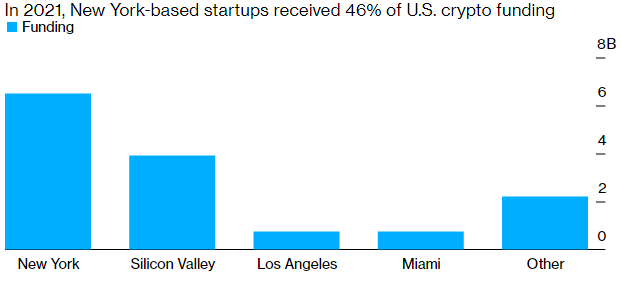

New York City is home to the most well-funded crypto startups in the U.S.

Last year, the city attracted $6.5 billion, accounting for 46% of funding to blockchain or crypto-centric companies, according to data provider CB Insights. The largest backers were New York Digital Investment Group LLC and Celsius Network LLC, which funneled $1 billion and $750 million respectively to New York-based firms.

Mayor Eric Adams has billed New York City the “center of the cryptocurrency industry,” and accepted with his first paycheck in office in Bitcoin and Ether, the digital asset underlying the popular Ethereum blockchain.

Adams has also proposed a friendly-competition with fellow crypto-enthusiast, Miami Mayor Francis Suarez, who has been aggressively courting companies to come to Florida.

Crypto Capital

Tech-hub Silicon Valley, known for its massive venture capital spending, ranked second in the nation for crypto-company funding with $3.9 billion. Elsewhere, Los Angeles and Miami both raked in $760 million.

Bitcoin and Ether, the two most popular cryptocurrencies, have struggled with a steep decline from all-time highs in November. The broader digital currency market endured a selloff in January as participants offloaded risky assets due to rising inflation and looming interest rate hikes.

Other key takeaways:

- Global blockchain fundraising surged to $25.2 billion, a 713% increase compared to 2020. The U.S. represented 56% of the world’s crypto venture-capital funding with a total of $14.1 billion.

- Coinbase Ventures was the leading investor in 2021, funding 68 crypto-focused companies.

- 1 in every 4 dollars is alloted to cryptocurrency exchanges and brokerages.

- Last year, funding for NFT, or non-fungible token, projects grew 12,878% to $4.8 billion.

Read full story on Bloomberg