Bitcoin slid below $50,000, a level some analysts view as a key pivot for assessing the largest cryptocurrency’s outlook heading into 2022.

The token fell as much as 4.5% on Tuesday in Asia and was trading at about $49,100 as of 1:10 p.m. in Singapore. Second-largest coin Ether and the Bloomberg Galaxy Crypto Index were also in the red.

Investors have retreated from the most speculative corners of global markets of late, worried that an ebbing tide of central bank stimulus could spell trouble. Just how exposed Bitcoin and the wider crypto universe is to that risk is the subject of heated debate.

For Bitcoin, overall there isn’t “anything worrying at this point,” said Vijay Ayyar, vice president of corporate development and international at crypto exchange Luno in Singapore. He added the virtual coin’s disposition will remain “bullish” if the $48,000 to $49,000 level holds.

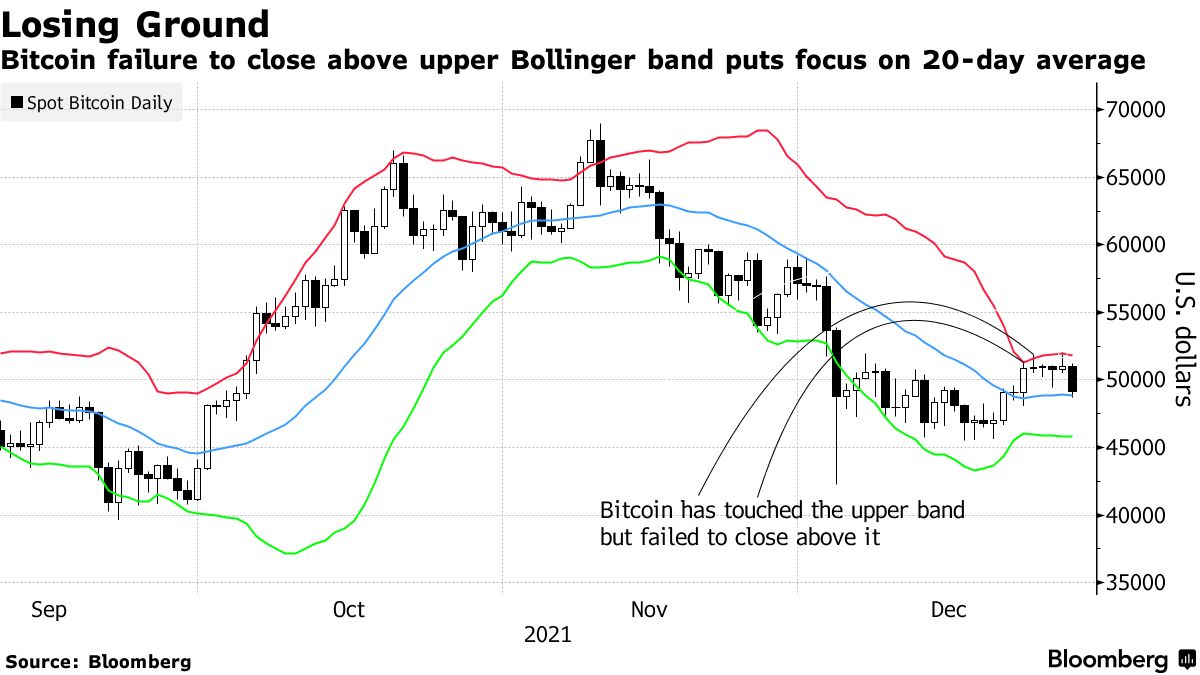

Technical studies suggest something of a tipping point for Bitcoin following a retreat from an all-time high of almost $69,000 in November, which has trimmed its year-to-date advance to some 70%.

For instance, a study using Bollinger bands — a popular way of looking at volatility — shows the virtual coin touched the upper band in the past week but failed to close above it. For some, that suggests Bitcoin may face difficulty making gains in the short term.

Smaller tokens such as Solana, Cardano, Polkadot and meme token Dogecoin also lost some ground Tuesday, according to tracker CoinGecko.

Read full story on Bloomberg