OlympusDAO (OHM) and many of the forked rebase projects it inspired have suffered brutal losses this past week despite the broader DeFi markets rebounding from last week’s lows.

The tumultuous markets have also pushed Ethereum’s seven-day burn-rate up to 11 ETH per minute, while the Fantom, Arbitrum, and Terra networks each posted significant TVL growth for the week.

OHM and Rebase Forks Plunge

OHM ranks as the weakest performing top 100 DeFi token for the week according to CoinGecko. The token is down roughly 53% since Jan. 10, including a loss of 32.6% in the past 24 hours.

Well-known OHM-holder, Twitter user “shotta_SK,” commented that they had “derisked” some of their OHM, adding that their remaining position would be held indefinitely. Mick Hagen, the founder of HiFi Finance, posted an Etherscan link believed to show shotta_SK selling more than $10M worth of OHM in a single transaction.

With shotta_SK also known to be a significant holder of Redacted Cartel’s recently-surging BTRFLY token, Hagen posted: “If you’ll do this to $OHM, I’m afraid for everyone holding $BTRFLY.”

The bloodshed has seen OHM fall out of the top 100 crypto assets by capitalization, currently ranking 107th with a $1.06B market cap.

Redacted Reverses

Redacted Carted (BTRFLY), an “official” fork of OlympusDAO that has rocketed since its mid-December launch, ranked as the second-worst performing top 100 DeFi token for the week behind OHM with a 46% loss.

BTRFLY had quickly surged 260% in just two-and-a-half weeks after beginning to trade on exchanges from Jan. 19, rallying $1,000 to nearly $3,600 thanks to public support from the OlympusDAO team.

However, the token has since lost more than half of its value, including a 41.6% loss over just the past three days.

Wonderland Not so Wonderful

Wonderland (TIME), another recently surging OlympusDAO fork, rounds out Coingecko’s top three DeFi drawdowns for the week. TIME has shed one-third of its value this past week, including 28% in just the past 24 hours.

TIME is now changing hands for $1,545, an 84% drawdown from its early November all-time high of $9,700. Wonderland now boasts a larger market cap than OlympusDAO despite the drawdown, ranking 91st overall.

KlimaDAO and Lobis

Smaller rebase projects are also down significantly, with most rebase protocols suffering sustained losses despite other DeFi assets beginning to recover this week.

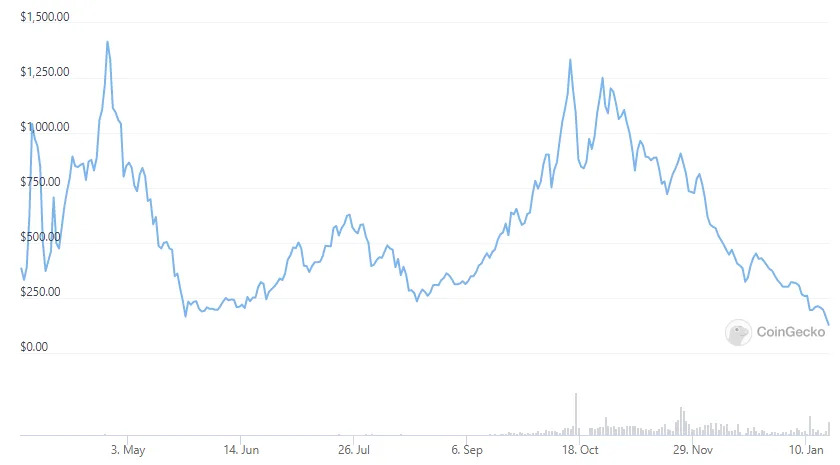

KlimaDAO (KLIMA), a carbon offset-based rebase protocol backed by Mark Cuban, has suffered brutally since rocketing during the days following its October launch.

While KLIMA has lost 14% over the past seven days, the token is also down 97% since posting all-time highs of roughly $3,650 one week after it began trading, last changing hands for $116.

Lobis (LOBI), an officially approved Olympus fork that launched in late November, is down 39% over the past four days. The LOBI token is now down 97.4% since its Nov. 25 high.

DeFi’s biggest losers for the week

OlympusDAO (OHM) – 52.6%

Redacted Cartel (BTRFLY) – 46%

Wonderland (TIME) – 33.4%

Lido DAO (LDO) – 23.8%

Loopring (LRC) – 20.2%

Top Gainers

Despite the bloodshed suffered by rebase protocols, half of the top 100 DeFi assets by market cap posted bullish recoveries this past week. Ampleforth (AMPL) ducked the broader downtrend for rebase projects to post the fifth-largest bounce among leading DeFi assets.

Anyswap (ANY) + 81.6%

Dopex Rebate Token (RDPX) + 63.4%

Keep3rV1 (KP3R) + 59%

Spookyswap (BOO) + 57.1%

Ampleforth (AMPL) + 49.8%

Market Cap

DeFi assets currently represent $145B or 6.7% of the combinedc rypto capitalization. Terra (LUNA) exerts a dominance of 20.4% over the sector with a $29.6B market cap, followed by Chainlink (LINK) with $925.2M and Uniswap (UNI) with $313M.

The combined DeFi market cap is up 7.8% over the past week.

Fantom and Terra Defy Slow Week for TVL Growth

The combined total value locked (TVL) in DeFi protocols trended steadily for the week, gaining 3.4% to currently sit at $236.6B according to DeFi Llama.

While the TVL of most networks trended sideways, sixth-ranked Fantom surged by 42.6% for the week, now representing $7.7 worth of locked assets.

Ten of Fantom’s fifteen-largest protocols posted growth of at least 20% for the week including two triple-digit gainers. Just two of Fantom’s top 20 protocols suffered drawdowns. Cross-chain DEX Multichain represents $3.5B or 45.5% of Fantom’s $7.7B TVL, followed by SpookySwap with $1.6B or 21%, and Geist finance with $846.M or 11%.

Terra also grew by roughly 9% this week, currently ranking as the second-largest DeFi network behind Ethereum with a TVL of $18.5B. Half the network’s TVL is held by a single project, with Anchor boasting $9.22B in locked assets.

Ethereum L2s up 11%

The combined TVL of Ethereum’s Layer 2 networks has grown by 11% since Jan.10 to tag $6.1B, its highest level in four weeks.

Arbitrum’s TVL represents 49.6% of the L2 TVL, currently sitting at $3.02B after tagging a new all-time high of $3.08B on Jan. 15 according to L2beat. Arbitrum’s TVL is up 15.4% in seven days.

Metis Andromeda posted dramatic growth of 81.4%, emerging as the largest Optimistic roll-up network and the third-ranked L2 with a TVL of $547M or 9% of the sector’s total.

Rival Optimistic network Boba has continued to slide, shedding 20% in seven days and slipping down to sixth with 5.4% of L2 TVL. Optimism currently ranks fifth with $401M or 6.6%.

Feel the Burn

Recent volatility has seen Ethereum’s burn rate skyrocket, with an average of roughly 11 Ether destroyed every minute over the past seven days according to Ultrasound Money.

The week saw 110,353 Ether burned in total (worth $362M at current prices), a 27.6% increase in seven days. More than 1.53M ETH has now been burned since the Aug. 4, 2021 launch of EIP-1559.

OpenSea destroyed 17,701 Ether in seven days to rank as the top burning protocol, followed by ETH transfers with 10,270 ETH, Uniswap v3 with 7,531 ETH, Tether with 3,700 ETH, and the LooksRare airdrop with 2,793 ETH.

Read the original post on The Defiant.