Big Thai companies are pouring money into Bitcoin mining as the cryptocurrency boom expands in the country, shrugging off central bank warnings over risk and volatility.

That comes as the number of people estimated to own cryptocurrency in the Southeast Asian nation surged over 400% in 2021 from the year before to 3.6 million, with shops and other places increasingly accepting crypto as payment.

“Bitcoin is booming and the act of listed firms and other financial institutions starting to join Bitcoin trading and mining helps confirm that the arrival of Bitcoin and other cryptocurrencies is a trend that we should not miss,” said an analyst at Kasikorn Research Center.

“[This interest from big companies and institutional investors] boosts confidence in digital currency and encourages small investors to join,” the analyst continued.

Brooker Group is one of the companies turning to crypto. The financial and real estate adviser has invested 1.2 billion baht ($36 million) in a Bitcoin trading business and set aside another 70 million baht for crypto mining. The company is also looking to invest around 150 million baht in Stablecoin and other digital assets soon.

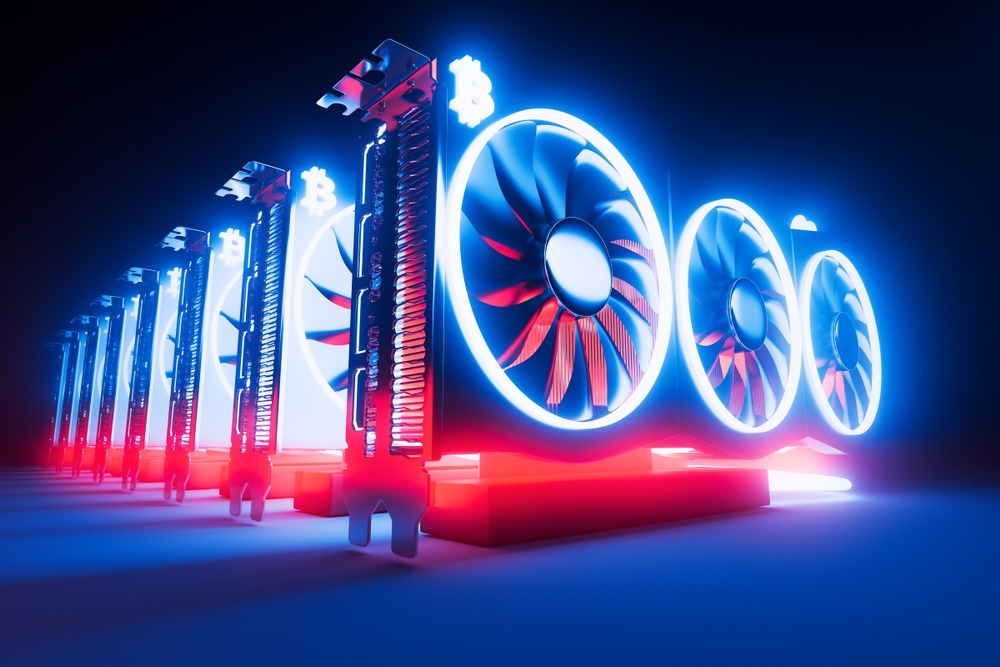

Jasmine Technology Solution has spent around 3.3 billion baht buying 1,200 Bitcoin mining machines from Bitmain Technology, and plans to add another 5,100 machines this year as it shifts to crypto from telecommunications technology. That transformation has driven its stock price about 90 times higher than it was a year ago, although the new business direction is yet to provide much of a boost to earnings.

Meanwhile, computer wholesaler and software developer Comanche International has also invested 60 million baht in a cryptocurrency mining business and a crypto trading platform.

The price of Bitcoin hit a record high of $64,400 in June 2021, sparking interest from would-be investors around the world and stoking the appeal of other cryptocurrencies as well.

And Thailand’s nascent crypto sector got a shot in the arm in November 2021 when the country’s oldest lender, Siam Commercial Bank (SCB), ramped up its drive into fintech with the acquisition of a 51% controlling stake in local cryptocurrency exchange operator Bitkub Online for 17.85 billion baht.

“That has made Bitcoin and other cryptocurrencies more interesting as more institutional investors are investing in them,” said an analyst at Asia Plus Securities.

Appetite for crypto has also been boosted after several companies, including leading department store operator The Mall Group, began accepting Bitcoin and some digital tokens as payment.

Leading real estate developers Sansiri and Ananda also accept Bitcoin as part of payment for their houses and condominiums.

However, the Bank of Thailand fired off a warning message over crypto on Dec. 1. As part of that, it said it doesn’t support digital assets as a mode of payment for goods and services, adding that it is working with other agencies to lay down proper regulations. The central bank is worried dramatic market fluctuations could hit investors hard.

Elsewhere, the Ministry of Finance expects to finalize regulations on taxing Bitcoin trading this quarter.

Bitcoin has dropped from its peak to around $42,000, with regulators urging investors to be careful. “Sometimes the price of Bitcoin jumps with no [apparent] reason,” said Sukit Udomsirikul, managing director in the research group at SCB Securities. “We don’t know how much exactly the coin should be valued at, so we need to be very cautious about it.”

Read full story on Nikkei Asia