Shares of wildly-popular cryptocurrency platform Coinbase (COIN) has been free-falling alongside almost anything growth-related these days.

Now off over 52% from its all-time high, just north of $350 per share back in November, investors don’t seem to be willing to give the intriguing growth stock the benefit of the doubt.

With a modest 11.9 times trailing earnings multiple and 34.1 times forward earnings multiple, COIN stock probably should have been spared from the tech-targeted market carnage.

Although Coinbase was one of the most exciting companies to go public nearly a year ago, the market seems to be doubting the value proposition to be had in the name. Is the relatively low price-to-earnings multiple too good to be true? Or is Coinbase stock actually a compelling value play for those looking to capitalize on the recent bout of market volatility?

Given Bitcoin’s (BTC) recent turbulence, plunging viciously in sympathy with broader markets, it’s not a mystery as to why Coinbase stock has failed to hold its own.

Undoubtedly, it’s the positive correlation between crypto assets and the broader markets that leads me to believe that Bitcoin and other cryptocurrencies aren’t as suitable a gold alternative as was previously thought.

Though Bitcoin can hold its own or even surge higher in a future crisis-driven market pullback, I remain skeptical over a common view that Bitcoin is a gold alternative or a “millennial gold.”

For that reason, Coinbase may or may not be real value, even after plunging over 50%. Therefore, I’m sticking on the sidelines with COIN stock, at least until the crypto markets calm. I am neutral on the stock.

What’s Behind the Low P/E Ratio?

The increased appetite for crypto assets has been nothing short of remarkable. Coinbase has been a standout player amid the latest crypto boom, with profound interest for its offering. Just look at the website-breaking success that was Coinbase’s controversial Superbowl ad, which caused the CEO to slam ad agencies for their “gimmicky” marketing ideas.

Indeed, the interest is there, but the real question is: how much longer can Bitcoin hold its own before the next cyclical downturn in the entire asset class? And how much of the interest was due to the nature of the ad, as opposed to the enthusiasm surrounding the crypto asset class?

In a prior piece, I praised Coinbase for its brand power, noting that it was enough to retain its lofty fees. Why? There’s a degree of trust when it comes to an established platform like Coinbase.

Indeed, the company benefits from strong networking effects and given the nature of how Bitcoin or Ether (ETH) hype is passed, Coinbase stock is arguably one of the smartest (and easiest) ways to bet on the crypto markets as a whole.

With the recent scams going on in the crypto space (think Grimacecoin or BabyMusk token), it’s really hard to know who to trust in the wild West that is the crypto markets. Such epic rises and falls of tokens are only likely to improve the magnitude of trust in a platform like Coinbase. It’s a platform and blockchain infrastructure play for investors who take Bitcoin and the like seriously!

Although Coinbase is arguably one of the strongest crypto stocks out there today, there’s a major reason why COIN stock has a P/E multiple that doesn’t seem to do it justice, given its promising growth prospects.

Crypto and Coinbase Stock Plunge as Crisis Unfolds in Eastern Europe

The crypto markets are ridiculously volatile, and a future plunge in Bitcoin could be detrimental to COIN stock. Further, the technicals on cryptocurrencies remain discouraging. Coinbase may be a standout player in its industry, but don’t expect it to hold its value if the crypto asset class were to plunge further over the crisis going on in Ukraine.

So much for Bitcoin being a safe haven asset through scary times!

It’s the recent geopolitical-induced selling pressure on Bitcoin that has me most concerned about COIN stock at this juncture. Gold has been moving higher amid the crisis brewing in Eastern Europe. Does recent action indicate crypto and gold are not equal substitutes? I think so.

Sure, an argument could be made that recent plunges in Bitcoin have been magnificent opportunities to buy the dip. It could easily soar back tomorrow if geopolitical tensions ease.

In any case, Coinbase could be subject to considerable multiple expansion should interest in crypto assets evaporate in a hurry, perhaps in a crisis scenario.

Wall Street’s Take

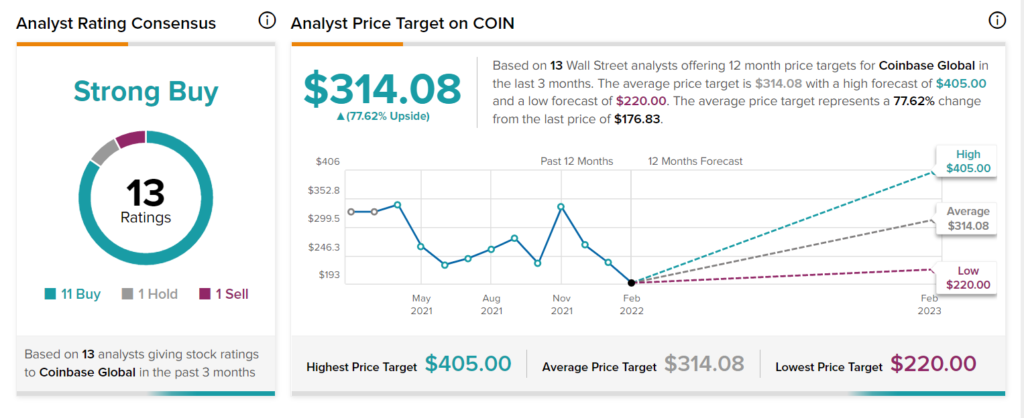

According to TipRanks’ consensus analyst rating, COIN stock comes in as a Strong Buy. Out of 13 analyst ratings, there are 11 Buy recommendations, one Hold recommendation and one Sell recommendation.

As for price targets, the average Coinbase price target is $314.08, implying an upside of 77.62%. Analyst price targets range from a low of $220.00 per share to a high of $405.00 per share.

The Bottom Line on Coinbase Stock

It’s so hard to not love a company like Coinbase. It’s head and shoulders above the pack in the crypto-exchange industry. Projects like Coinbase NFT could yield rewards if interest in crypto assets stands firm following recent market jitters. To put it simply, Coinbase is firing on all cylinders, and it’s doing almost everything right.

That said, if crypto goes down, expect Coinbase stock to follow suit. For that one reason, the low P/E multiple in COIN is not the deep value play that it looks like.

If investors seek crypto exposure to diversify their portfolios, I’m not against buying COIN stock here and now. For those unwilling to buy more if the crypto market were to plunge and remain flat for a prolonged period, it’s probably a better idea to look elsewhere.

Read full story on TipRanks