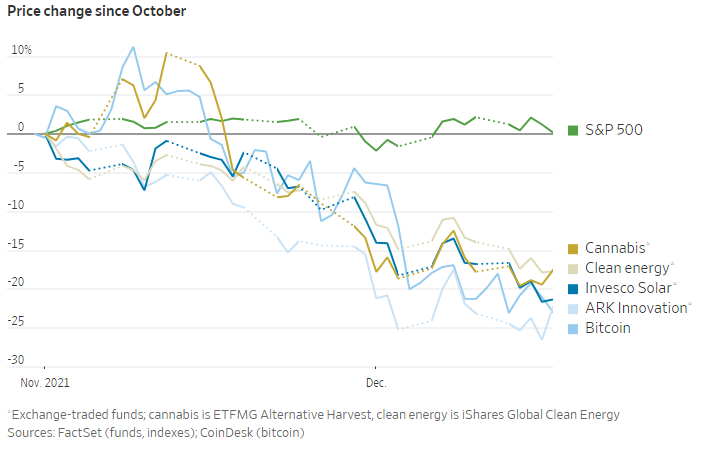

Speculation seems to be going out of fashion. Since early November, the most speculative stocks have been crushed, even as the wider market reached new highs. Many blame the Federal Reserve, but the link between monetary policy and speculation is less clear than it seems.

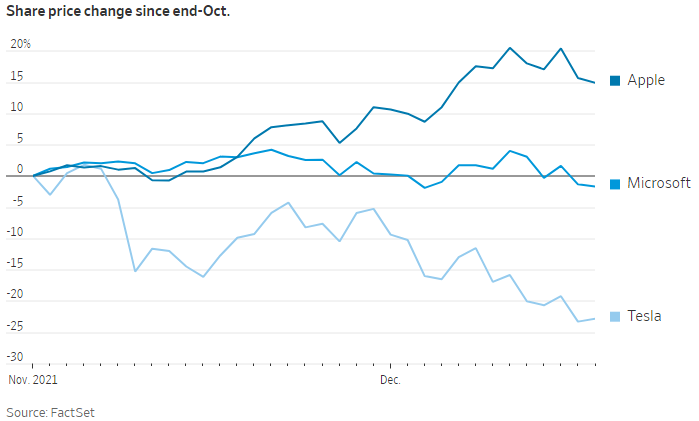

Among those losing 20% or more: The “meme” stocks of GameStop and AMC Entertainment, electric-car maker Tesla, hydrogen darling Plug Power, bitcoin and a host of tiny unprofitable stocks. T

he businesses have little in common, but all rely for high valuations on buyers willing to bet on a story—and have benefited from the surge in individuals trading stocks. (A stunning rally in some of the speculative names Friday did little to mitigate the losses; AMC led with a 19% daily gain, but is still down one third from early November, and worth just over half where it peaked in June.)

The pattern extends into the wider market, where the volatility beloved of speculators was the most important predictor of performance. The more volatile a stock in the S&P 500, the more it rose in the 12 months up to the start of November, and the more it fell since.

Investing Fashions Come and Go

It is very tempting to say this is all about the Fed and other central banks. The lowest rates in history and trillions of dollars of quantitative easing surely encourage long-shot speculative bets. Take those away, as the Fed says it will, and it should be no surprise that those speculative bets suffer.

The timing fits with the recent falls being the Fed’s fault, too. The Fed started tapering off its bond-buying program last month, coinciding with the end of a big rally in everything speculative. It said last week it would end the QE program earlier than previously planned, as well as penciling in three rate rises next year.

The trouble is, what is the theory here? How would the Fed’s rate path affect assets that look more like gambling tokens than ownership rights? No one buys GameStop, let alone bitcoin, because of a discounted cash flow model.

It is true that a higher expected interest rate from the Fed should lower the value from any model using it as the discount rate. But even if some misguided soul did try to value GameStop, AMC or the rest with such a model, they would discount cash flows using long-dated bond yields, which have fallen, not risen, as the Fed talked about tightening.

It is hard to see the link to Fed bond-buying, either. The Fed’s favorite theory for how QE works is that bond-buying pushes cautious investors out of safe Treasurys into riskier assets, in turn pushing their owners into riskier assets, and so on up the risk ladder. At the very top someone on Reddit makes a GameStop meme.

Tech Isn’t All Bad

Even if this “portfolio channel” theory is correct, and I doubt it is this predictable, it isn’t backed up in the numbers. Since April, the entire QE program and more has been offset by investors piling into funds that put the money back at the Fed, using its reverse-repo operations.

Adjust the Fed balance sheet for the sudden popularity of reverse-repo and there has been a sort of voluntary quantitative tightening going on that is taken the Fed’s total assets back to where they stood in October last year.

Still, speculative stocks and crypto depend for their value on stories, not on reported earnings. Stories about the Fed tightening are just as powerful as stories about future demand for batteries, stories about a switch from gold bullion to cryptocurrencies or stories about stuffing short sellers—but hurt rather than help the price.

Higher interest rates might matter in a simpler way, by making cash in a bank account more attractive. But even the three rate rises predicted for next year by the median Fed policy maker would only take the range of Fed rates to 0.75%-1%. It is hard to believe that would be enough to tempt many people away from high-risk bets with payoffs hundreds of times as high.

This isn’t to say that the amount of money sloshing around doesn’t matter to speculative assets, or that the price of money—the interest rate—is irrelevant.

It is just that the money sloshing around isn’t the money created by the Fed. A reasonable theory is that the money pumped into bank accounts by government stimulus is what matters—backed up by the individuals talking about trading their “stimmy checks.”

“You’ve given people gambling money and they’ve got nothing else to do so they’re YOLOing into individual stocks,” said Andrew Lapthorne, global head of quantitative research at Société Générale, using the acronym for “you only live once.” “But that is gone away.”

As stimulus-filled bank accounts run low and newbie traders return to work, those flows into the most-speculative stocks are reduced or turn negative, a drag on prices.

The prospect of higher interest rates hurts too, even if few will be tempted into cash by slightly higher rates. Johanna Kyrklund, group chief investment officer at fund manager Schroders, says even a few people switching to cash could hit the price of assets driven up by a constant influx of new buyers.

“At the margin the cost of sitting on your hands [in cash] has gone down so at the margin that reduces the FOMO,” she said, using the acronym for “fear of missing out.”

Whatever the relationship between the Fed and speculative assets, it isn’t a neat mathematical one. Speculative assets had even bigger falls from their January-March highs before a brief but spectacular rally for many of them in the autumn, and neither move was linked to the central bank.

We can say for sure that tighter monetary policy is a headwind for speculators, but there is too much uncertainty to know whether it will blow them away soon, or even if it was the cause of their recent losses.

Read full story on The Wall Street Journal