London Metal Exchange Chief Executive Officer Matthew Chamberlain will step down from the world’s biggest industrial metals market to run a blockchain-based asset custodian.

Chamberlain, a former banker who was just 34 when he was promoted to lead the LME five years ago, will become CEO of Komainu, a company backed by Nomura Securities, Ledger and CoinShares International. Adrian Farnham, the head of the LME’s clearing house, will become interim CEO when Chamberlain leaves at the end of April.

The differences are stark. Komainu was created just a few years ago as one of the first companies offering the service of guarding crypto assets, while the LME is a London institution steeped in centuries of history, setting prices for some of the most basic materials, such as copper and tin, that have played critical roles throughout much of human history.

It’s also been slow to adapt at times — Chamberlain’s predecessor stepped down after a backlash over his efforts to modernize the exchange.

Chamberlain, who joked at the LME dinner in October that he could “look forward to an alternative career” if the exchange’s users took their business elsewhere, is leaving after a turbulent year.

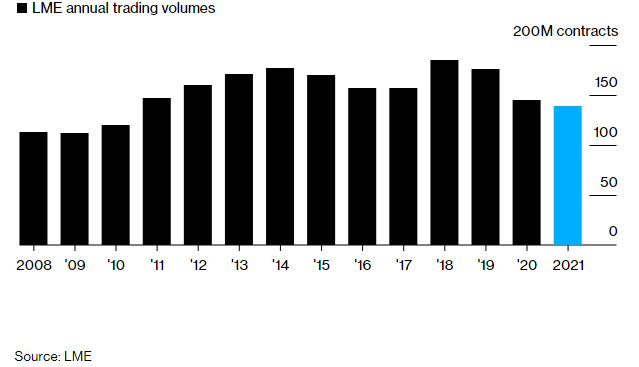

Even as metal prices have shot to record highs, the exchange’s relations with some of its biggest brokers have been strained by a fight over whether to close the historic open-outcry trading floor. The LME is also facing declining trading volumes, which fell to the lowest in more than a decade last year.

Chamberlain joined the LME in 2012, after advising Hong Kong Exchanges and Clearing Ltd. on its takeover of the bourse while at UBS Group AG.

He rose quickly through the ranks, overseeing a major reform of its warehousing network, and was drafted into the top job in 2017 as the LME battled pushback from users over rising trading fees and the growing influence of algorithmic trading on the bourse, which traces its roots back to the early 19th century.

While Chamberlain won praise from core users for rolling back some fee increases as part of a package reforms early in his tenure, he’s more recently faced an outcry from the LME’s famously fractious user base over a planned move to permanently close the trading floor and move fully to an electronic and phone-brokered market.

Trading on the floor was suspended due to Covid-19 in March 2020, and at the start of last year the bourse tabled a proposal to close it for good. But after a public backlash from industrial users, Chamberlain instead opted to reopen the floor to carry out some of its former pricing functions.

Muted Volume

Trading activity declined for a third straight year on the LME

Even then, brokers warned that a steep drop in volumes threatened the long-term viability of the floor, and ongoing discord between the LME and its members was evident during the bourse’s annual industry get-together in London in October.

In a speech that was met with occasional jeers from the crowd, Chamberlain quipped that he might consider an alternative career at the LME’s former offices in the heart of the City, which have been transformed into an immersive theater venue.

Chamberlain took over from former NYSE Liffe boss Garry Jones, who had stepped down in the wake of a backlash from users over his plans to commercialize and modernize the exchange.

The LME, which was owned by its brokers prior to the HKEX takeover, is one of the last few bourses in the world where trading is conducted face to face, and prior to the pandemic, the bourse still relied on a paper-based repository for the metal stored in its warehouses around the world.

As the prospect of a lockdown in London sparked panic that couriers wouldn’t be able to deliver documents to the repository, Chamberlain — a self-confessed technophile with a degree in computer sciences from Cambridge University — scrambled to develop an electronic alternative. He’s also taken broader steps to overhaul the exchange’s systems and infrastructure, including ongoing development of a new trading platform.

“I have always been passionate about building safe and efficient solutions to ensure global markets function as effectively as possible,” Chamberlain said in a statement announcing his move to Komainu. The blockchain-based start-up “truly represents the natural evolution of our industry”, he said.

Read full story on Bloomberg