Trading volume has slowed across many cryptocurrency trading platforms during the rout in global assets triggered by the Ukraine crisis, a potentiality troubling sign for a sector that has billed itself as alternative to traditional finance.

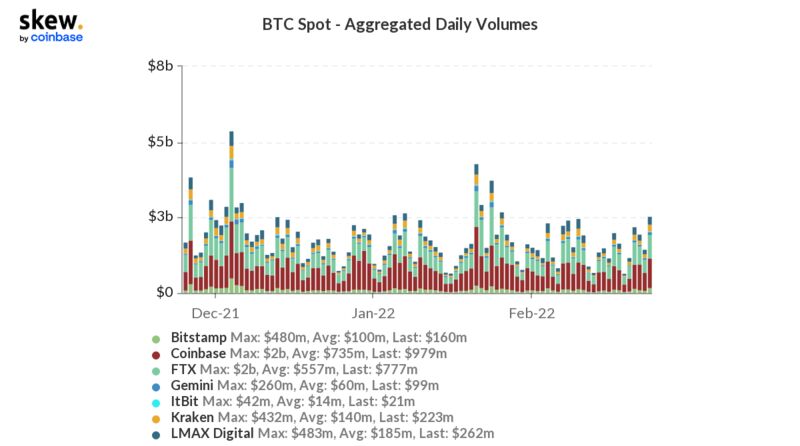

Bitcoin’s aggregated daily spot trading volume on Coinbase, Bitstamp, FTX, Gemini, ItBit, Kraken and LMAX Digital was around $3 billion, according to data from researcher Skew. That’s compared with previous highs of roughly $5 billion in the beginning of December.

At one point Thursday, Bitcoin lost about $27 billion in market value.

“The overall volume wasn’t too high today.” Patrick Chu, head of institutional coverage at Paradigm, a crypto over-the-counter trading firm, said. “Markets had already capitulated last week or so.”

At the same time, a shortage in the amount of tokens available for trading is getting worse as the number of Bitcoin held in exchange addresses has dropped to roughly 2.55 million from a one-year high last July at around 2.71 million, according to Glassnode data. A decrease in the amount of Bitcoin on exchanges means that fewer coins are available to buy or sell.

Still, that has helped Bitcoin to outperform so-called alt coins that typically have less liquidity, said Teong Hng, co-founder and chief executive officer of Hong Kong-based Satori Research. Bitcoin slumped as much as 8.5% on Thursday, while Litecoin tumbled as much as 15%.

“It’s very quiet these days [on exchange inflows], meaning most of the OG whales are holding BTC,” said Ki Young Ju, CEO of blockchain data firm CryptoQuant.

Kaiko research head Clara Medalie said that bid-and-ask spread on Bitcoin trading in dollars across exchanges surged to as much as 20 basis points when the news broke on Russia’s attack on Ukraine, suggesting the cryptocurrency became harder to trade.

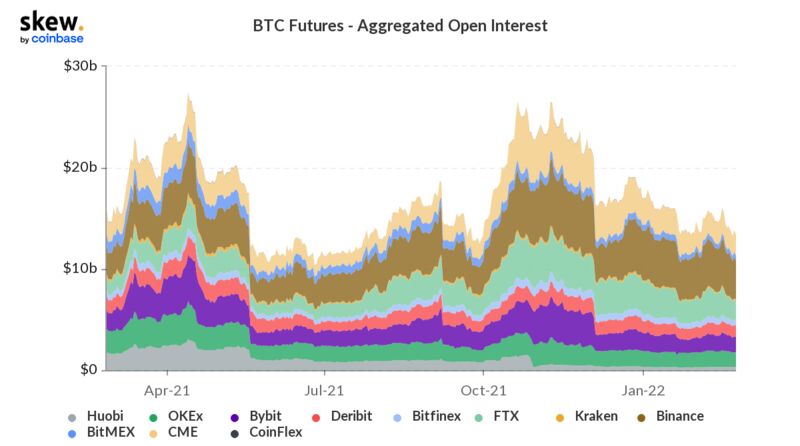

The total open interest in the Bitcoin futures market was at $13.4 billion on Wednesday, down nearly 50% from its November peak of $26.4 billion, according to Skew data. Bitcoin has slumped about 50% since its all-time high in November.

The average funding rate of Bitcoin’s perpetual swap, or the cost of holding long positions in the perpetual futures, remained neutral to slightly negative, according to the data source Coinglass. Funding rates are calculated every eight hours by the exchanges.

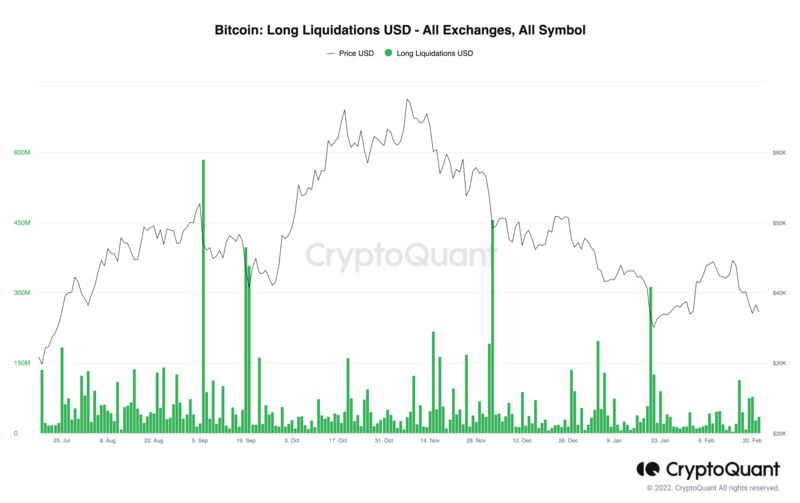

CryptoQuant’s Ju said that the long liquidation, or liquidation caused by those traders who were betting on higher Bitcoin prices, was much lower than previous sell-offs in January or December.

“This [price] drop was not a long squeeze, but pure selling activities,” Ju said.

Read full story on Bloomberg