If you’re looking for sound and unbiased financial advice on investing in cryptocurrencies, then social media “influencers” should not be your first port of call.

In something of an EU first, Spain moved to nip such an encounter in the bud on Monday, with its national securities market commission being given the power to regulate crypto advertising.

The measures, which take effect in a month’s time, require influencers and their sponsors to pre-notify authorities of some posts and to warn of crypto’s risks or face fines. Singapore also placed new restrictions on crypto advertising on Monday.

Spain’s new powers come after the watchdog clashed in November with footballing legend Andrés Iniesta over his paid promotion, lacking the usual risk warnings, of Binance, the world’s biggest cryptocurrency exchange.

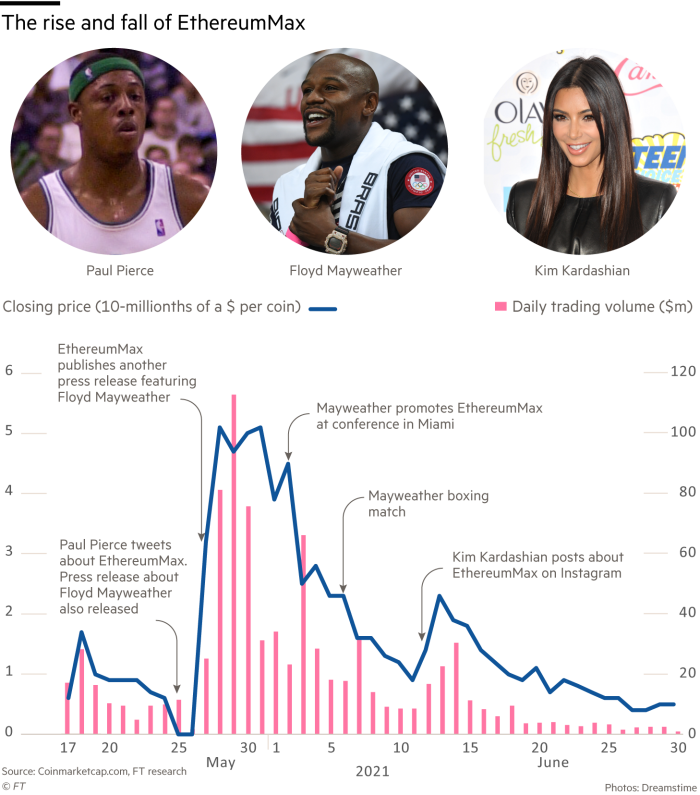

In the US, a class-action lawsuit filed this month claims reality-TV star Kim Kardashian and other celebrities, including boxer Floyd Mayweather and former NBA player Paul Pierce, helped inflate the price of one cryptocurrency as part of a scheme that enriched its backers at the expense of ordinary investors.

It alleges the backers of EthereumMax used the inrush of cash from Kardashian’s followers to sell a significant amount of the tokens at a profit, pocketing their gains before the price cratered.

EthereumMax disputes the allegations, but the case highlights the worrying trend of retail investors turning to non-traditional sources of advice for their cryptocurrency investments, where the providers are often being paid large sums for promoting a particular digital asset.

Social media influencers were infamously taken in by the Fyre Festival fraud in 2017 and Alphaville was immediately reminded of this when it viewed the recent Cryptoland video, a cartoon promoting a Fijian island that was set to be made into a paradise for crypto backers.

On first viewing, the video comes across as a spoof, full of in-jokes and highlighting how crypto investments can represent another incarnation of Ponzi schemes. But, as Alphaville points out, Cryptoland featured 60 parcels of land that you can “buy” via NFTs and build mansions on, on the real island of Nananu-i-cake.

The video has been widely derided on the internet and The Guardian reports the project appears to have run aground, with the contract to buy the island for $12m falling through.

While regulation is necessary and inevitable, in Cryptoland’s case, social media itself appears to have been an effective watchdog, alerting prospective investors to what could have been trouble in paradise.

Read full story on Financial Times