One of the hottest things in the cryptocurrency world right now is GameFi. Its name reflects the combination of the old-fashioned thrill of winning prizes with new crypto developments in what’s known as DeFi.

GameFi players can trade, lend or rent out their winnings or or even borrow against them. You can’t do that with the stuffed kitty you scored at the county fair.

As its popularity soars, there’s a debate over whether GameFi will remake gaming or just separate the credulous from their money.

Reports of people borrowing to play raise the prospect of GameFi democratizing crypto opportunities — or becoming a form of digital sharecropping.

1. What is GameFi?

DeFi stands for decentralized finance, a field in which token-based transactions like lending and borrowing take place on blockchains, decentralized digital ledgers similar to that first used with Bitcoin.

In its most common usage, GameFi refers to decentralized applications (“dapps”) with economic incentives. Those generally involve tokens granted as rewards for performing game-related tasks such as winning battles, mining precious resources or growing digital crops. It’s an approach also known as play-to-earn.

In many GameFi apps, such as Alien Worlds, users can also earn money passively by letting others mine their virtual lands. They can also earn interest by using techniques developed by DeFi platforms to lend assets like digital characters or deposit them in what’s known as staking.

2. How does GameFi work?

Details can differ, but here’s the basic — and most successful — model to date, introduced in the game Axie Infinity, which had $564 million in on-blockchain transaction volume just in the last 30 days, per DappRadar.

Axie’s economy hinges on two tokens, AXS and Smooth Love Potion (SLP), plus non-fungible tokens (NFT), digital certificates of authenticity representing game characters and digital real estate. Players first typically put in around $700 to buy little blob-like monsters called Axies.

They get paid SLP for winning battles and completing quests. Axies can also breed, and the offspring can be sold. AXS is what’s known as a governance token that confers a right to participate in discussions on the future direction of the project. AXS tokens can also be staked to earn interest.

3. Isn’t that a lot to pay to play a game?

It is, but many other games don’t charge nearly as much upfront. Also, in some circumstances, playing can be extremely rewarding. Essentially, if you earn tokens in a game that grows in popularity, those tokens can grow in value, perhaps sharply: In 2021, the price of AXS went from 54 cents to $94. That means playing is not only a contest against digital dragons but a form of currency speculation as well.

Whether or not that’s a sustainable model, during Axie’s upswing it was enough to attract players in low-income countries like the Philippines. Those who couldn’t afford the game’s upfront cost often rented existing Axies from earlier players.

In many cases, they paid by sharing their income from the game. Last year, there was a flood of social-media posts about people in the Philippines making more money via Axie than at traditional day jobs — reports that might be worth taking with many grains of salt, given the incentives for game creators and early players to talk up a game’s appeal.

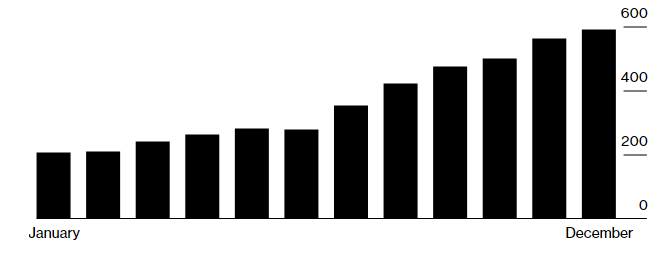

A Lot More GameFi Going On

Number of active blockchain-based game dapps in 2021

4. There have always been tokens in video games, right?

Pretty much. Virtual world Roblox’s Robucks can buy virtual Gucci purses for avatars; Fortnite’s Battle Royale lets you use V-Bucks to purchase pickaxes.

In Pokemon World, there’s the Pokemon Dollar, which is prize money for wining battles, and it can be used for buying potions and clothes. But that kind of money and digital goods can’t often be easily — or legally — sold outside of games, or converted into cash.

5. How is that different in GameFi?

The tokens are designed to work as full-fledged cryptocurrencies. That means that players can theoretically convert in-game winnings into cash on a slew of decentralized exchanges. GameFi tokens share the volatility common to cryptocurrencies not pegged to a traditional currency.

That means that if demand is growing, even modest winnings can grow substantially: the Metaverse Index, which tracks the prices of tokens from 15 different game and entertainment efforts including Axie Infinity and Decentraland, has more than doubled since its launch last April.

Of course, holding on to volatile assets can mean steep losses as well as gains, and players could face difficulties if they try to cash out during a major slump. Some tokens can also be used in a myriad of DeFi dapps, where they can earn interest by being used as collateral for taking out loans, for example.

6. How do GameFi companies make money?

Game developers usually receive tokens for their work, so the more people play the game and trade the coins, driving up coin prices, the more money they make. Some games also charge fees on certain transactions, and that money flows into the efforts’ related companies or treasuries, from which developers get paid.

7. How big is GameFi?

The number of blockchain games grew to more than 544 active dapps by the end of 2021, up from about 200 the year before, according to DappRadar: In the first week of January alone, the top 10 of those games handled more than $841 million in transaction volume, and attracted more than 2 million unique active cryptocurrency wallets.

While many of these games are fairly basic, venture capitalists have poured $4 billion last year alone to nurture efforts like Forte, which offers tools to create play-to-earn games. T

he result could be so-called AAA-quality video games with stronger graphics and more exciting gameplay than the current crop — as well as potentially greater earning possibilities. Traditional video-game makers are getting in on the action as well:

- Assassin’s Creed maker Ubisoft has invested in Animoca Brands, which makes its own blockchain games and is also an investor in the likes of Axie. Ubisoft’s Yves Guillemot recently called GameFi “one of those revolutions.”

- Square Enix, the maker of Final Fantasy, recently said it would consider issuing its own token.

- Mobile game-maker Zynga, which was just acquired by Take-Two Interactive, is exploring NFTs, and Take-Two CEO Strauss Zelnick said in January that the combined company can more effectively tackle blockchain-related opportunities.

8. What do critics say?

As game makers look at adding NFTs and other blockchain-based features, many hard-core gamers worry they will simply give the companies yet another way to milk them for money. Then there’s a long list of ways things can go wrong in GameFi, besides the potential for token values to crater:

- Regular folks playing these games can lose out to bots — computer programs designed to play these games for profit that can post millions of transactions a day. Sunflower Farmers, a game in which players are rewarded for planting and harvesting digital crops, recently had to take its website down to fix a vulnerability bots exploited: its SFF token fell from $5.25 on Jan. 2 to 8 cents on Jan. 13, per tracker CoinMarketCap.

- Bugs in code abound and can mean losses too.

- There’s also the real possibility of a “rug pull” — developers making away with money. That’s what happened with a game based on the Netflix show Squid Game: its currency fell from $2,860 to near zero in one day in November as the game’s creators cleaned out over $3 million in funds.

9. Is this about anything more than making money?

Many proponents see GameFi as a chance for the little guy — the player — to come out from under traditional game makers’ thumb. Many players loathe some of the companies that make their games.

Some dislike the firms’ sexist cultures and others are angered by the way they entice users into paying for additional content. GameFi apps, in their ideal form, are governed by their communities of users, who decide on things like fees. Through tokens, gamers own a piece of the effort. They also own their digital avatars and other NFTs.

10. Are regulators looking at GameFi?

At this point, regulators are still trying to catch up with earlier waves of crypto developments. They have already signaled they have concerns about the freewheeling world of DeFi, and could release additional rules this year. It’s not a stretch to think that games with DeFi-like features will have to abide by the same rules — and probably sooner rather than later, if success stories like Axie Infinity are anything to go by.

Read full story on Bloomberg