TeraWulf Inc., a cryptocurrency miner that aims to be more environmentally friendly than peers, on Monday closed down 17% after paring a steeper decline that was the most since its reverse merger in December.

Earlier, the company’s shares slid as much as 33% to an all-time low of $4.03, adding to a persistent decline for the celebrity-backed crypto firm. The stock is down more than 80% since the company’s reverse merger with Ikonics Corporation and listing on the Nasdaq Stock Market at $25.

TeraWulf stock stumbled right after its trading debut and about $800 million of its market capitalization has been wiped out since then.

The firm, with celebrity backers including Gwyneth Paltrow and Mindy Kaling, describes itself as a “clean” cryptocurrency mining company amid concerns of the environmental impact of such energy-intensive activities.

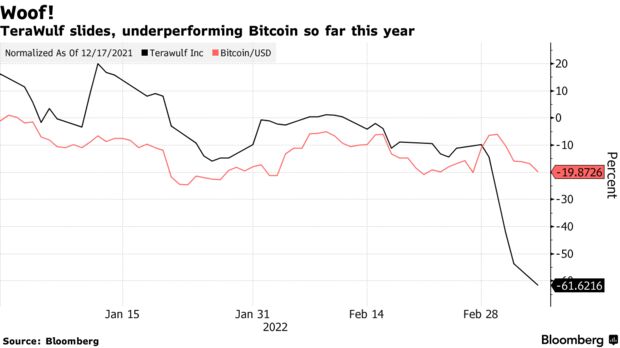

Terawulf’s decline comes amid a broader rout in crypto mining companies, many of which have underperformed Bitcoin so far this year on concerns around rising costs and falling digital currency prices.

Marathon Digital Holdings Inc., Core Scientific Inc., Riot Blockchain Inc. and Hut 8 Mining Corp. are down at least 30% so far this year. TeraWulf shares are down 67% over the same time period.

Read full story on Bloomberg