As a blockbuster year for cryptocurrencies ticks to a close, some of the smallest coins are having a moment.

Polkadot and Cardano were among coins posting the biggest moves on Monday following a relatively quiet holiday weekend, with each up more than 6%, according to data from Coinmarketcap.com. Bitcoin, the largest digital asset, rose a more muted 1.5% to about $51,575 as of 10:15 a.m. in New York, while Ether added 0.4% to trade at about $4,100.

“There is no question that Bitcoin’s dominance has waned recently,” said Matt Maley, chief market strategist for Miller Tabak + Co. “I think that is merely because some investors are chasing the ‘newest thing.’”

That alternative coins are gaining traction isn’t a new development: Many cryptocurrencies other than the largest few have posted spectacular runs this year as the crypto economy expanded and attention shifted toward other areas of the market. Coins such as Dogecoin, Cardano and Shiba Inu, previously relegated to the most speculative corners of the market, have turned into household names this year.

“Bitcoin is making rapid progress within the global economy but it’s easy to see how that headway is being outpaced by some of the smaller and faster-growing networks,” said Mati Greenspan, founder and CEO of Quantum Economics.

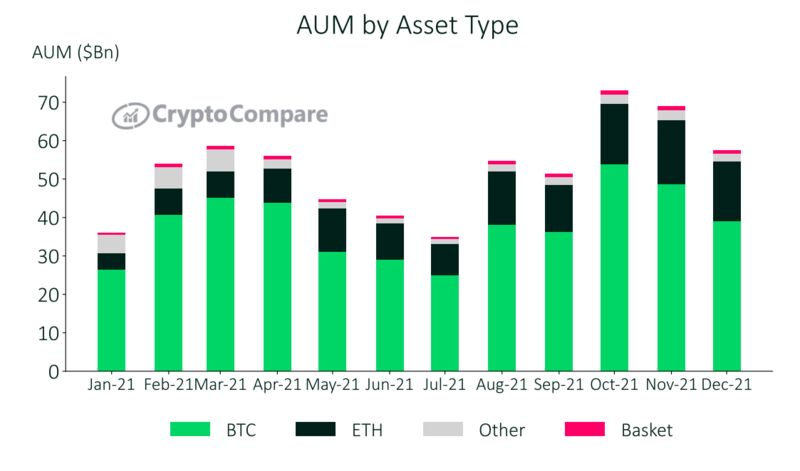

This dynamic has lessened Bitcoin’s dominance, with total assets under management for Bitcoin-related products falling 20% to $39 billion in December, according to a report from CryptoCompare. The decline reduced Bitcoin products’ portion of the crypto market to 67.8% from 70.6%, the lowest share of the year, according to the data provider.

Polkadot and Cardano have each gained more than 25% over the past seven sessions, according to Coinmarketcap.com. Axie Infinity’s coin has added 22% in that period, while FTX’s coin rallied 10%.

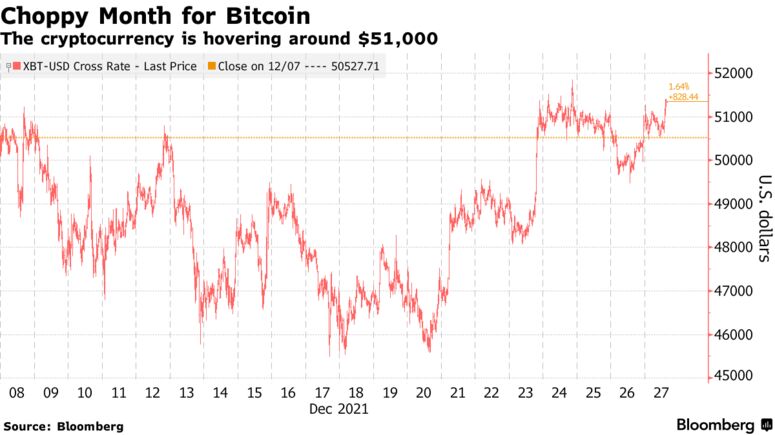

December was a stretch marked by choppiness for Bitcoin, the original and once-supreme cryptocurrency. The coin is down 10% so far this month, on pace for its second consecutive monthly decline.

Still, Maley says investors shouldn’t go too far out on the risk scale when it comes to cryptocurrencies. “Like it was with the internet stocks in 2000, only the best survived in the long run,” he said.

Source: Bloomberg