People who have made fortunes investing in digital currency, or who helped build the vast crypto industry, are the new darlings of the high-end residential property market

When real-estate agent Ryan Serhant received an offer last fall for one of his listings, a roughly $25 million Downtown Manhattan apartment, he was pleased but dubious.

The buyer, to whom he gave a property tour, seemed nice but didn’t fit the profile of Mr. Serhant’s typical high rollers who often come from Wall Street or prominent families. This buyer said he was self-employed, but when Mr. Serhant googled him, he found nothing that explained his wealth.

Crypto Dealmakers

Wary that the offer was a hoax, Mr. Serhant asked for proof of funds and was stunned by what he received: a statement of the buyer’s cryptocurrency holdings, worth around $600 million. “It was crazy,” he said.

It is a scenario playing out across the real-estate world, as newly minted crypto-millionaires and crypto-billionaires, who have either invested in or have helped build the infrastructure that enables digital currency, have flooded the luxury market.

PHOTOS: NBCU PHOTO BANK/GETTY IMAGES (SERHANT); GETTY IMAGES (ARMSTRONG); NBAE/GETTY IMAGES (BOSH); GETTY IMAGES (SOTO-WRIGHT); BLOOMBERG NEWS ( CARLSON-WEE); WIREIMAGE (SAPIR)

That has led to a string of pricey deals over the past year. They include the $133 million purchase of a Bel-Air estate by Brian Armstrong, CEO of the largest U.S.-based crypto exchange, Coinbase.

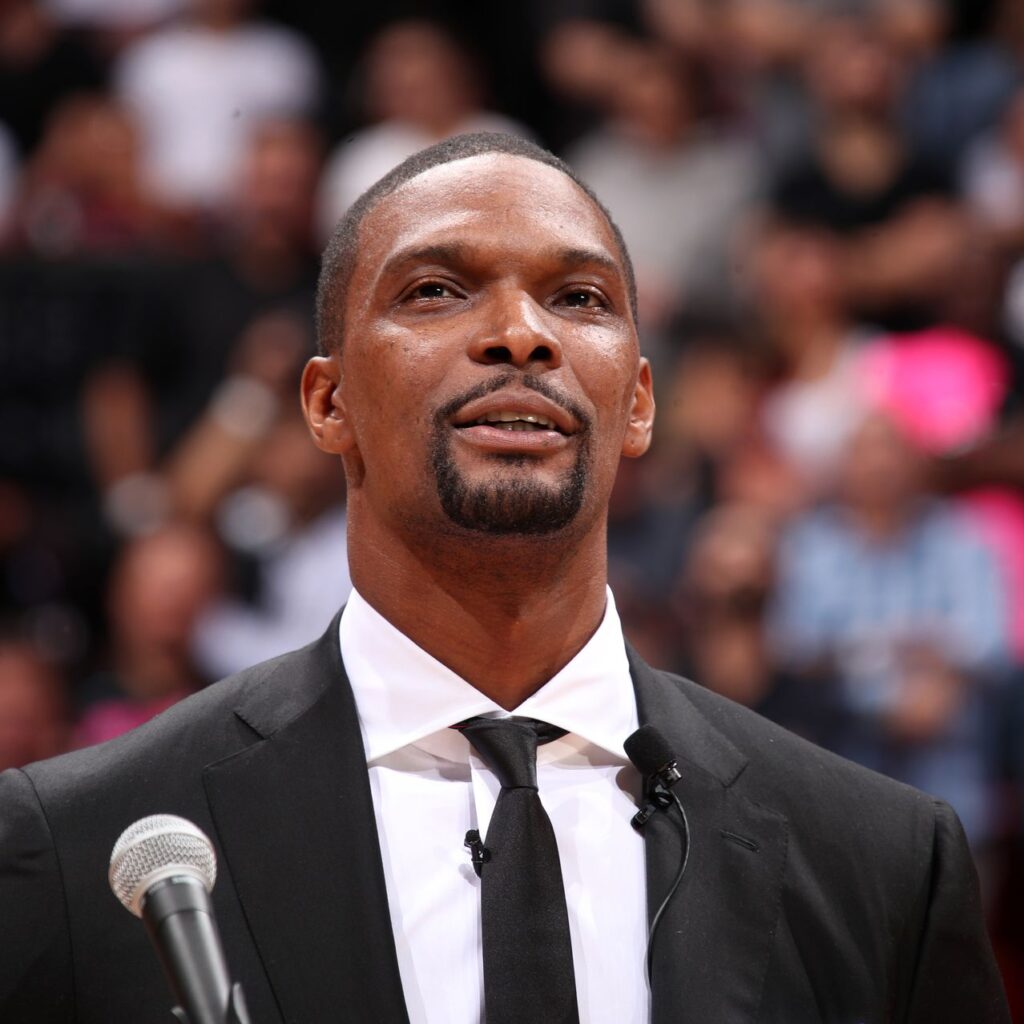

Other major deals include a waterfront Miami estate formerly owned by retired Miami Heat player Chris Bosh being sold for roughly $38 million to Ivan Soto-Wright, co-founder and CEO of crypto-payments infrastructure provider MoonPay.

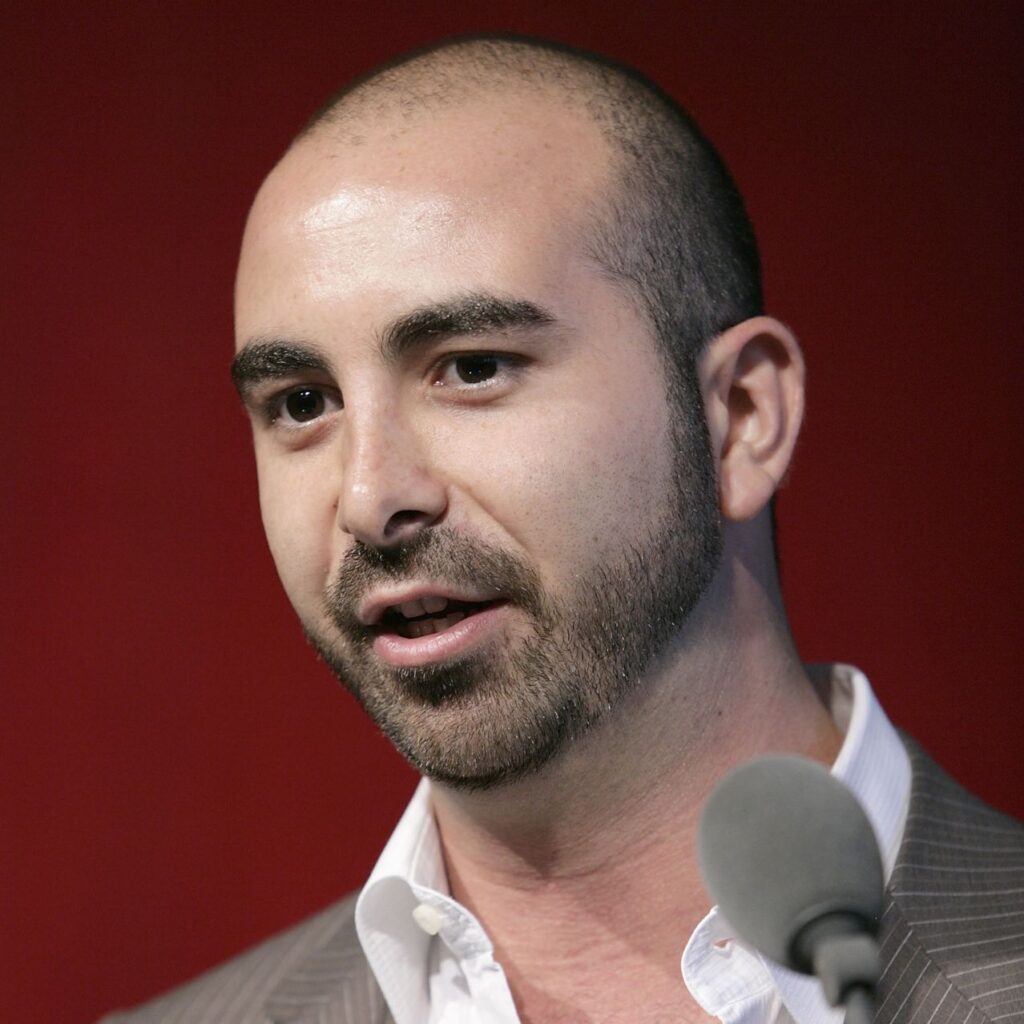

Another was the $28.5 million deal for a mansion in the Hollywood Hills, purchased by Olaf Carlson-Wee, CEO of crypto-focused investment fund Polychain Capital and Coinbase’s first employee, according to people familiar with those transactions.

Multiple Los Angeles real-estate agents said that Fred Ehrsam, a Coinbase co-founder, has been actively shopping for a property at a similar price to Mr. Armstrong’s. Gavin Wood, a co-founder of Ethereum, an app-hosting platform where ether cryptocurrency trades, is also looking for a big-ticket property in New York and has been closely eyeing a penthouse listed for $66 million at the Billionaires’ Row megatower 111 West 57th Street, according to a person familiar with the situation.

Mr. Ehrsam could not be reached. Dr. Wood and Michael Stern, a developer of the 57th Street building, declined to comment.

The crypto rich are the new whales in the luxury residential market and the industry is taking notice. Real-estate developers are jumping through hoops to accept crypto. Agents are trying to lure crypto enthusiasts to their high-end listings with gimmicks such as NFT art parties.

Brokerages are hosting cryptocurrency seminars for their agents. Increasingly, sellers are openly advertising that they would be willing to accept cryptocurrency in exchange for their homes.

To look at the property market, one might think that crypto has gone mainstream. But while buyers who made fortunes in crypto are flooding the market, there are still only a tiny number of deals being done entirely using cryptocurrency.

Despite sellers advertising their willingness to accept crypto, most who do so take significant steps to minimize the risk of cryptocurrency price volatility by enlisting third-party platforms that transfer the crypto-payments to U.S. dollars immediately upon closing.

Cryptocurrency value is notoriously volatile. In November 2021, bitcoin traded for a record $68,990.90, up from $5,000 in March 2020. The November price was also more than double bitcoin’s 52-week low of $28,825.76 in July 2021, according to CoinDesk.

But, as of Jan. 26, bitcoin was trading back at around $38,000. The top 10,000 individual bitcoin accounts held an aggregate $232 billion, a recent study from the National Bureau of Economic Research reported.

Crypto Crib

This is a new class of investor that society didn’t know about a few years ago, said Miami developer Alex Sapir, who sold a $22.5 million apartment that was purchased with cryptocurrency last year. “You’re getting them in the early onset stages of their investment career.”

For some crypto owners, “it’s gotten to the point now where it’s like, ‘OK, so what do I do with all this?’ ” Mr. Serhant said.

Some crypto owners are starting to look to diversify into other assets while, for others, “the name of the game in crypto is hoarding crypto,” said Bill Barhydt, founder of Abra, which manages over $1 billion in crypto and offers loans for down payments that are backed by the borrower’s crypto.

“People who borrow against crypto don’t want to sell it; they’re highly motivated,” he said.

Lane Rettig, an Ethereum developer, said he and his wife, Lily Rettig, bought a 1,500-square-foot condo on Central Park North for $3.5 million last year, as a way of diversifying their assets.

Mr. Rettig, 38, said the couple made a down payment on the three-bedroom unit in cash in part because he is long on crypto and doesn’t want to sell his bitcoin.

The mortgage didn’t take into account Mr. Rettig’s crypto holdings because he manages the assets in a self-custody wallet, he said. “I can’t give a bank a piece of paper saying, ‘Lane has x, y and z.’ It’s a screenshot of an app,” he said.

However, Mr. Rettig said their loan officer was comfortable with the terms and large loan size, relative to the couple’s income, having seen evidence of Mr. Rettig’s crypto assets. “In my mind, it’s an arbitrage of rates,” Mr. Rettig said of the mortgage. “My worst-case scenario for bitcoin is a lot better than 3% a year.”

Jonathan Yantis, an early bitcoin miner and Blockchain investor, said he was also reluctant to sell his bitcoin when buying and selling several luxury homes over the past two years. In late 2021, Mr. Yantis purchased a roughly 40-acre estate outside Denver for $12.5 million.

In Hawaii, he sold an oceanfront home on Maui for $15 million in May 2021. He also owns a roughly 10-acre estate on the island, which he bought for $24 million in December 2020. In December 2021, he listed that property for $59.5 million. “I want to build a custom house—the largest in Maui,” he said in an email.

Mr. Yantis said he purchased in U.S. dollars, which crypto investors call fiat currency, otherwise known as government-issued money. First, he sold crypto—not bitcoin—for tether, another cryptocurrency that is pegged to the U.S. dollar. Then he converted the tether to U.S. dollars.

While he has been on a real-estate buying spree, he would still choose to invest in crypto over a bricks and mortar asset, he said. “Real estate makes nothing in returns compared with crypto, where you can 100x your investment,” said Mr. Yantis, 51, who is co-founder of WAX, or Worldwide Asset eXchange, an NFT blockchain. “Less than 1% of my net worth is in real estate. That should say how bullish I am on the crypto markets.”

Mr. Yantis acknowledged that crypto’s volatility can impact its conversion to U.S. dollars. “I keep some cash set aside for when the market crashes,” Mr. Yantis said. Right now, he characterized the crypto market as being in “extreme fear,” meaning, he says, it is a great time to buy.

Only a handful of luxury real-estate deals across the country have actually been completed using cryptocurrencies, and in most cases the sellers have opted to transfer the crypto to U.S. dollars immediately upon closing.

For instance, the developers of Arte, a boutique condominium in Miami’s Surfside neighborhood, announced last spring that they had sold the penthouse at the building for $22.5 million to a purchaser using cryptocurrency.

While initially touting how the deal showed the viability of cryptocurrency’s decentralized payment system in the U.S. real-estate market, Mr. Sapir, one of the developers, said they converted it to U.S. dollars immediately because, as a publicly reporting entity, they couldn’t hold cryptocurrency.

Some buyers and sellers use BitPay to facilitate crypto transactions. Through BitPay, sellers can generate an email invoice, which the buyer can pay from their preferred crypto wallet, either manually or by scanning a QR code.

BitPay then transfers the funds to the seller in U.S. dollars via direct deposit the next business day. The price is set for 15 minutes to avoid dramatic swings in the crypto’s value. The QR code expires after 15 minutes and a new invoice needs to be generated. This locks in the price for the buyer.

Developer PMG recently became the first real-estate developer to accept preconstruction condo deposits in crypto, said managing partner Ryan Shear.

Last year, the company partnered with FTX US, a major cryptocurrency exchange, to accept crypto as a down payment for units at two of its buildings, E11EVEN Hotel & Residences and the Waldorf Astoria Residences in Miami, Mr. Shear said.

To accept crypto, PMG had to partner with a regulated exchange that could quickly convert crypto to U.S. dollars, then convince an escrow agent to accept down payments from the exchange, rather than directly from the developer.

Mr. Shear said most escrow agents looked at him like he was crazy, but “20 lawyers, one year later, and a lot of brain damage, everybody got comfortable.”

So far, PMG has accepted crypto for a handful of units, said Mr. Shear, who said it was easier to implement because PMG owned the land unencumbered by bank debt. “I have to imagine if our lender was in place…they might have shut it down,” he said. “Lenders are conservative. It’s not in their nature to take unnecessary risks.”

Avi Dabir, vice president of business development at FTX US, said he sees real estate as a growing sector for the company because crypto transactions are faster and more efficient than traditional deals, which rely on an often-cumbersome banking system.

“If I want to send a wire transfer today using my traditional bank account, it’s got to be banking hours, I need to make sure I hit that wire cutoff time and I can’t do it on the weekends,” he said. “That’s not a problem with cryptocurrency. It’s open 24/7.”

For regular homesellers, the prospect of accepting cryptocurrency can be intimidating.

In Miami, real-estate agent Keith Marks of Brown Harris Stevens Miami and his partner, Sonia Toth, said they recently sold a condominium for $7.2 million worth of the cryptocurrency ether after the buyer agreed to make the down payment in U.S. dollars.

The agents declined to comment on the identities of the buyer or seller, but records show the seller was a company tied to Brazilian businessman Roberto Justus, known for starring in the Brazilian version of “The Apprentice.” The buyer is listed in records as Federico Gutierrez Castro. Mr. Justus didn’t respond to a request for comment and Mr. Castro couldn’t be reached.

The seller of this condo, at Zaha Hadid-designed One Thousand Museum in Miami, was initially anxious about selling his unit in exchange for cryptocurrency, but went through with the $7.2 million deal anyway.

Mr. Marks said the seller of the unit, a four-bedroom at One Thousand Museum, a luxury building designed by architect Zaha Hadid, initially balked at the ether offer, wondering if it was a gimmick or worse. “There’s always this fear that, you know, what if this is somebody moving drug money?” he said. “Or I sell the unit and all of a sudden…the money is impounded or something?”

After consulting an attorney, the seller accepted the offer and the deal proceeded smoothly, with a cash down payment to avoid the risk of currency fluctuations. The buyer paid the balance in ether, but the seller organized to have it immediately converted to U.S. dollars upon closing.

In the eyes of the IRS, cryptocurrency is treated as property, according to tax expert Alan Fyne of Dinnall Fyne & Company, who worked for the seller on the crypto deal at One Thousand Museum. Someone who buys bitcoin at $1 and sells at $10,000 must report $9,999 as profit, whether it is short-term or long-term capital gains.

Mr. Fyne said he does see potential for abuse. The process could potentially be exploited, he said, by those “laundering money for bad actors” as well as by those attempting to avoid taxes on the sale of their cryptocurrency if it has appreciated over time.

The danger, Mr. Fyne said, also lies in the fact that, in some cases, it can be difficult to trace the origin of crypto funds. While cryptocurrency exchanges usually demand some background from participants on the platform, the process isn’t as rigorous as the scrutiny applied by banks to mortgage applicants, for instance.

“We received some crypto, the sale went down. And do we really know who it came from?” he said.

Read full story on The Wall Street Journal