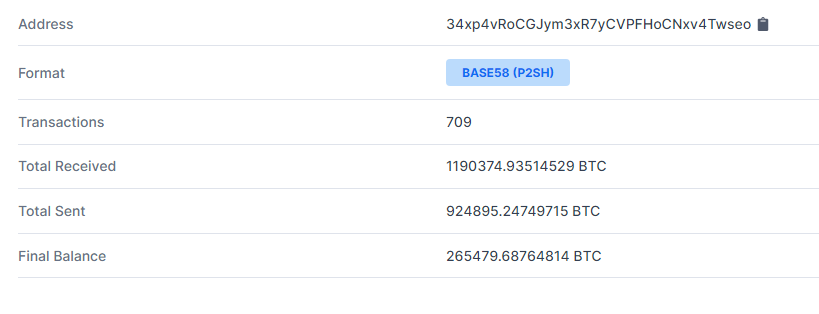

Wallet 34xp4vRoCGJym3xR7yCVPFHoCNxv4Twseo had $16.29billion (£12.28bn) worth of the crypto on Friday. By Saturday morning, that had dropped to $15.45billion (£11.65bn) then to $13.81billion (£10.41bn) by the evening, wiping out $2.48 billion in one day.

In fact, the unlucky trader has seen the value of his stash sink by $5.5million (£4.15m) in less than a month.

BitInfoCharts shows the wallet – which has been trading since October 2018 and owns 1.53 per cent of all Bitcoins – clocking a high of $19.33billion (£14.55bn) on November 11 before dipping to $16.78billion (£12.65bn) several days later and then hitting a low of $11.3billion (£8.4bn) today.

As the price of Bitcoin has continued to nosedive, trading in the cryptocurrency has tailed off.

Trading across the exchanges on Tuesday was just $4.8bn, data from Kaiko compiled by Messari show.

That compares with $13.1bn a year earlier, and is well below the one-year average of roughly $9.2bn, according to Bloomberg.

It comes as one crypto trader said he lost millions of dollars in just under five minutes.

The anonymous Reddit user claimed he made $1.3million (£900,000) after investing in SQUID, the digital currency inspired by the Netflix series Squid Game.

The cryptocurrency surged to a top price of $2,681 (£2,000) before plummeting to $0.01 – a 99.99 per cent fall over the last month.

Tech website Gizmodo had previously warned that the coin was likely to be a scam, commonly known as “rug pull” that happens when the creators of the new crypto quickly cash out their coins for real money.

The drop comes less than a week after Bitcoin reached a record high of over $69,000 (£52,000).

The sharp fall has wiped around $300billion (£226bn) worth of value from the combined crypto market in just two days.

Bitcoin, the number one cryptocurrency reached a low $51,808.54 (£39,000) market value, according to CoinDesk figures.

All the other major players including ethereum, Binance‘s BNB, solana, cardano and Ripple’s XRP have experienced drops of around 10 per cent.

Why has the cryptocurrency market crashed?

The swings in cryptocurrencies follow a volatile period for financial markets, with spiking inflation forcing central banks to tighten their monetary policy.

China has also ramped up it’s clampdown on Bitcoin mining, which helped cause the last crash earlier this year.

The omicron variant has also led to risk aversion over concerns about what it might mean for global economic reopening in the coming months.

Global stocks are down more than 4 per cent from a record in November, while haven assets like Treasuries have rallied.

The dollar has also been strengthening against other flat currencies and crypto this week, in part because interest rates are rising to drive down inflation.

Read full story on The Scottish Sun