State Street Corp. is working with U.S. regulators to ensure it’s in position to roll out custodial services for cryptocurrencies once approved, in the latest sign of traditional finance converging with digital assets.

The centuries-old, Boston-headquartered bank started a digital division last June, and has “mega plans” to offer digital wallet safekeeping services to clients, according to Nadine Chakar, leader of the group.

The challenge is regulatory, Chakar said, pointing to State Street’s status as a Global Systemically Important Financial Institution (G-SIFI).

“The minute we get the nod, we’ll be ready,” Chakar said in an interview with Bloomberg journalists on Thursday. “We’re literally investing in the future,” she said. “We know clients are out there looking for this.”

Custodial services in traditional finance include trade settlement, exchange, clearing as well as safekeeping assets. But in the still-nascent digital-asset custodial space, the primary role is safekeeping assets by securing so-called keys, which Chakar says requires a close examination of the different types of digital custody options and their levels of risk.

State Street in June set up its digital division, and also last year rolled out crypto reporting, reconciliation and processing services to private fund clients. The bank’s custodial plans for digital assets, however, would take aim at crypto-native shops like that of Coinbase Custody and BitGo.

“We think a custodian bank like State Street can continue to do what it’s best at, which is keeping order and safety into the system. But we’ll do it differently,” Chakar said. “It’s my personal mission to prove that elephants can truly dance,” she said, referring to State Street’s size.

With $43.7 trillion in assets under custody and administration and $4.1 trillion in assets under management at the end of December, State Street is among the big Wall Street firms stepping up its presence in crypto, alongside banks including JPMorgan Chase & Co., Goldman Sachs Group Inc., and a unit of Fidelity Investments that have started offering various crypto services in recent years.

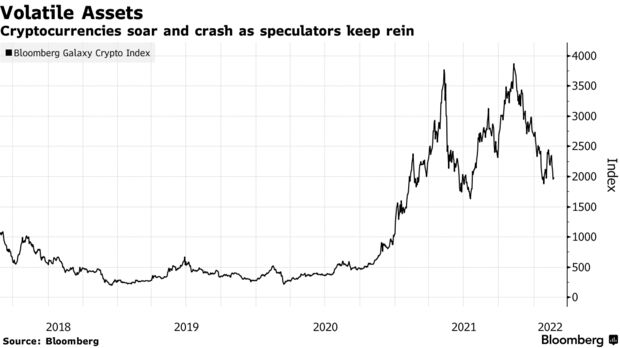

Chakar also said that she, along with many in the industry, has been surprised that in recent months cryptocurrencies have emerged as a risk asset, rather than a haven. “Everything we thought it was going to do, it isn’t,” she said, referring to cryptocurrencies being like a digital form of gold and a hedge against inflation.

Research still shows that there is “great adoption” by institutional investors, and with allocation increasing to the asset class, it will hopefully be less volatile over time, she said. Adoption will become much larger when clients can “take comfort” that the world’s largest custodian — State Street — is safeguarding the holdings, she said.

Read full story on Bitcoin Magazine