Once billed as one of the hottest rising stars in crypto, Solana’s repeated run-ins with bots, outages and frustrated traders during the recent market crash might be about to knock the blockchain network off its pedestal.

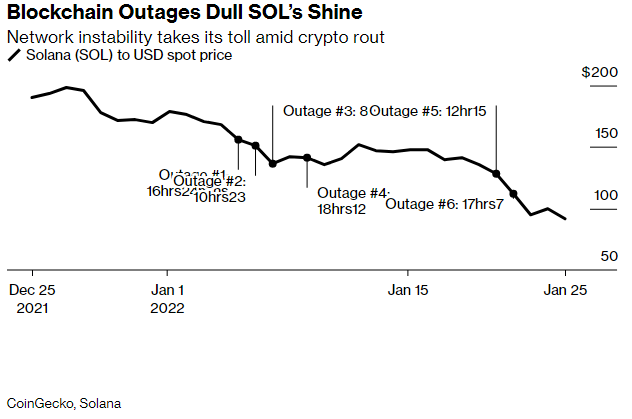

The protocol suffered its sixth serious outage of more than eight hours this month over the weekend, which a notice on its website attributed to excessive duplicate transactions causing a high level of network congestion.

Solana Labs co-founder Anatoly Yakovenko also pointed to an explanation on Twitter which cited market volatility as causing downtime, as bots rushed to earn bounties on leveraged positions eligible for liquidation.

During these periods of network instability, crypto traders are often left unable to sell off their positions as transactions fail to complete on Solana’s network, yet another sign of how unreliable this emerging technology can be during times of stress.

When combined with a market-wide crash in crypto prices, investors scrambling to offload their tokens are left to figure out other routes while their portfolios rapidly decline.

Yakovenko further stoked traders’ ire during the crypto crash by making light of Solana’s instability. Over the weekend, the Solana Labs co-founder tweeted a screenshot showing a Solana node reporting 2.05 million duplicate data packets being submitted to the network, accompanied by the caption ‘lol’.

“The outages are partly a function of Solana’s success, in that the usage and developer activity has grown significantly faster than the maturity of the protocol,” Alkesh Shah, global crypto and digital asset strategist at Bank of America Securities Inc., said by phone.

“In some ways, it’s a high-class problem, having so many transactions meaning it’s an attractive platform for developers and users.”

Solana’s SOL token has lost 35% of its market value in the last seven days, according to CoinGecko, amid a wider rout for crypto assets as investors sought to exit risky bets. An all-time peak of $259 recorded in November represented growth of almost 14,000% since the start of 2021 — but following its continued issues, that figure has now dropped to 4,800%.

Rival coins promising to reinvent the capabilities of blockchain technology are also biting at Solana’s coattails. The value of Terraform Labs’ Luna token, which runs on the Terra protocol for algorithmic, fiat-pegged stablecoins, has skyrocketed in the last year, rising more than 7,000% in value over the last 12 months.

But Solana isn’t the only one having issues. Ethereum continues to be plagued by scaling difficulties and extremely high gas fees, while newcomers like Polygon PoS saw costs spike by more than seven times in a month in January as play-to-earn video games clogged up demand.

Sam Bankman-Fried, chief executive of crypto exchange FTX and an investor in Solana’s $314 million funding round in June, said the blockchain network’s “degraded performance” was “relative” to a period of outsized demand in which Solana had processed more transactions than any other major protocol “combined”.

“Solana is mostly out of slack — the demand from transactions has reached the supply,” Bankman-Fried added on Twitter, indicating that the network might soon reach the end of the line with how much instability traders will tolerate. “So, you keep working to increase the throughput of the system, and the efficiency, to scale with the demand.”

Bankman-Fried has previously supported Solana through similar periods of instability, though those may have been famous last words. Speaking to Bloomberg following a similar case of the network rebooting after a flood of transactions in September, the crypto chief said: “If it were to happen again today, it would be fine.”

“The real indicator will be if developer activity and transaction activity significantly slows,” said Shah. “That would mean that people are not viewing the benefits of Solana versus the challenges of its growing pains. At this point, that’s not happening.”

Today, Solana has lost more than 50% of its value in the last month, according to data from CoinGecko. However, alongside other altcoins, it recovered somewhat from the selloff and sat up 11% in the last 24 hours on Tuesday.

Whether its fortunes are due to turn around will be in the hands of Solana’s developers, who could be about take advantage of the low-frequency transaction periods found during a “crypto winter” to bolster the network.

“The ecosystems that are being built on Ethereum and the alternative blockchains are still thriving. There is no winter for that ecosystem growth, and that’s really where the value is going to be added,” added Shah.

Read full story on Bloomberg