Fanatics Inc. will start a new trading-card brand as it puts into motion a plan to realign the collectibles industry.

Zerocool is set to debut Tuesday in a push for Fanatics to extend beyond sports and into pop-culture, art and entertainment-focused products. It will look to sign licensing deals with production studios, musicians, fashion houses and more for all sorts of intellectual property that has an active fanbase.

“It’s all of the important people, brands and companies in our lives other than sports,” Josh Luber, co-founder and chief vision officer of Fanatics Collectibles, the subsidiary that oversees the company’s trading-card ambitions, said in an interview. “At some point there will definitely be trading-card sets for politicians, for businesspeople.”

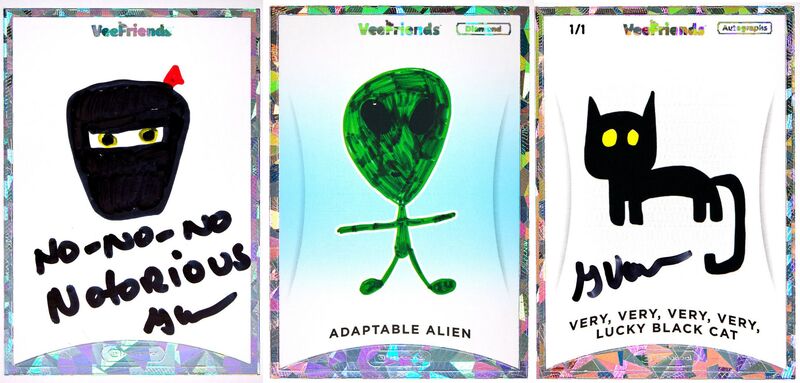

Zerocool’s first card line is in collaboration with investor Gary Vaynerchuk, based on his NFT project VeeFriends. Cards will be sold through its website, where users can place bids in a blind Dutch auction, a mechanism that isn’t often used in the industry, to promote pricing equity.

Fanatics, which began as a sports-merchandise and memorabilia seller, has been expanding into several new businesses under Chief Executive Officer Michael Rubin, including sports betting and nonfungible tokens. Earlier this month, Fanatics was said to have raised $1.5 billion at a $27 billion valuation from investors including Fidelity Management & Research Co. and funds operated by BlackRock Inc. and MSD Capital LP.

Fanatics invaded the trading-card industry last year by locking down several licensing agreements across sports, including baseball, basketball and football, snatching away longtime moneymakers for incumbents Topps and Panini SpA. Fanatics then acquired Topps for $500 million in January, fast-tracking its way into the baseball-card market and adding one of the strongest brands in the industry.

Management plans to operate a portfolio of trading-card brands within Fanatics Collectibles rather than combine them under the Fanatics banner, with Zerocool as its first launch. Luber declined to say if Fanatics was in talks with any potential acquisition targets.

Panini and Upper Deck are two of the largest remaining companies in the space, along with smaller players such as Rittenhouse and Parkside. He said he doubts there will ever be a Fanatics-branded card.

Michael Jordan or an ETF?

Luber, who formerly ran sneaker marketplace StockX, first met with Fanatics in 2020. Rubin flew out to Detroit and the two talked trading cards for hours at a hotel. By the end of the meeting, Rubin decided to try to obtain the sports licenses.

Fanatics is looking to expand the hobby beyond the hardcore or nostalgic collectors who make up much of the market. Investors have taken to alternative assets as a hot place to park their cash, buying up items like classic cars, wine, jewelry and digital art. In trading cards, executives at EBay Inc. said that the marketplace moved $2 billion in cards in the first six months of 2021, en route to a “very strong year” for the category.

“How much more fun is it to buy a Michael Jordan rookie than an ETF?” said Luber, referring to exchange-traded funds. “Once you break that barrier, not only is it a real investment, but also there’s a liquid market.”

A card-breaking operation — where shoppers can split the cost of boxes and have their packs opened on camera as entertainment for a streaming audience — is also in the works at Fanatics. Executives don’t plan on getting into card grading, but they may soon sign on one of the existing companies as a partner.

Read full story on Bloomberg