Markets have been juggling worries over the Omicron variant of coronavirus over the past weeks, and cryptocurrencies have not been immune.

As per cryptocurrency research firm CryptoCompare, total inflows into digital asset products turned negative in December’s third week. That marks the first time since mid-August.

Average daily volumes also dipped from the start of the month through December 20, slipping 1.4% to $659 million. In January, they stood at $1.51 billion.

However, digital products along with other risky assets have caught some Christmas cheer from the so-called “Santa Claus rally” this week. Bitcoin is up about 8% so far this week, on track for its best week in two months.

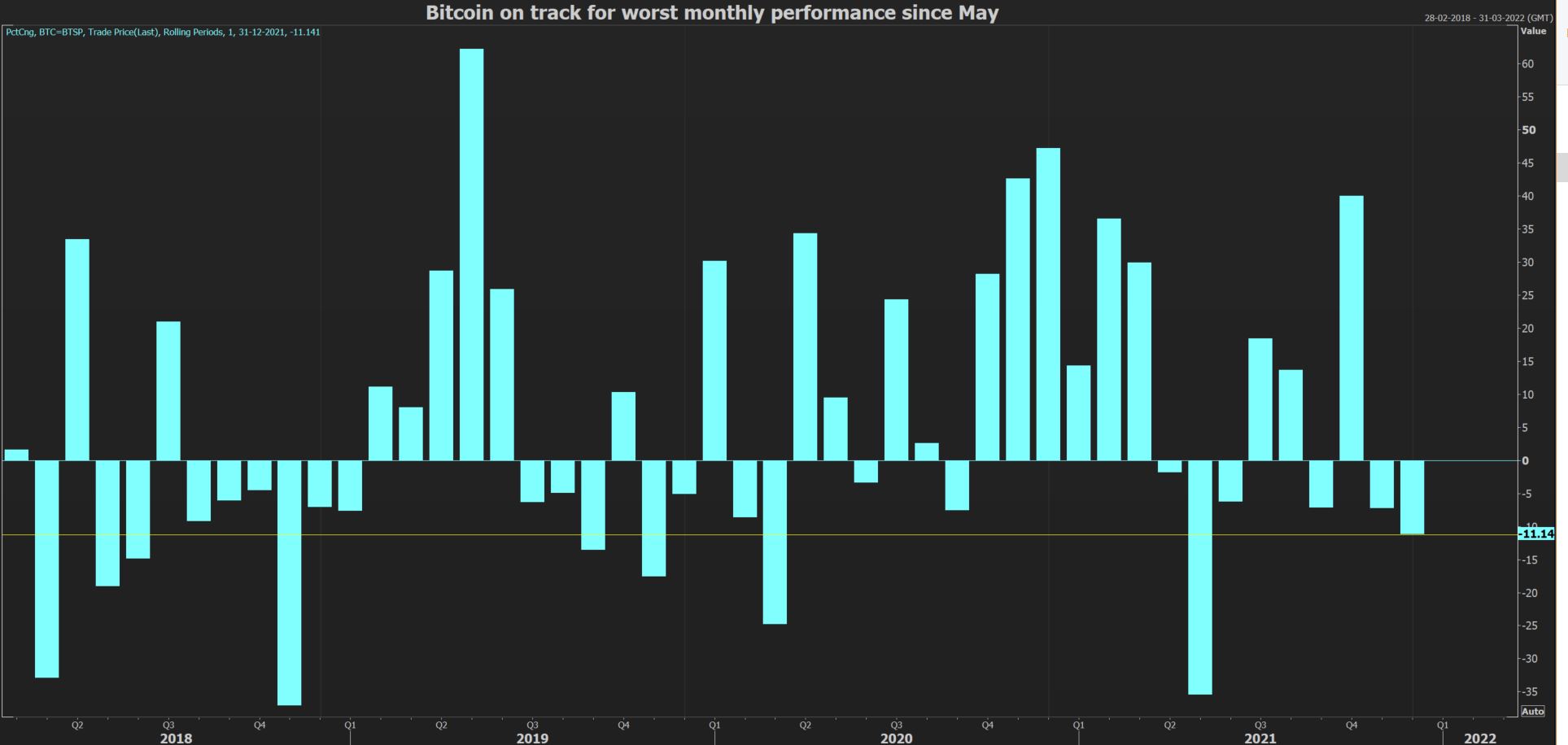

Still, it looks to be a rather blue Christmas for bitcoin, barring any major year-end moves. The cryptocurrency has slid about 11% so far this December, putting it on track for its worst month since May.

The MVIS CryptoCompare Digital Assets 100 Index (.MVDA), which tracks a basket of the 100 largest digital assets, is on track for monthly losses of 9%.

On the brighter side, CryptoCompare notes that weekly flows in December still average around $43.4 million of inflows each week. Unsurprisingly, bitcoin-based products captured the most new money, averaging $35.6 million of net inflows.

However, ethereum has posted $18.6 million of weekly net outflows on average, the only digital asset tracked to do so. Meanwhile, products tracking solana, the internal cryptocurrency of the solana blockchain that is seen as a potential ethereum competitor, saw an average of $10 million in weekly inflows in December.

Meanwhile, assets under management in Greyscale investment products dipped 17.1% to $43.9 billion, as per CryptoCompare data. Greyscale products still hold the lion’s share of the digital asset investment market, with a market share of 76.2% of total AUM, but they have lost some ground from the 86.6% they held at the start of 2021.

Read full story on Reuters