Decentralized options protocol Opyn is readying to launch its Squared ETH or SQUEETH token, which is designed to hedge ETH-based liquidity provider (LP) positions on automated market maker (AMM) exchanges.

In a Dec. 17 blog post, Opyn developer Joe Clark described SQUEETH as a “new DeFi primitive” that allows stablecoin/ETH liquidity providers to earn swap fees without being exposed to the impact of price fluctuations in Ethereum for the first time.

The instrument will be a new addition to Ethereum’s growing ecosystem of decentralized derivatives, with DeFi traders able to hedge using yield tokenization, leveraged tokens, structured options products, and futures contracts offered by decentralized protocols. Opyn has not announced an expected launch date for the product.

Power Perpetuals

SQUEETH was first articulated in an August research paper based on research from Opyn and Paradigm Research. SQUEETH was then described among other “power perpetuals” offering returns based on a price curve.

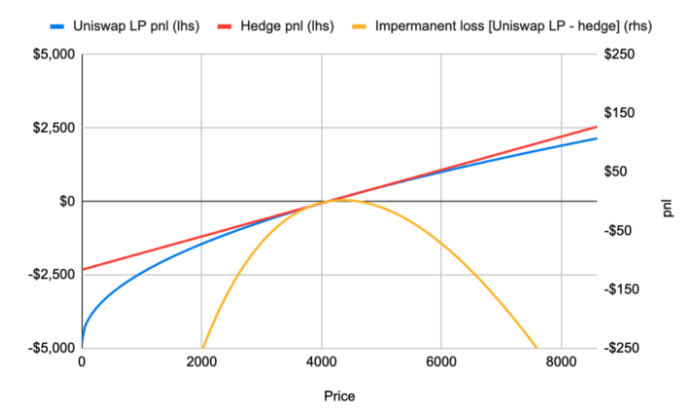

Clark’s latest blog post states that SQUEETH is now being designed to overcome the impermanent loss associated with providing liquidity on an AMM. The developer describes SQUEETH as a “quadratic“ instrument that improves hedging against “non-linear positions” — instruments that perform according to a curve, such as AMM LP positions.

AMM liquidity providers deposit equal values of two assets contained in a pair and receive LP tokens representing their position that can be redeemed for the underlying assets. However, fluctuations in asset prices result in AMM pools rebalancing, causing LPs to suffer divergent or impermanent loss.

Impermanent loss is when the price of only one of the assets in an AMM pair appreciates. The AMM protocol rebalances LP positions to represent a larger sum of the asset that is underperforming and a smaller sum of the asset that is gaining compared to a liquidity provider’s original deposit.

The price of SQUEETH is designed to hedge against this divergence, with the asset’s price expected to fluctuate proportionally to the impermanent loss caused by price volatility.

SQUEETH offers two core utilities to stabecoin/ETH liquidity providers.

Firstly, liquidity providers can purchase SQUEETH while holding their LP position to offset impermanent loss, allowing them to profit from Ether price gains while also earning swap fees.

Swap Fees

When partnered with a short position using futures contracts, SQUEETH can also be used to hedge against drawdowns in the price of Ether while still earning swap fees. “We can quite accurately hedge any non-linear exposure with a linear instrument (futures) and a quadratic instrument (SQUEETH),” said Clark.

The developer noted that SQUEETH can also be used to hedge against LP positions on Uniswap v3, as SQUEETH is purchased with a variable curvature corresponding to the concentrated liquidity ranges offered by v3.

While Clark conceded that “some leftover cubic and higher order terms” will have a “small impact” on the effectiveness of the hedge, he concludes that “the hedge holds remarkably well” overall.

Read the original post on The Defiant.