This Thanksgiving, crypto hedge-fund manager David Tawil is bracing for a much more lively conversation about his line of work.

Bitcoin usually comes up amid the clink and clatter of cutlery and plates. But after this year’s surge in interest about all things crypto, anything from NFTs and DeFi to Dogecoin and Ether could be up for discussion.

Not only did Bitcoin and Ether, the two largest cryptocurrencies, see a jump in popularity, but the soaring value of meme coins and non-fungible tokens has made the notoriously volatile asset class a must-own item for many retail and institutional investors alike.

“Excitement is what excitement is,” Tawil, president of ProChain Capital in New York, said. “Certainly what’s newsworthy and makes headlines is top of mind, and I think people get excited with big percentage moves. They want to see if they can make 1,000% on something.”

So families across the country are gearing up for table talk centered around turkey, cranberry sauce and Shiba Inu. This was the year Wall Street institutions started to embrace crypto in earnest; companies like Venmo allowed it on their platforms; and long-time curmudgeons caved and bought in.

“It should be at the point where people don’t want to talk about it anymore because they’re tired of talking about it,” Jerry Braakman, chief investment officer of First American Trust in Santa Ana, California, said by phone. “And it’s still going to be a topic.”

“The nieces and nephews are talking about it, the aunts and uncles are trying to figure out what it’s about,” he said. “Everybody has an interest.”

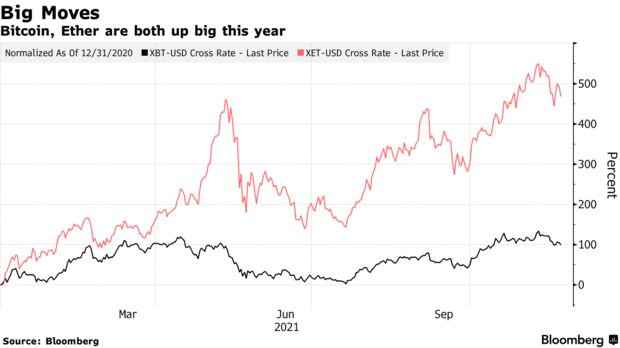

To be sure, Bitcoin has been a dinner-table mainstay since its big bang in 2017. Darker years made those conversations harder. In 2018, for instance, Bitcoin dropped roughly 75%, making believers want to avoid the topic altogether. But crypto fans say they are feeling more confident in a red-hot market. Bitcoin and Ether have gained about 100% and 500%, respectively, this year. The global crypto market cap even rose to around $3 trillion at one point before falling in a mid-November swoon.

This Thanksgiving, Steve Chiavarone is visiting family in Red Bluff, California, a town north of Sacramento. The portfolio manager doesn’t yet know the entirety of the guest list or what food will be served. But he knows one thing for certain: crypto is going to come up — probably after the Brussels sprouts, but before the pecan pie.

“It speaks to the fact that there are a lot of people who have dabbled in or are curious about it,” the head of multi-asset solutions at Federated Hermes said. “I know that every time prices are higher — and they’re quite high — there’s more interest in it.”

With the rise of retail investing after lockdowns during the pandemic, more and more people have started investing in crypto. At the beginning of the year, a survey from New York Digital Investment Group found that 44 million Americans — or 22% of the adult population — own Bitcoin. However, that number is likely higher now.

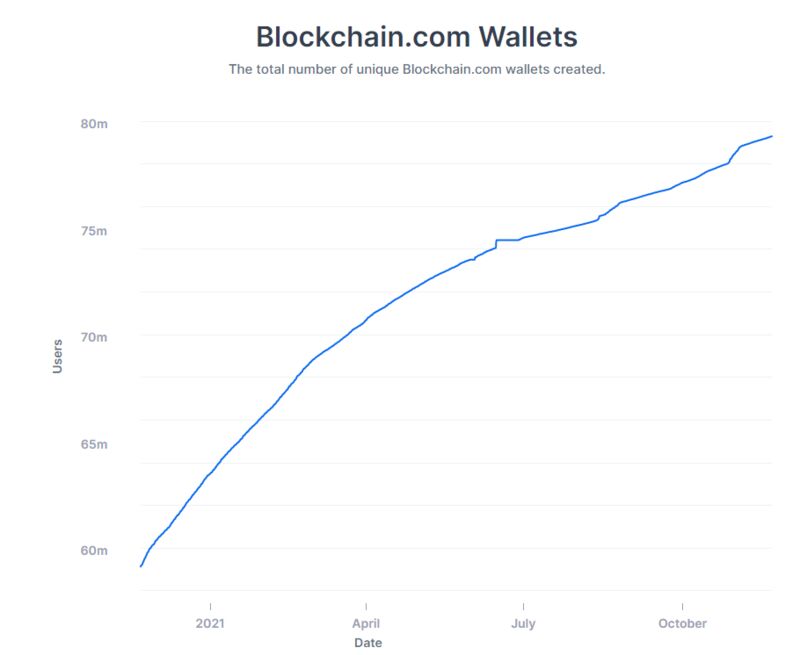

Rampant championing from celebrities and glitzy television ads about the industry have helped propel ownership to new heights. The total number of unique wallets used to store cryptocurrencies created on Blockchain.com is hovering around 80 million, up from 58 million at this point last year. Major sports teams are accepting crypto sponsorships and a growing number of arenas are carrying crypto-firm logos.

“Everyone’s going to be talking about crypto — what else is there to talk about? Are you going to talk about movies? Are you going to talk about sports? Are you going to talk about the weather?” Meltem Demirors, chief strategy officer at digital-asset firm CoinShares, said by phone. Crypto is “part of the zeitgeist, it’s part of the culture and it’s definitely a big part of the financial system at this point.”

Crypto platforms have certainly been booming. Coinbase Global Inc., which made its public trading debut in July, has more than 73 million verified users, making it the largest crypto exchange in the U.S. In the year through September, it saw nearly 13 million U.S. app downloads, according to analytics provider AppAnnie. Meanwhile, Crypto.com saw more than 7 million downloads, and Binance.US notched 3.5 million.

ProChain’s Tawil, who’s been involved in crypto since 2015, has been surprised by how many friends, family members and acquaintances have approached him about digital assets. Recently, he says, the inquiries have veered into the eccentric. “What they own can run a much wider gamut than even those things I’m comfortable talking about — cryptocurrencies I’ve never heard of that trade for 0.000001,” he said.

The user-base is vast. Alex Potter, 16, is a high schooler in New York City who’s recently gotten into crypto. He started a club that hosts panels with crypto professionals and he broadcasts podcast-style interview sessions on his website.

“People like to talk about it,” he said in a phone interview of crypto. “I can definitely see it coming up (over Thanksgiving) and us having a long conversation about it.”

— With assistance by Olga Kharif. Read original article on Bloomberg