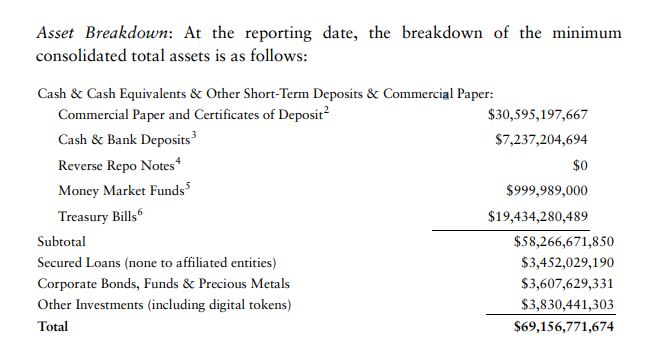

Tether published its latest ‘proof of funds’ last week. The figures are a snapshot of the controversial stablecoin issuer’s assets as of Sept. 30, 2021 and show it holding some $69.2 billion in reserves to back its tokens, which form an important backbone of the cryptomarket, and for Bitcoin in particular. The breakdown looks like this:

Look closely and you’ll see a line for “Reverse Repo Notes” that’s immediately followed by a big fat $0.

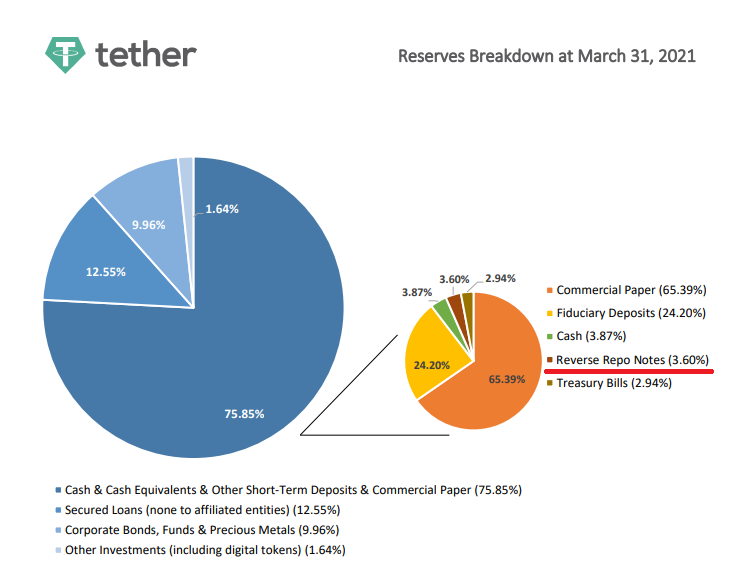

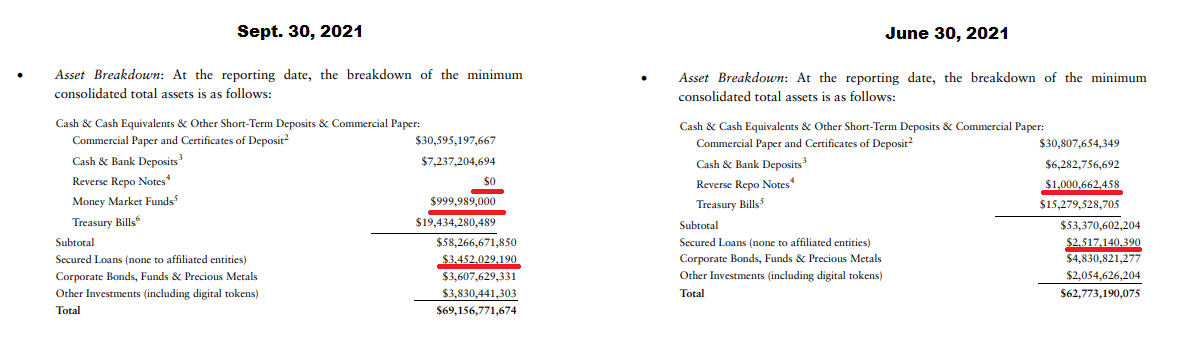

When Tether first provided an update on its holdings earlier this year it said it had 3.6% of its ‘cash equivalent’ assets in reverse repo notes (which worked out to about $1.11 billion based on total assets of $41 billion). Cash and cash-equivalents are used to back up the value of the stablecoin, and allow it to maintain a 1-to-1 peg against the dollar. In Tether’s June 30 release, reverse repo notes totaled $1 billion.

But there is one big problem with Tether’s reverse repo notes.

No one knows what they are, or perhaps we should say what they were.

It’s not a commonly used term. Search the Bloomberg terminal — which contains oodles of financial data stretching back to the 1990s — and nothing comes up. It’s the same story for Google. Industry participants have never encountered the term before either.

Here, for instance, is Barclays Plc Strategist and long-time repo expert Joseph Abate writing in a note this week that:

“The definitions of what we consider fairly standard money market instruments lack transparency in Tether’s attestation. For example, we have never seen a “reverse repo note.” Likewise, the footnotes accompanying the description of cash and bank deposits are a bit opaque. Reported balances include cash that can be withdrawn with 2d advance notice as well as term deposits. There is no information about the relative maturity distribution of these deposits or, significantly, if these are located at U.S. banks or offshore (at U.S. or non-U.S. banks).”

So what are Tether’s reverse repo notes?

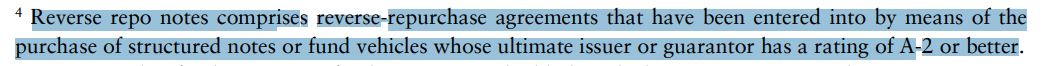

For what it’s worth, Tether defines them in a footnote as:

But that’s hardly enlightening. Reverse repurchase agreements don’t typically involve structured notes or fund vehicles, but rather an agreement to sell securities and buy them back a little while later.

It might help instead, if we try to answer where all those reverse repo notes actually went.

Tether began investing in money market funds for the first time according to its latest breakdown. These investments now total $999 million — which isn’t too far off from the $1 billion of reverse repo notes that seems to have disappeared since June 30.

However, “money market funds” comes with its own definitional footnote, described as comprising “funds investing in highly liquid, short-term money market instruments, including but not limited to deposits, treasury bills, commercial paper, and reverse-repurchase agreements.” Unless Tether has been using a very unusual definition of ‘reverse repurchase agreement,’ it seems like reverse repo notes would not be included in the “money market fund category.”

That leaves another possibility — secured loans, which rose from $2.05 billion in June to $3.45 billion between June and September.

Back to Barclays’ Abate:

“[Tether] invested $1bn in money market funds, and it increased its holding of “other assets,” which include crypto of $1.8bn to nearly $4bn and 5.5% of its portfolio. Tether had not previously owned any money funds. It also shifted $1bn out of ‘reverse repo notes’. But this is more likely a reclassification as the description of these instruments did not look like a repo transaction but more like a secured loan. In fact, its reported secured loans increased by about the same amount in September.”

Tether’s sometimes lauded for creating a new kind of currency, one that preserves the most desirable aspects of crypto while simultaneously limiting its volatility. But Tether’s creative ingenuity arguably goes even farther, all the way to the new and not very well-understood terms it’s using to describe the assets backing up its stablecoin.

Read original story on Bloomberg