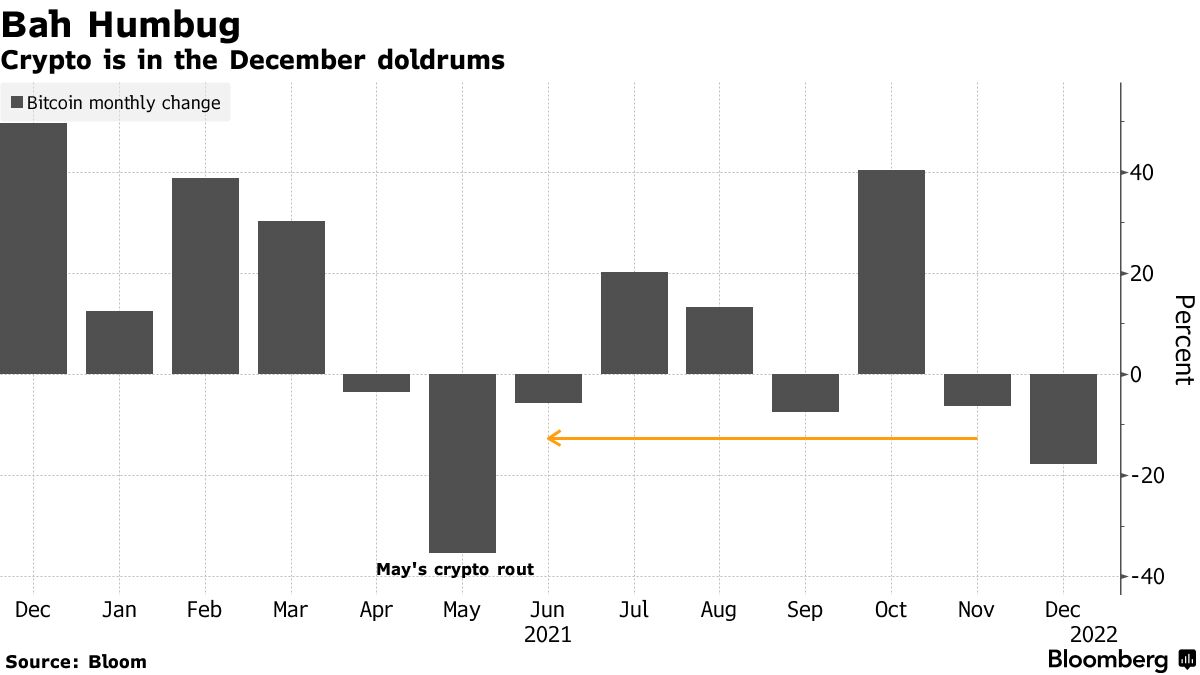

Bitcoin swung between gains and losses Wednesday amid a monthly slump that puts it on pace for its worst decline since May.

The volatile token was up 0.6% to trade around $47,800 at 10:14 a.m. Wednesday in New York, following a near 7% drop the prior session. It has retreated some 16% this month, while the wider crypto universe has shed more than $300 billion of market value over the period, according to tracker CoinGecko.

Demand for the most speculative investments has waned as 2021 comes to a close, in part as the Federal Reserve pulls back on the exceptional stimulus that helped to lift a variety of assets this year. Some analysts say the reversal will be brief.

“I suspect year-end book squaring into thin market conditions exaggerated the range,” said Jeffrey Halley, a senior market analyst at OANDA. “There is nothing to suggest that Bitcoin’s recent $45,000 to $52,000 is under threat.”

On Wednesday, other coins also got hit hard, with Cardano and Solana losing more than 6% each, and Polkadot falling nearly 3%, according to CoinGecko.

Strategists are keeping an eye on key technical levels to discern clues about Bitcoin’s direction.

Katie Stockton, founder and managing partner of Fairlead Strategies, an independent research firm focused on technical analysis, said Bitcoin’s next level of support is around $44,200, based on a Fibonacci retracement.

The token’s wobble this month has pared its year-to-date climb to about 65%, still ahead of traditional assets including global equities and commodities.

And for perspective, the total crypto market-cap drop of 8% over the last couple of sessions represents a move of less than two standard deviations for that measure when looking at the past year of two-day percentage changes. That would equate to a 1.5% drop in the S&P 500 across two sessions, according Bespoke Investment Group.

“Hardly the stuff of nightmares,” Bespoke analysts wrote in a note. “This is a helpful reminder that crypto assets are extremely volatile and holders can expect these kind of 10% drops as a matter of course, regardless of whether the space continues to appreciate or vice-versa.”

Crypto adherents expect Bitcoin will resume its advance and head back toward the record $69,000 it reached last month. Among their arguments is the controversial idea that the token offers a hedge against inflation.

“The arc of history is long,” Graham Jenkin, chief executive officer of crypto exchange CoinList, said on Bloomberg Television. “Over time Bitcoin is going to be a pretty superior asset to invest in.”

Walid Koudmani, an analyst at XTB Market, agrees that crypto prices could recover soon.

“While these moves could deter some less experienced investors, it is worth noting that 2021 has seen crypto and blockchain mass adoption increase significantly with a large influx of institutional investments that has renewed confidence in this sector and could ultimately lead to significant price gains and increased volatility as retail investors attempt to catch up,” he said by email.

Read full story on Bloomberg